Bitcoin Will Make You Rich, Not Attending A University

There’s an opportunity cost in every decision you make, but choosing to pay a university over buying bitcoin could cost more than you think.

There is an opportunity cost in every decision you make in life. Some are bigger than others, but there is one I’ve seen way too many people fall for, and that is earning a degree at a university instead of buying bitcoin.

Attending a university today is extremely expensive and is pushed onto kids so hard that it’s almost predatory. Most kids don’t have the money to pay for it so they’re incentivized to take on debt to attend, and this often backfires on students. Degrees don’t guarantee jobs, and many young adults are left jobless, with debt and no direction in life.

As a college dropout myself (backed up by my bitcoin friends who also dropped out), I can confidently say that accumulating bitcoin and working on your passions is a much better use of your time and money than attending a university. Don’t believe me?

Let’s crunch some numbers.

Cost

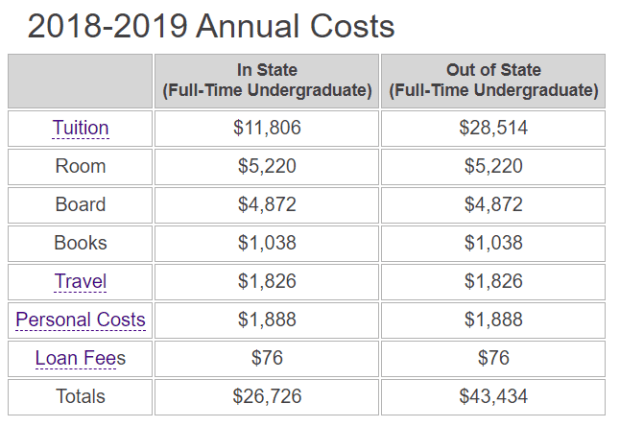

Take, for instance, James Madison University, a university in my home state that I was planning on attending but I eventually turned it down.

If I would have attended this University straight out of high school and the annual cost (in state) would be $26,726 for tuition, room, board, books, travel, personal costs and loan fees. After a bare minimum of attending the school for four years, the cost would total more than $106,904.

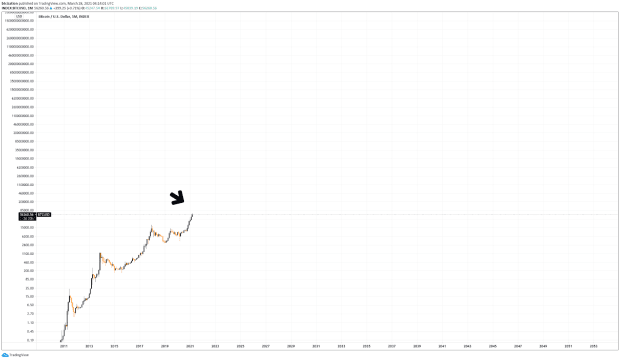

The price of bitcoin was $6,537.74 on July 5, 2018 via price by date, the day students would start paying their schooling costs. If you would have invested that year’s cost of $26,726 into bitcoin on that day, you would have netted 4.08796951 BTC, which, at the time of writing, is worth $235,285.28. If you would have invested the cost of all four years on that day, that would have netted you 16.351828 BTC, which, at the time of writing, is worth $942,846.40.

Both that 4.08796951 and that 16.351828 BTC are way more money than most people will ever see in their lifetimes. To accumulate this much of a limited supply asset is a once-in-a-species opportunity that is wasted by nearly every young person.

A 20- to 21-year-old with that bitcoin could just sit on the BTC for the rest of their life and outperform most, if not all, of their colleagues who got a degree (or degrees) from a university. They could even take some of that bitcoin, develop a product or sell a service by starting a company, in hopes to provide value to their society. Having more wealth opens your options in life tremendously, and gives you the freedom to explore your passions. This is something that university students don’t get to experience. It’s a much better way to start your adult life than to be shackled in debt with no money and no real sense of direction in life.

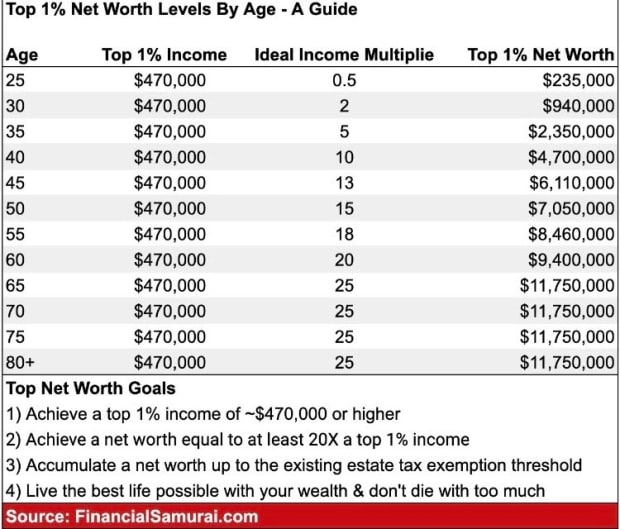

Many who can’t afford that upfront cost always have the opportunity to attend college and use their student loans to buy bitcoin, which makes you able to afford this. But that can be uncomfortable for most, so even if you don’t have that money to buy bitcoin off the bat, working a job(s) to buy as much bitcoin as possible still puts you in a position that’s way ahead of everyone else. In the recent couple-year bear market, there was a Zoomer named David on Bitcoin Twitter who was able to accumulate more than two BTC working part-time at a coffee shop. That’s now worth about $116,000 at the time of writing. This savings got him two of the 21 million total supply of bitcoin, and put him on track to be in the 1 percent in terms of net worth.

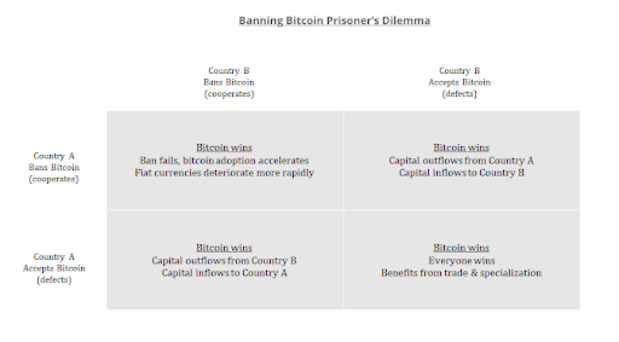

Bitcoin is currently priced at about $58,000 fewer than three years later. But this argument of accumulating bitcoin instead of paying to attend a university is still valid. The upside and potential ROI for bitcoin is unimaginable to those who don’t understand Bitcoin and the current state of the financial world.

Education

Educating myself online and working jobs in fields that I’m interested in instead of attending a university has been one of the best decisions I’ve ever made. I’m free to express myself and find out what I like and don’t like about different careers. In a university, you learn all about potential careers but you are never really sure if that’s what you want until you try it for yourself — which many students don’t do, they just get the degree and ask questions later. I’ve talked to many people who earned a degree for a career they ended up hating, who wish they never got it. But I’ve never heard someone regret earning bitcoin and being upset at the results that came with it.

The education that you tend to gain in the Bitcoin space is around taking responsibility, self sovereignty, Austrian economics, providing value to society, thinking for yourself and more. Most if not all of this can be learned at just the cost of a phone/computer and an internet connection. You don’t have to pay for any of the required university costs above, this can be all learned for free.

Why pay hundreds of dollars for a single textbook that teaches Keynesian economics, which emphasizes the state at your expense, when you could buy “The Theory Of Money And Credit” by Ludwig von Mises for $12.99 on Amazon? You get a more useful and better book for a fraction of the cost.

I got the education of a lifetime on Twitter and a few other sites. It has allowed me to socialize and network with some of the most brilliant minds in the world and opened up doors I never even knew existed. Since we are so early, there is endless opportunity in the Bitcoin space, just waiting for someone to come and grab it. There are many things about life that you will not learn from a classroom and must learn from a mentor. The Bitcoin space has loads of smart adults who are eager to pass on their knowledge to younger generations, helping them succeed. This is a huge step up from university networking, where you’re just talking with a bunch of kids who also have no idea what they’re doing in life.

All In All

Accumulating bitcoin while pursuing your passions in life is a more beneficial use of time than paying to attend a university. It results in you avoiding any bad debt while saving life-changing amounts of money. This life-changing amount of money then allows you to face any challenge head on and reach your full potential.

The great thing about this is while you’re getting rich and earning life/work experience, your options open up. You wouldn’t need a degree to have a successful career, because you’d have the experience and capital to do whatever you want. And if you do want to get a degree, you can go later, after you’ve made your money and the cost of the degree is cheaper (priced in bitcoin).

There’s a whole world full of opportunities for us to go chase. There is an opportunity cost in everything we do. Some decisions are better than others. Bitcoin gives us the possibility to actually go about life debt free, worry free and financially free. The cost of attending a university stands in the way of that for young adults.

This is a guest post by Nik Hoffman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.