Bitcoin’s Correlation With Gold Hits Record High

(dario hayashi/Shutterstock)

Bitcoin’s Correlation With Gold Hits Record High

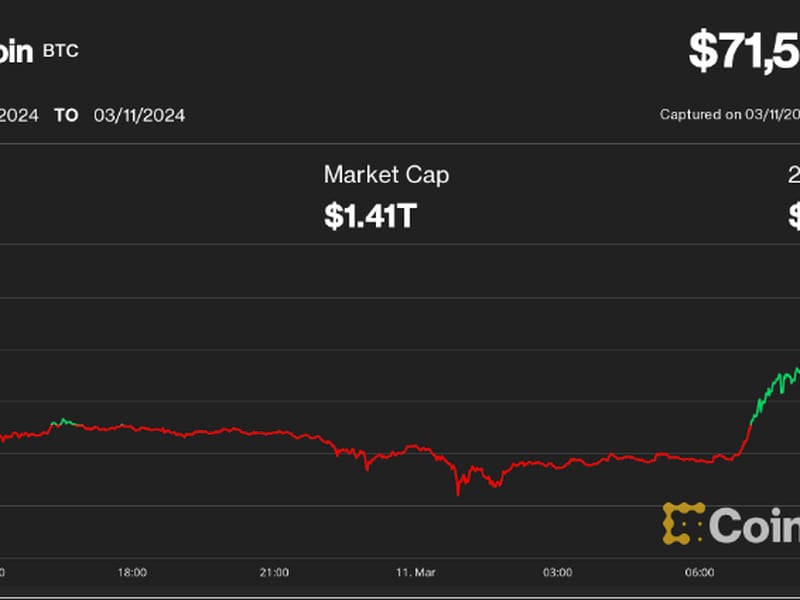

Bitcoin is now more closely tied to safe-haven gold than ever, possibly bringing the cryptocurrency greater resilience to risk aversion in the traditional markets.

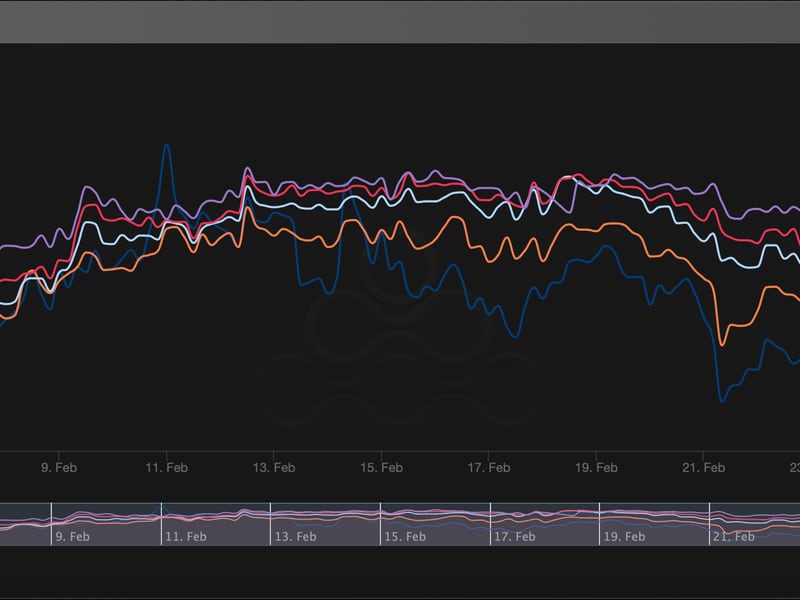

- The 60-day correlation between the two assets is hovering at record highs above 0.5, according to Coin Metrics data.

- The positive correlation has strengthened sharply since the beginning of July, as the U.S. dollar started taking a beating against other major currencies.

- The sell-off in the greenback, the global reserve currency, is seen as boding well for scarce assets like bitcoin and gold.

- The strengthening of the positive correlation appears to validate the popular narrative that bitcoin is a store of value and a haven asset. Some investors believe it is sound money, like gold.

- As such, the cryptocurrency’s sensitivity to movements in risk assets, mainly equities, could lessen.

- Bitcoin defended the $10,000 support for the fifth straight day on Monday, despite losses on Wall Street.

- The repeated defense of the critical support, coupled with several bullish developments in on-chain metrics, suggests scope for a recovery rally.

- Bitcoin’s hash rate or computing power has risen to fresh record highs near 150 exahashes per second, according to Glassnode.

- That suggests miners remain unfazed by bitcoin’s recent decline from $12,400 to $10,000.

- Further, the percentage of bitcoin unmoved in over three years has hit a two-year high of 30.91%, according to data source Glassnode.

- “It suggests an increase in the holding mentality,” Simon Peters, a crypto-asset analyst at multi-asset investment platform eToro, said in an email.

- “The recent drop represents overselling and buyers may soon step back in again,” Peters added.

- The cryptocurrency is trading near $10,200 at time of writing, representing a 0.7% gain on the day.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.