Bitcoin’s Bearish September Has Kneecapped Crypto ETP Activity: Report

Bitcoin’s bearish price performance this month has prompted investors to pull out of some crypto derivatives products, with trading volumes taking a nosedive as a result.

- A CryptoCompare report published Thursday shows volumes for cryptocurrency-based exchange-traded-products (ETPs) have fallen to a fraction of what they were in August.

- Average daily volumes have fallen 75% from $186.5 million in mid-August to just $48 million by the middle of September, the firm wrote.

- The slump was experienced across the board with product providers in both Europe and North America, including Deutsche Boerse XETRA, feeling the pinch.

- August had been a record month for crypto derivatives generally, as CoinDesk reported at the time.

- CryptoCompare’s report doesn’t include volumes from products that run on unregulated derivative providers, such as BitMEX or Binance.

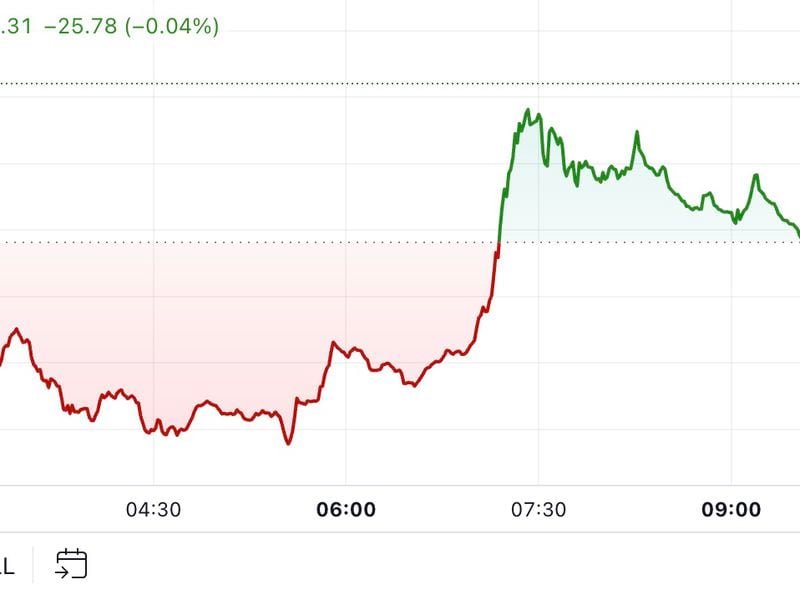

- Market leader Grayscale saw volumes for its Bitcoin Trust fall to just $40 million a day (pictured above).

- Its Ethereum and Ethereum Classic products have lost nearly 65% of their value since June, something CryptoCompare puts down to waning interest among investors.

- Grayscale is part of Digital Currency Group, CoinDesk’s parent company.

- Crypto derivatives track the price performance of selected digital assets, usually bitcoin, through a product that’s tradeable on regulated stock exchanges.

- As such, they are popular with investors who want to gain exposure to the digital asset market through a traditional instrument.

- Constantine Tsavliris, CryptoCompare’s head of research, told CoinDesk investors may have been put off as bearish market sentiment grew.

- In the first week of September, bitcoin fell from $12,000 to $10,000, but has since recovered to trade around $10,613 at press time, according to CoinDesk data.

- But negative feelings still pervade the market. The Fear and Greed Index, a consolidated sentiment tool for digital assets, is currently at 46, suggesting traders are still mildly bearish.

- “ETP investors generally invest long-term, and therefore the recent drop in price combined with a generally bearish market has likely encouraged more cautious trading activity,” Tsavliris said.