Bitcoin’s 14% Weekly Gain Signals ‘End of an Era’ as Big Tech Dumps, Analyst Says

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Bitcoin’s (BTC) bullish momentum has spread to the broader crypto market this week as all crypto sectors booked gains, CoinDesk data shows.

BTC gained over 14% in a week, recently consolidating at around $33,700 after it hit fresh yearly highs at $35,000 but failed to break through that price level. Bitcoin’s performance is roughly in line with the CoinDesk Market Index’s (CMI) 14% advance.

The strongest pocket of digital assets was the CoinDesk Computing Sector (CPU) – an index that tracks protocols aiming to build and support the infrastructure of Web3 and distributed computing. CPU saw over 17% gains, driven mainly by tokens of Chainlink (LINK) and Fetch.AI (FET).

Even the laggard decentralized finance (DCF) and digitization (DTZ) sectors were up over 7% this week, highlighting the breadth of the crypto rally.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KUXKQ5IP2RCRDBZ44NZBRGTGHE.png)

Notable best-performing cryptocurrencies include notorious meme coin pepe (PEPE) with 76% advance following a token burn, LINK rallying over 44% which benefitted from the tokenization of real-world assets trend and finance-focused Injective Protocol’s native token (INJ), adding another 58% gain to its already-impressive run following a token upgrade this August.

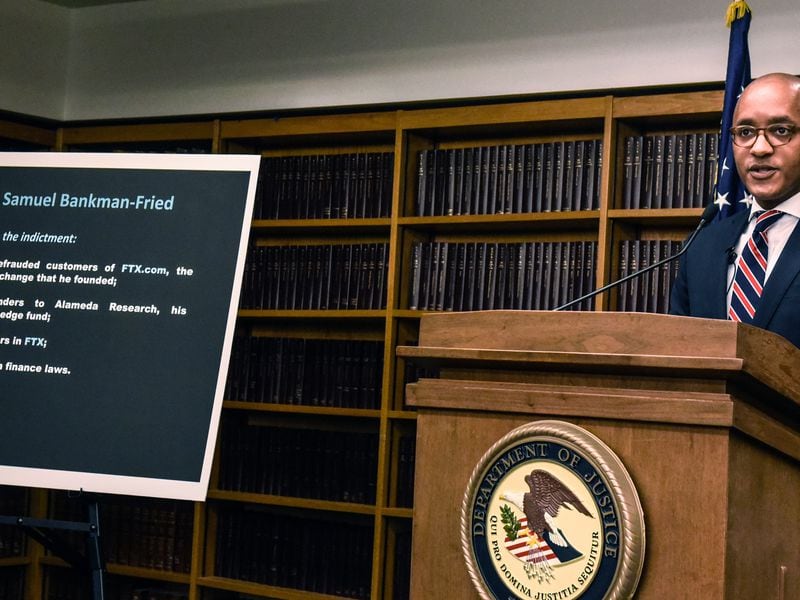

Crypto’s ‘uptober’ and big tech’s demise

What has made crypto’s bullish week even more significant is the dismal performance of U.S. equities, Coinbase analysts David Duong and David Han noted.

They pointed out that BTC moved 4.3 standard deviations higher this week compared to the previous three months, while the S&P 500 and Nasdaq moved nearly 2.5 to 3.0 standard deviations lower during the same time, the Coinbase report said.

“That massive divergence partly reflects a deteriorating macro trading environment juxtaposed against bitcoin’s positive idiosyncratic story,” Duong and Han wrote.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SGFSSQOOP5G4XBVSG3Y43PBUNE.png)

“Uptober is certainly living up to its name,” Charlie Morris, founder of investment advisory firm ByteTree, said in a Friday market update.

Morris noted that the tech-heavy Nasdaq’s slump amid BTC’s and gold’s advance signals a shift in the investment landscape away from the ever-growing, large U.S. tech giants.

“Big tech is expensive, and following underwhelming results this week, the sector no longer grows fast enough to justify premium prices,” he said. “Admittedly, they had plenty of room to reduce costs, but real growth comes from sales rather than costs.”

“It’s the end of an era, and tech investors should jump ship,” he added.

Edited by Aoyon Ashraf.