Bitcoin Will Be Analogous to Amazon, Mark Cuban Compares Crypto to the Dot-Com Bubble

Mark Cuban is arguably one of the most popular billionaire investors in the world. Like many celebrities, he recently took the chance to comment on the current state of cryptocurrencies, comparing Bitcoin and Ethereum to the internet stock bubble.

Mark Cuban: Crypto is Exactly Like the Dot-Com Bubble

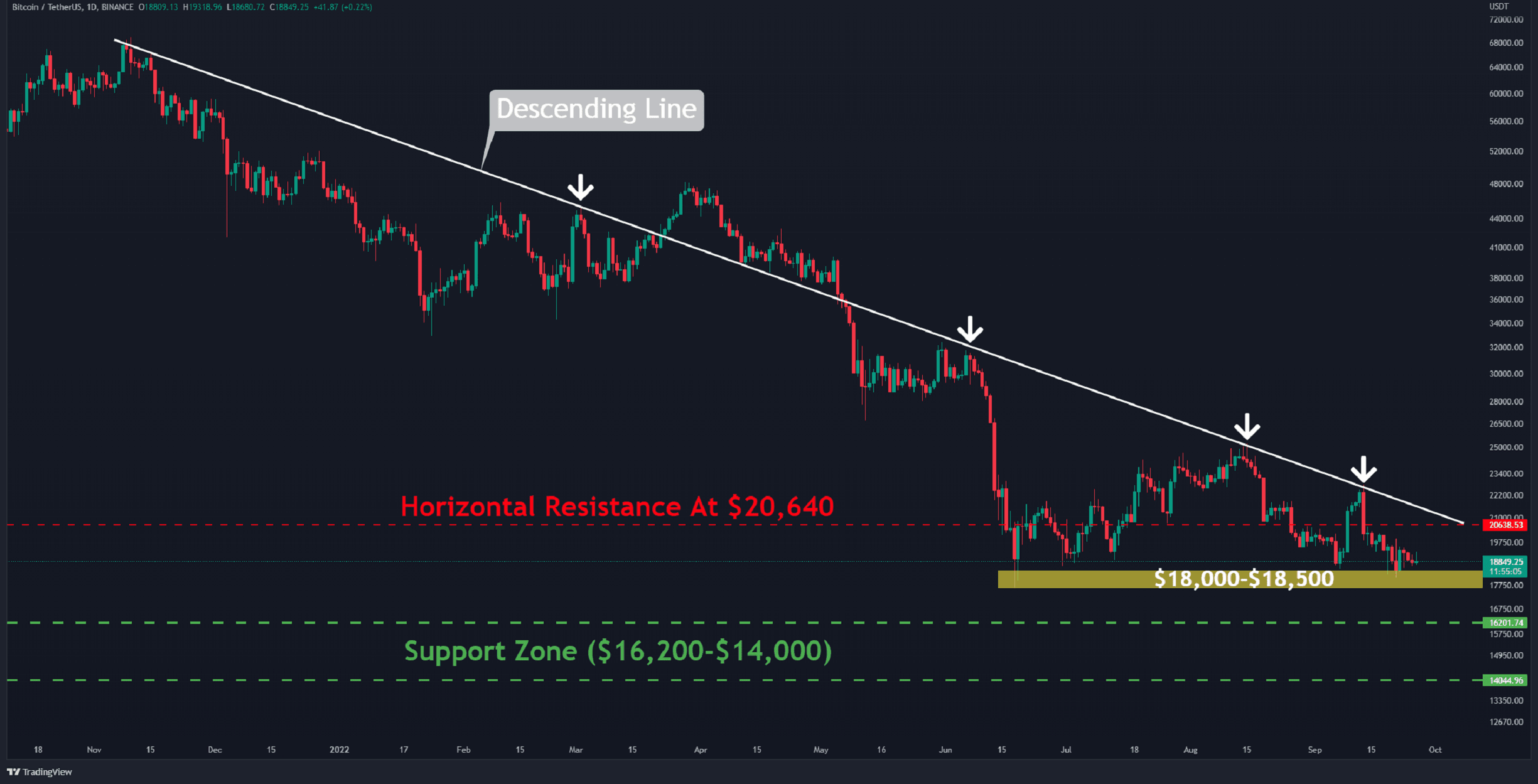

The recent volatility in bitcoin’s price took many by surprise, even though analysts and experts with sufficient experience have been warning about the potential of such a correction for quite a while now.

One of the people with a celebrity-like status to comment amid yesterday’s nosedive was billionaire investor Mark Cuban.

In a Twitter thread, he said that cryptocurrencies are “exactly like the internet stock bubble. EXACTLY.”

He also weighed in on his thoughts on particular assets like Bitcoin and Ethereum. Speaking on the matter, Cuban commented that he thinks “BTC, ETH, a few others will be analogous to those that were built during the dot-com era, survived the bubble bursting and thrived, like AMZN, eBay, and Priceline. Many won’t.”

Watching the cryptos trade, it’s EXACTLY like the internet stock bubble. EXACTLY. I think btc, eth , a few others will be analogous to those that were built during the dot-com era, survived the bubble bursting and thrived, like AMZN, EBay, and Priceline. Many won’t

— Mark Cuban (@mcuban) January 11, 2021

Traps and Dangers Along the Way

While Cuban seems somewhat convinced that the leading cryptocurrencies will prevail and stand the test of time, he also believes that “many fortunes will be made and lost, and we find out who has the stomach to HODL and who doesn’t.” He has also spoken fondly of hedging as an important necessity for those who want to make it in the long term.

The investor also took a stab at people who’re trying to justify the current prices of cryptocurrencies. He said that it’s a supply-and-demand driven and that all the “narratives about debasement, fiat, etc., are just sales pitches. He concluded that the “biggest sales pitch is scarcity vs. demand.”

However, Cuban also touched upon the dangers of leveraging and highlighted the importance of risk management.

Let me add one thing: if you are taking on debt that you can’t afford to pay back to invest in crypto (or stocks or currencies), YOU ARE A FOOL and there is a 99pct chance you will lose EVERYTHING. Personal disaster stories are built on leverage.

Indeed, as CryptoPotato reported yesterday, there were almost $3 billion liquidated positions (both long and short) in a span of less than 24 hours. This just highlights how overleveraged the current market is.