Bitcoiners, Solana Acolytes Crash Ethereum Conference in Denver – for a Reason

-

Last week’s ETHDenver conference, originally focused on the Ethereum blockchain, drew a presence from developers and teams focused on other ecosystems, including Bitcoin, Solana and Polkadot.

-

The draw reveals Ethereum’s influence and reach – as well as the potential competition.

Ethereum conferences aren’t just for Ethereans anymore.

Last week’s ETHDenver conference in Colorado, one of the year’s largest gatherings for developers and users of the Ethereum blockchain, drew in a cross-section of the blockchain industry.

The broad swath of attendees might be a testament to Ethereum’s influence on other blockchain ecosystems, attracting onlookers from other crypto tribes. But it also might be a sign of rival systems looking to encroach on Ethereum’s success in making blockchains more programmable, with its vibrant ecosystem of software developers looking to create new applications.

Bitcoin, which is in the midst of a developer renaissance with the advent of its own NFTs and decentralized finance (DeFi) services, had an impressive turnout of builders at the conference. So did Polkadot, the “hub-and-spoke” blockchain created by Gavin Wood, an Ethereum co-founder who used to market his new project as an improvement over the Ethereum model. Even Solana, the speed-focused network that’s long positioned itself as an “ETH Killer,” had a well-attended booth at Denver’s National Western Complex, the conference’s venue.

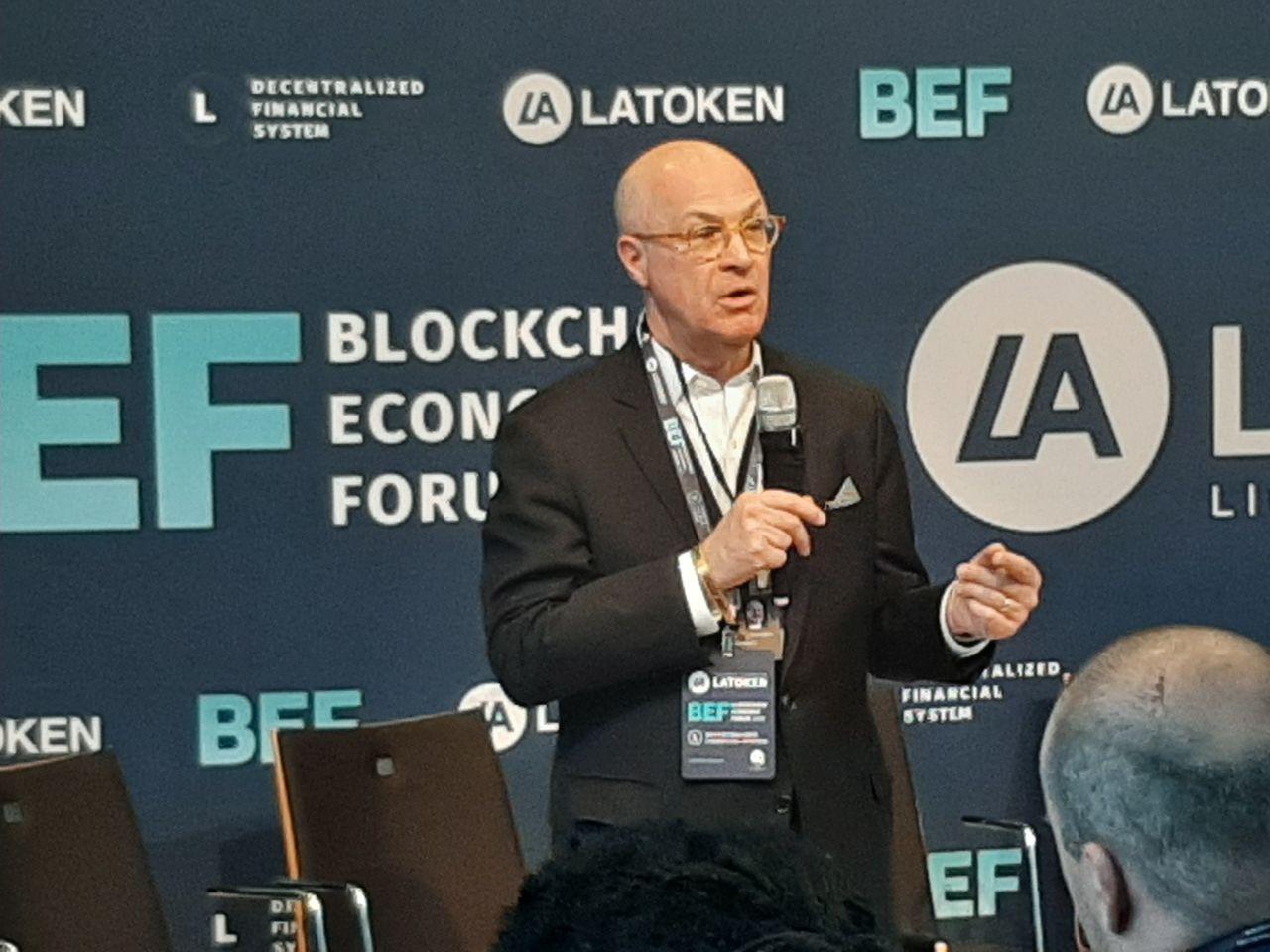

John Paller, the conference’s founder and executive steward, told CoinDesk in an interview that there were “probably seven or eight layer 1s that are here, and we have probably 12 layer 2s.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ND54UVRW2NGYNNFORVZ7DGRCW4.jpg)

The cross-chain camaraderie might have been out of place in past years, when dueling strains of maximalism defined the blockchain industry. But it makes sense that networks might now wish to make inroads with Ethereum’s developer community.

“Even though there are a lot of issues with Ethereum, it is probably the first virtual machine that a developer will interact with if they’re new to this ecosystem,” said David Roebuck, co-founder of TRGC, a crypto investment firm focused on early-stage companies. “Ethereum, being here for eight or nine years, really has this compounding network effect, so all the layer 1s trying to stay relevant are integrating and doing things with Ethereum.”

The Ethereum community seems more than willing to embrace its competitors, with the rise of “layer 2” networks increasing the community’s comfort level with working across multiple blockchains.

“As users become more fragmented, and as the developer community on Ethereum starts to become a lot more flexible and versatile across different protocols, you are 100% going to see the ‘Ethereum ecosystem’ grow to encompass other blockchain ecosystems,” Christine Kim, vice president of research at Galaxy Digital, told CoinDesk during a conversation in the ETHDenver press office.

ETHDenver 2024’s Big Tent

Ethereum’s biggest weakness has always been its transaction fees, which can make something as simple as a token swap cost upwards of $10 in fees alone. “Ethereum is not planning on bringing down fees for its users, and that’s a reality that people need to understand,” explained Kim.

To circumvent its fee problems, Ethereum has gone full-throttle on rollups, the “layer 2” networks that settle transactions on the Ethereum chain but offer lower fees and higher speeds to users.

“Ethereum is king,” said Paller. “It’s how do we build around Ethereum, with layer 2s to ZK-fill-in-the-blanks or whatever.”

Ethereum co-founder Vitalik Buterin started to advocate for a “rollup-centric” roadmap for the chain in 2020, and over the past year his vision has been realized, with layer-2 rollup networks like Arbitrum, Optimism and the U.S. crypto exchange Coinbase’s Base consistently surpassing Ethereum in overall traffic.

While Ethereum’s rollups ultimately pass data to the base Ethereum chain, they’re still separate networks – each with its own programming, app ecosystem and community.

“All of this talk around interoperability between rollups naturally leads to conversations of, well, why aren’t we having increased interoperability with other execution environments like the Solana VM,” or the Cosmos ecosystem, said Kim.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FZ5L2AS7YBBIRHPFYOBZ5PBXPU.jpg)

The “data availability” problem

As the Ethereum umbrella expands to include other blockchains, it must lean into one of its weakest use cases: data availability, or “DA.”

When blockchains need to store data, they frequently lean on other blockchains: So-called data availability layers, which keep a full record of a chain’s transaction data so it can be formally verified.

While Ethereum can technically be used as a data availability layer, there are other networks, like Celestia and Filecoin, for which data availability is their bread and butter.

“In terms of its reliability and resilience, I think Ethereum as a data availability layer is unmatched,” Kim said. “However, you have the problem of high fees and high costs. You have other cheaper data availability solutions.”

Ethereum’s next big upgrade, Dencun, will happen later this month, and is explicitly designed to make the network friendlier for layer-2 services via improved data availability: The key upgrade, “danksharding,” re-jiggers the network’s programming to make it easier for layer 2s to settle “blobs” of data onto the chain – theoretically, as a way to ramp up Ethereum’s capacity to store L2 transaction information.

But Dencun might be too little too late. Ethereum is ultimately playing catch-up in the realm of data availability, and it’s unlikely that its costs will decrease to get within range of other DA networks anytime soon.

The risk for Ethereum

As Ethereum continues to shift in the direction of layer 2s and cross-chain interoperability, it risks “ceding its dominance as a general purpose platform for general-purpose compute,” Kim said.

Ethereum is currently the largest blockchain for “general computation” – both in terms of the size of its developer community, as well as the level of liquidity in its decentralized finance ecosystem.

Its expansion to new ecosystems comes amid a wider trend of blockchain “modularity,” where apps that would have historically lived on one blockchain are now picking and choosing pieces of different blockchain architectures, and deploying elements of their programs across all of them.

“Applications are cross-chain, their architectures are cross-chain,” said Sam Friedman, a principal solutions architect at Chainlink Labs, which builds interoperability architecture for blockchains. “It’s not independent instances of the app on different chains. It’s the same app with different components” on different chains.

With the shift towards modularity, Ethereum’s lead in the blockchain race might begin to blur, if not erode altogether, given its speed, cost and data storage shortcomings.

Meanwhile, builders from the other blockchain ecosystems are waiting in the wings.

“If there was some Ethereum killer that showed up and had better tech, and the ability to build a stronger, more vibrant, more durable community than Ethereum, then it should win,” said Paller.

Margaux Nijkerk contributed reporting.