Bitcoin’s 2020: The Rise Of Certainty

2020 was unforgettable, especially for Bitcoin. To help memorialize this year for our readers, we asked our network of contributors to reflect on Bitcoin’s price action, technological development, community growth and more in 2020, and to reflect on what all of this might mean for 2021. These writers responded with a collection of thoughtful and thought-provoking articles. Click here to read all of the stories from our End Of Year 2020 Series.

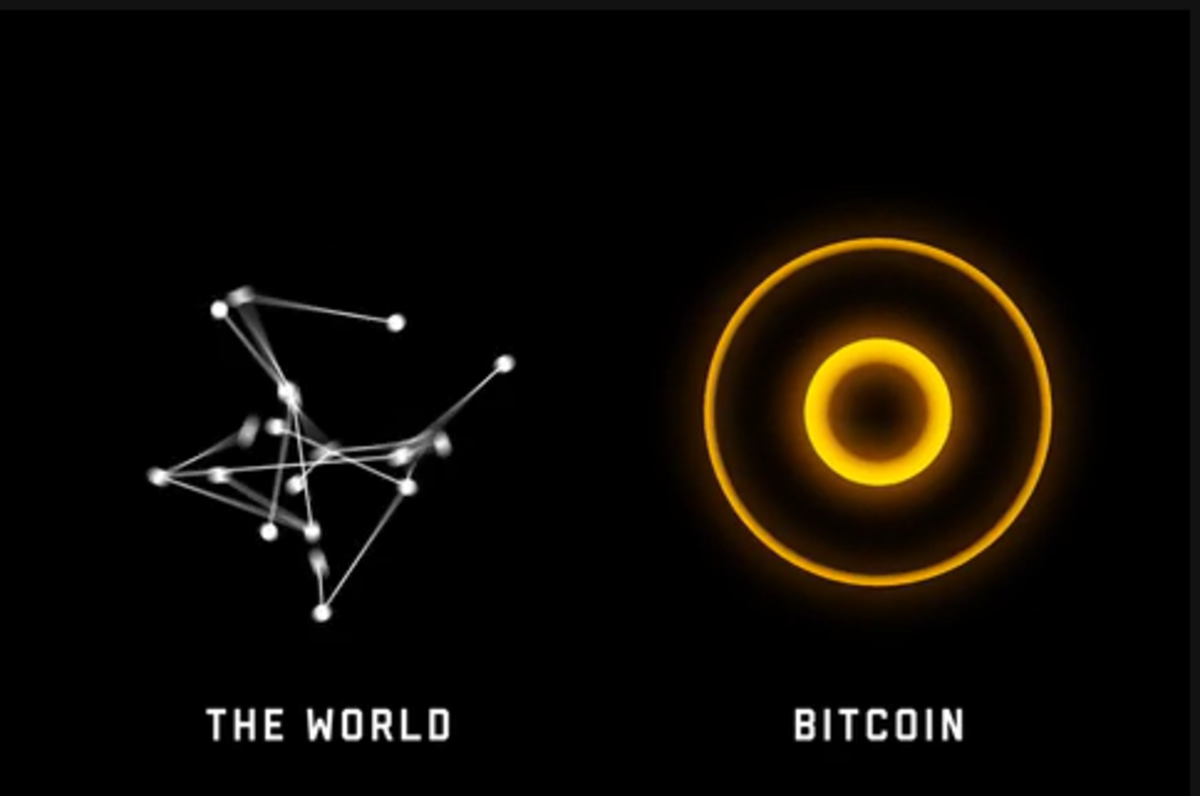

In a year overflowing with chaos throughout the world, Bitcoin continued to function flawlessly and give precisely zero fucks about what the rest of the world was doing. And, in doing so, Bitcoin’s predictability has contrasted sharply with the world as a signal of truth in a rising sea of both actual and manufactured chaos.

It was a constant, simple beacon of certainty.

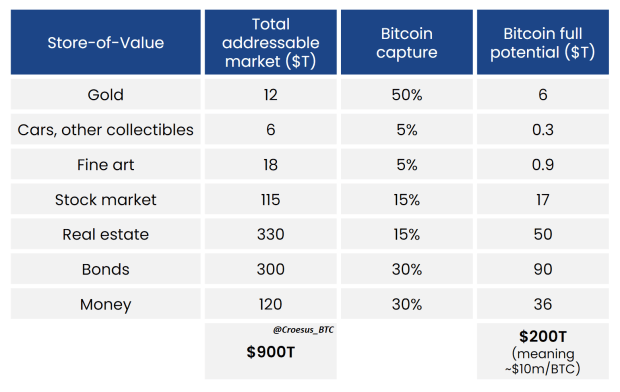

Throughout 2020, Bitcoin has grown, evolved, strengthened and, most importantly, all of these developments in aggregate have increased the certainty of bitcoin’s eventual form as a global reserve asset.

Core to my own view of Bitcoin is that the certainty of Bitcoin’s eventual end-state is far more important than timelines; the scope and scale and importance of what is being built and emerging in front of our eyes must not fail, so consequently should not be compromised by the impatient.

From this framing, let’s explore a few of the strands of Bitcoin’s rising certainty.

Developer Funding

While 2019 saw some excellent articles highlighting the perennial issue of insufficient funding for Bitcoin developers, 2020 saw the emergence of five more initiatives that acquired and supplied additional funding for Bitcoin developers.

BitMEX Research summarized its current state earlier in the year in this excellent article and subsequently, we saw these other efforts emerge:

- Human Rights Foundation

- Square Crypto with a focus on design and UX

- Bitcoin Brink with a focus on providing mentoring in conjunction with funding

- Long-absent Bitcoin-focused businesses stepping up in Gemini and Coinbase

- And my personal favorite, Bitcoin Devs List created for accepting direct contributions

These new initiatives built on top of those Bitcoiners who quietly and privately support developers who they know, and on top of the many good actors in the space who recognize that supporting the foundational strength of bitcoin is actually critical to their businesses.

The longer that HODLers retain their bitcoin, the more discretionary purchasing power they will control. I am very hopeful that many bitcoiners will, through some of the mechanisms that now exist, support bitcoin developers. I was delighted to support several devs on the Bitcoin Devs List in a small way as I have been able to recently. Take a look if you’d like to make a small but material difference too.

Helping the developers who build and maintain Bitcoin is a foundational piece in Bitcoin’s certainty.

The Third Bitcoin Halving In May

For those new to Bitcoin, “the Halving” is the reduction in the bitcoin emission rate — the block subsidy that occurs every 210,000 blocks, which is roughly every four years. In May of this year, that 10-minute block reward reduced from 12.5 bitcoin to 6.25 — a new rate of 900 BTC per day.

So with a static demand for bitcoins, and a halving of supply, basic economics dictates that price should escalate. If, however, demand was to increase at the same time as supply was reduced, that price action could be accelerated, as we historically observed in prior halvings.

For me, the third Halving in May was the first Halving that I’ve deeply understood as it happened — it was both a milestone to be celebrated with much joy and fun and laughs and joking and memes and art and music and articles and podcasts and live streams… and also supremely boring.

Boring in the sense that block 630,000 was mined just like every other before it, and every one that has followed it since — hashed to the preceding block, and propagated and validated near-instantly throughout the global network of nodes. As @citizenbitcoin first noted: #ticktocknextblock.

In a beautiful nod to both the genesis block and the degrading macro-economic climate, @f2pool_official (which mined block 630,000), added this message in the coinbase transaction itself:

“NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue,” permanently etching it into Bitcoin’s timechain like Satoshi’s original message to us.

The predictability and unstoppable costly forging of the world’s bitcoin transactions into an immutable timechain is the manifest display of Bitcoin’s inevitable certainty. #ticktocknextblock

Number Go Up

NgU is one of Bitcoin Twitter’s favorite and perennial memes and typically references the price of bitcoin as measured in your local currency, like AUD, EUR, GBP or USD. That NgU represents increased validation in Bitcoin’s core value propositions by a wider group, and for Bitcoiners, reflects an increased purchasing power and a validation of their understanding and conviction.

Yet there are so many more important NgU metrics within Bitcoin, which is why I’ve been a huge fan of Clark Moody’s Bitcoin dashboard and Bitbo’s more recent take, which consolidate many of these data points in an accessible point-in-time snapshot. Some of my 2020 favorite NgU’s are:

- Hash rate: Up about 50 percent, demonstrating a more secure network

- Block fees as a percentage of reward subsidy: From consistently under 2 percent to finding a new median between 6 percent and 10 percent

- Whirlpool cumulative CoinJoin volume: Growing from 1,800 BTC to 18,000 BTC, demonstrating better privacy

The hash rate underpins the security of the Bitcoin network, and also reflects the inflow of capital investment by mining groups (facilities and ASICS), as well as the organizational commitment to significant energy contracts. It is up 50 percent in 2020, and a whopping 1,000 percent since the last bull run (start of 2018).

Block fees will eventually replace reward subsidies as the income for miners who provide all of that crucial hash rate. Dan Held dug into this in detail in his 2019 article “Bitcoin’s Security Is Fine.” Since the Halving in May, the value of block fees has risen from under 2 percent to consistently between 6 percent and 10 percent, validating the fee model as expected.

While the increase of digital surveillance has been pervasive, so too have the rise of privacy tools and the willingness of people to both value and protect their privacy. In Bitcoin, CoinJoins are a great privacy tool, and Samourai’s Whirlpool use statistics are evidence of this.

So many NgU’s — and all of them reinforcing Bitcoin’s certainty.

The Formalization As BIPS: Their Review And Merging Of Code For Taproot, Schnorr And MAST

The most significant Bitcoin base layer protocol change — comprising three Bitcoin Improvement Proposals (BIPs) — in several years was formalized, published and extensively reviewed this year. Following the BIP reviews, the implementation was progressed and eventually merged into the pending Bitcoin Core v0.21, where it awaits release. The discussion on the appropriate soft fork activation mechanism is an active conversation and when a broad consensus is reached, that too will hopefully move forward.

With these BIPs, Bitcoin gains some minor block space efficiencies, important transaction privacy improvements and increased power and flexibility. Yet, like all changes to critical systems, there’s caution and care about deploying those changes — and that’s exactly how the activation discussions and considerations are progressing.

Looking at the process as a non-developer, I see better information dissemination; a wider, welcoming and public review process both for the BIPs and the implementation; and open, considered discussion on activation.

This makes me bullish AF, and is yet another reinforcing aspect of Bitcoin’s inevitable rise.

The Rise Of The DCA Army

As a fellow Australian, I’m blessed to count @FriarHass as a friend, and he has been crucially influential in encouraging, cajoling and informing on the importance of dollar-cost averaging (DCA) to provide bitcoin price stability. Throughout 2020, prominent Bitcoin businesses have added DCA mechanisms to their platforms, or extended DCA flexibility and capability.

Definitely high up among “things we love to see”:

- The AmberApp in Australia adding AmberBlack to its mobile platform

- Bitaroo in Australia enabling hourly, daily and weekly stacking

- Bitnob in Nigeria offering mobile DCA stacking

- BullBitcoin in Canada adding DCA capability to its platform

- Cash App in the U.S. adding DCA capability to its existing bitcoin buys

- CoinFloor in the U.K. providing DCA capability for the U.K. market

- Relai launching auto DCA in Switzerland for the European market

- River Financial in the U.S. adding DCA and monster buy limits for greedy stackers

- Swan Bitcoin in the U.S. offering sat stacking in all 50 states

Throughout the year has been the quiet and humble voice of the Friar echoing from his discussion with John Vallis: “If you want Bitcoin to be stable, put your nuts on the table.”

And wow, have we seen that take hold this year. Cash App’s published quarterly growth figures show incredible growth and demand for bitcoin, and the DCA Army is growing stronger, broader and hungrier for increasing their own stacks of sats, and with it, the value and stability of Bitcoin. The DCA Army is now buying a significant portion of the daily reward. This sets the floor from which future price gains build.

While the price gains are great, for me the simplicity of “set and forget” in a busy life means I never forget to buy, and each day I’ve got a bit more bitcoin than I had the previous day. More sats is my favorite Number Go Up. The rise of the DCA Army, though, is about ordinary people, not vetted as “sophisticated investors,” but ordinary people using the best savings technology ever invented. And damn, front-running the established financial markets is a mighty fine feeling, too.

The growing recognition of Bitcoin as the ultimate savings technology reflects growing certainty.

Growing Adoption

Seeing more friends and family buy bitcoin and seeing it begin to provide them with financial certainty in a frenzy of unrestrained debt-printing makes me appreciate that many others see Bitcoin’s value too.

Like many before me, I initially came for dollary-doo Number Go Up, but then as I learned more, I realized that, more importantly, Bitcoin is not about getting “rich,” but about not getting poor. It is just as simple as protecting my savings.

That has been reinforced for many bitcoiners this year as the U.S. Government increased the amount of USD by 20 percent. Not that the U.S. Government was alone in any way in the latest episodes of the “Money Printer Go Brrr” saga; all over the world there’s been vast quantities of debt printed and distributed. Central Banks aren’t printing money, they’re issuing debt and, in doing so, debasing the monetary supply and corrupting savings accumulated through work.

Unsurprisingly, us working plebs haven’t been the only ones noticing this.

MicroStrategy neatly summarized its predicament of a $500 million cash balance as sitting atop a melting ice cube. So, after casting around for options, it settled on making bitcoin its treasury reserve asset, and acquired $425 million worth, which now sits on its corporate balance sheet, a first for a listed U.S. company. And in line with its policy, it has subsequently added to that position.

I count their CEO, Michael Saylor (aka, Uncle Chad) as another bitcoiner — just with a few extra zeroes of fiat selling power. Thorough in his research, and generous with his time subsequently, it has been interesting to watch other parts of the corporate sector start to consider Bitcoin following MicroStrategy’s move and Saylor’s eloquent articulation.

Yet the news that heartened me most in the adoption category was a call from my long-retired parents concerned about their fixed income annuity streams: “We think it might be time for us to buy some more bitcoin.” A small initial purchase early this year was probably as much to placate their lunatic-fringe son as to satisfy their curiosity. Seeing “the light come on” for those you love is the heart-warming.

The best savings technology ever invented is meaningfully real for all age groups. Certainty is seeing all of these groups arrive in increasing numbers.

Maturing Financialization

Ignoring the obvious increase in Bitcoin’s realized and total market capitalization, there are three aspects of Bitcoin’s financialization that I’ve found so exciting to watch this year:

Firstly, the global liquidity crunch in March, and the effect it had on Bitcoin, was the most bullish thing I’ve seen since UASF — which is the most bullish thing in Bitcoin.

In the lead up to that hard crunch in mid-March, the regulated equity markets were frequently hitting their “stop-loss” indicators, freezing all market orders for minutes or hours at a time: To protect the market. To provide a circuit breaker. Bitcoin ain’t got none of that part-time market nurse-maiding; it’s 24/7 in every corner of the globe and as the world’s most accessible liquid market.

It dipped hard, and recovered quickly.

It didn’t have “circuit breakers.” No one “closed the market.” The Bitcoin CEO didn’t offer press briefings to all of the world’s financial media, providing carefully prepared remarks to “calm the market.” Nope, Bitcoin had none of that. It got sold hard, dipped hard and bounced back quick.

For bitcoiners with dry powder, it was, most likely, a never-to be repeated, BTFD gift.

And what it demonstrated to bitcoiners, and to anyone with eyes to see, was that Bitcoin had matured into a viable free market that corrected according to market behaviors rather than regulators. I’m pretty sure that makes it unique. And uniquely valuable.

The latter two things have emerged in the latter part of the year, and both are new products that offer bitcoin-native financial services. Both are early, evolving and exciting. And neither has a side serving of vegetables.

Bitcoin DeFi has arrived with Hodl Hodl’s Lend platform which offers peer-to-peer lending, utilizing bitcoin as collateral that’s secured against loans of stablecoins using an on-chain bitcoin multisig contract. As the platform does not touch fiat, and as stablecoins are easily redeemable for fiat, Hodl Hodl has created a basic DeFi product that’s true to the ethos of Bitcoin — trust minimized, peer-to-peer and devoid of intrusive surveillance requirements.

The third aspect has been the launch of Lightning Labs “Lighting Pool” product to provide an automated, trust-minimized marketplace to offer inbound Lightning liquidity to Lightning nodes seeking that service. Like Hodl Hodl’s lending platform, the marketplace participants determine what acceptable rates are to them — and from that a marketplace emerges.

In essence, Lightning Pool is a platform to “rent” your Lightning node liquidity upon which you can gain a bitcoin-denominated return. This, in turn, from a financial perspective offers the prospect of starting to determine a yield curve for understanding the value of bitcoin using more traditional financial models.

Many may consider these aspects of little interest to them, but as we expect bitcoin to become recognized as the best money the world has ever known, it is important to track these emerging financialization aspects. They’re not as important now as they’re going to become, but their emergence definitely shouts loudly “certainty, certainty, certainty.”

Bullish On Bitcoiners

Bitcoiners are a diverse bunch from all walks of life, from all the villages in all the tribes, and curious, critical, humorous, witty, clever, creative and educational. Of all the resources in Bitcoin, it’s bitcoiners that are most under-rated, and the one which I’m most bullish about. The diversity of viewpoints, knowledge, experience and perspective helps everyone sharpen their own understanding. To sift hopium from reality.

Bitcoiners are certain about Bitcoin.

For me, Bitcoin remains the single longest lever upon which we can push to affect change to the most fundamental good in humanity: money. If we can fix the money, we can eventually fix the world.

The progress for Bitcoin throughout 2020 has been incredible and positive and increases the certainty of the outcome that I and many others seek for it: bitcoin as a global reserve asset.

This is a guest post by WizardofAus. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Bitcoin’s 2020: The Rise Of Certainty appeared first on Bitcoin Magazine.