Bitcoin Wallets For Beginners, Part One: Self Custody And Avoiding KYC

In part one of the “Bitcoin Wallets For Beginners” series, we cover the importance of bitcoin self custody and dangers of KYC regulations.

This article is part one of a five-part series designed to demonstrate to Bitcoin beginners how to install, secure and use a Bitcoin wallet. This first part of the series covers the importance of self-custody and the dangers of know your customer (KYC) regulations.

Generally speaking, new Bitcoin users discover the importance of self-custody and the dangers of KYC after they have already started acquiring bitcoin. Since bad habits are hard to break, I wanted to cover this topic for Bitcoin beginners first. This tutorial has been designed for a total Bitcoin beginner, someone who is interested in Bitcoin but has no idea where to begin or what a Bitcoin wallet is or what to do with them.

With this ongoing five-part series, I hope to have put together an informative guide to some pitfalls to watch out for for new users with a focus on the installation and use of their first Bitcoin wallet and how to obtain non-KYC bitcoin. This way. anybody can bookmark this tutorial and reference it when they have the time and interest.

This first part is my attempt to help Bitcoin beginners understand my opinions around the importance of self-custody and the dangers of KYC. I wanted to take the time to share these thoughts in long form because I believe that if a person can understand what is at stake, then they will take this stuff more seriously, forming better habits from the beginning. I’m making the guides I wish I had when I was first getting started with Bitcoin.

Five Reasons For Self Custody

When you install a Bitcoin wallet on your mobile device or desktop, you are taking the radical responsibility of self custody. This means that you and you alone are responsible for your bitcoin. Some of this may be alarming, but it’s the honest truth; if you lock yourself out of your wallet, then that is 100 percent your fault and you are responsible for that loss. If you fall victim to a phishing attack and share compromising information with a scammer, that is 100 percent your problem and your loss. There is no customer support hotline in Bitcoin. There is no charge-back feature in Bitcoin. And there is no card-lock security in Bitcoin. Unlike using a bank, you and you alone are responsible for your bitcoin once you cross the threshold into self custody.

As the saying goes: “A ship in harbor is safe, but that’s not what ships were built for.”

You may be asking yourself why I’m such an advocate for self custody after reading that last paragraph.The answer is simple: freedom. With non-KYC bitcoin in self custody, financial permission, confiscation and censorship have no effect on the way that you economically interact with the world. That may come across as hyperbole or a load of buzzwords but let me give you five very real-world examples that may resonate with your life experience.

1. Maybe you have worked your whole life but you have never been able to set aside a meaningful savings account. Maybe you live paycheck to paycheck and you spend 110 percent or more of your wages every pay period.

This is because fiat currency like the USD is a terrible store of value. Your purchasing power is continually being siphoned out from underneath you through various forms of inflation, which is effectively confiscation. Every dollar printed is stealing the value of the dollars you accepted in exchange for your time and effort in labor.

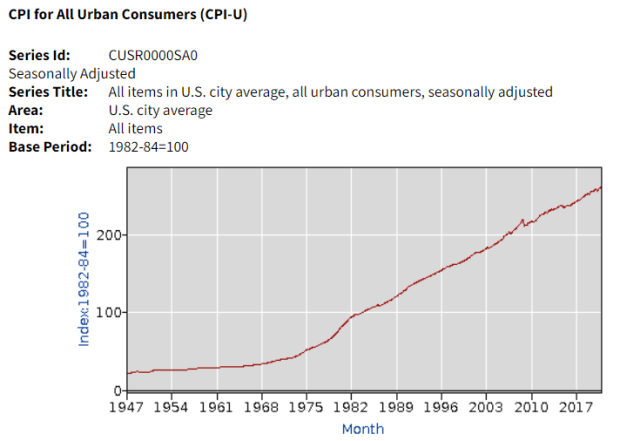

Bitcoin helps ensure that the value stored today will be preserved for the future, and when you self custody your bitcoin, you can verify that your wealth is cryptographically in your possession at all times without trusting a third party. Check the Consumer Price Index to see how the cost of a basket of average consumer goods and services has increased over the years.

The majority of us have only ever seen our money lose purchasing power. If your wages haven’t increased by about 160 percent since 1983, then you’re falling behind.

2. Maybe you have had your wages garnished — that’s a much more direct form of confiscation. Maybe your state government decided that you owed it even more money in taxes than you already paid. Your state government has the authority to siphon money out of your paycheck before you receive it.

You thought living paycheck to paycheck was tough before? Try opening your paycheck one day to find that 15 percent has been confiscated after your federal income tax and state income tax and medicare and social security and mandatory health insurance have been taken.

Every Bitcoin transaction must meet the consensus rules, and if a transaction is not signed by the owner, then it will not be accepted. When you self custody, no third party can arbitrarily confiscate what is yours. When centralized authorities are removed from the equation, value can be transferred from peer to peer, uninhibited.

3. You’ve probably been working for a while. Every paycheck you get has medicare and social security taxes taken out that you will likely never benefit from. But the worst part is that every paycheck has a federal income tax taken out as well.

Federal income taxes are used to pay the interest on the money that the Federal Reserve prints for the United States Treasury. That’s right, you have to pay interest out of your pocket for a monetary policy that you have zero voting rights for. In fact, the people operating this monetary policy are not even elected officials, you have absolutely no voice.

The more money they print, the more purchasing power is confiscated from you, and there is more money circulating for you to pay the interest on. Bitcoin has a 21 million coin hard cap, this means that using bitcoin as a bearer monetary instrument ensures no representative and un-backed IOU is being printed and loaned out for circulating economic activity, thus eliminating the need for an interest-based monetary debt instrument, such as the U.S. dollar.

4. Have you ever had a transaction blocked by your bank because it doesn’t support the type of business you are attempting to interact with? That’s what permission looks like; your money, their rules.

Maybe the business was totally legal but it’s just in a taboo industry, like pornography. Maybe it’s legal in your state but illegal at the federal level, like a marijuana business. Maybe, in a not-so-distant future, your political contributions will be blocked unless they align with your bank’s vision of the world.

When your money is in someone else’s possession, you have to get their permission to use it. With bitcoin in self custody, so long as your transaction follows the consensus rules, i.e., you’re not trying to double spend, then nothing will stop it. No one’s opinion of your business is relevant, Bitcoin is software and will execute as expected for any person for any reason, every single time.

5. Have you ever been blocked from opening an account at a bank or had your account closed? That’s a form of censorship.

In 2019, when I moved my family to Wyoming in an attempt to leverage its “crypto friendly” legislation to start a Bitcoin ATM business, we found out the hard way what financial censorship looked like. We were rejected by 12 banks in Wyoming, plus one bank in California, two banks in New York and two banks in Colorado — 17 banks in total. Two of them had even opened accounts with us and then promptly shut us down and refunded our deposits once they found out our business was Bitcoin-related.

Bitcoin ensures that anyone is free to economically interact with the rest of the world. Because of Bitcoin’s decentralized nature, there is no central authority to deny your transaction or shut you out of the network. So long as your transaction meets the consensus rules, it will be valid and upheld by the network.

These are just a few examples of what it means to take self custody of money that is permissionless, cannot be confiscated and is censorship resistant. Third parties and all of the associated risks can be eliminated by using Bitcoin. There are many more examples and I think that if you reflect on your own life experiences, you will find incidents in which you fell victim to these kinds of problems.

The Risks Of Trusting Bitcoin Exchanges

Let’s say you get all that, you understand why bitcoin is better money — with the hard cap, the permissionlessness and the censorship resistance. But you still think that having your bitcoin in the possession of your exchange or broker is better than self-custody. After all, the exchanges deal with huge volumes of bitcoin everyday, so surely they can be trusted with your bitcoin. But therein lies the problem: trust. Let’s discuss what you’re sacrificing with that trust and see if you still think the same way about self custody afterwards.

Maybe you have heard of Mt. Gox, Quadriga or EXMO? These are a few exchanges that had catastrophic impacts on the people who trusted them.

When an exchange gets hacked, there are no fixes for the end users who have their bitcoin stolen. There is no FDIC or SIPC insurance. Furthermore, there is often no way for the public to verify that an exchange actually has the bitcoin it purports to have. An exchange could potentially sell 100 bitcoin IOUs when it only has 10 actual bitcoin, or it may have zero real bitcoin for that matter. There’s no way for the public to know.

Ask yourself what happens when you’ve handed your life savings over to Coinbase, for example, and suddenly there is a bitcoin liquidity crisis, and it turns out it sold more in bitcoin IOUs than it actually held in real bitcoin. Do you really think you’ll be safe? Do you really think you’ll get your money back? If you had your bitcoin in self custody, it would be safe and you could verify its existence for yourself.

Ask yourself what happens when the U.S. Securities and Exchange Commission decides that bitcoin trading needs to be halted, like it arbitrarily decided for 15 publicly-traded stocks. Do you think Coinbase or other regulated exchanges will keep your best interests in mind?

I want to take a moment to explain another issue that goes hand-in-hand when you trust a custodian with your bitcoin, instead of holding your bitcoin in self custody, and that issue is KYC.

The Dangers Of KYC

KYC requirements is an invasive scare tactic used to preemptively collect the data and personally-identifiable information about you that would prove, beyond a reasonable doubt, your ownership of bitcoin. Stemming from the Bank Secrecy Act, KYC regulations are enforced by the Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Treasury.

These regulations were originally the federal government’s attempt to prevent U.S. citizens from funding foreign enemies. However, these regulations have morphed into an excuse for corporations, government contractors and state agents to harvest, track and share your personal information, opening the means by which governments can enforce controls on you. The range of KYC requirements can vary from providing your full name, birth date, email and phone number to your social security number, physical address, IP address, financial background statements, photographs of you holding your government ID, or all of the above.

Since bitcoin exchanges, brokers and most on ramps are conducting what the federal government considers “regulated activity,” these businesses are required by federal law to comply with these regulations. By not complying, a business runs the risk of being fined or shut down, which means that your best interests will always take a back-seat when dealing with regulated entities.

In recent years, it seems as though the federal government has irrationally raised the KYC requirements when it comes to bitcoin. For example, the Travel Rule would require money services businesses to automatically file suspicious activity reports to the federal government for bitcoin transactions exceeding $250 in value that cross a U.S. border, among other things.

The Travel Rule was fueled in part by the Financial Action Task Force (FATF), which is basically a group of assholes that take the broken anti-money laundering (AML) policies of the United States and try to force them into Bitcoin by writing recommendations like this.

This is the basis for my conjectures that forcing broken legacy system regulations into the Bitcoin ecosystem is abhorrently disastrous. The old financial system has failed miserably, the vast majority of people I know have seen their wages stay stagnant for years, they cannot afford to buy a home in the neighborhoods they grew up in, the money they do have is worth less every year, and 75 percent of all USD in existence has been printed after the launch of Bitcoin in 2009. Bitcoin is not the government’s money, they don’t get to make the rules.

Clearly, the rules governing the legacy system have failed, so I find it disturbing that people want to force these same rules into Bitcoin. The rules don’t even work in a system where the orchestrators have all of the control, why in the world would anyone think those kinds of rules are going to make Bitcoin better? I say cut the ties, burn the bridge that connects the old world to the new. Central banking is a rotten corpse and I’m sick of its stench.

The regulations are supposed to inhibit money laundering, however, the world’s largest banks are the ones facilitating the vast majority of money laundering and when they get caught, the penalties are less than the profits they made, which is incentive to do it again. If you haven’t read the articles from the International Consortium of Investigative Journalists, collectively known as the FinCEN Files, I highly recommend familiarizing yourself with them. Their key findings were:

- Global banks moved more than $2 trillion between 1999 and 2017 in payments that they believed were suspicious, The figures include $514 billion at JPMorgan Chase and $1.3 trillion at Deutsche Bank.

- Five global banks moved illicit cash for shadowy characters and criminal networks even after U.S. authorities fined these financial institutions for earlier failures.

- Banks didn’t have information about one or more entities behind the transactions.

- Years after concerns first emerged, banks continued to move money for fraudsters, drug dealers and allegedly corrupt officials, leading to cases of real harm.

There is also a cool map of the major transactions that were flagged in suspicious activity reports provided by ICIJ.

KYC/AML regulations cost businesses billions of dollars, these costs are passed on to the consumers. Ronald Pol of amlAssurance wrote a thought-provoking article about the costs and effectiveness of KYC/AML policies. He wrote:

“…anti-money laundering policy intervention has less than 0.1 percent impact on criminal finances, compliance costs exceed recovered criminal funds more than a hundred times over, and banks, taxpayers and ordinary citizens are penalized more than criminal enterprises.”

Can you see what kind of potential problem is mounting here? There are millions of hard working people who have struggled their entire lives, having their purchasing power confiscated from them through inflation, their money held hostage by the rules of bankers and their freedom of financial expression being censored. These people have discovered a solution to those problems with Bitcoin and they have volunteered their personal information to get it.

The requirement for that information is a cascading shadow of a failed financial system that prolongs the agonizing death of central banking. As country after country falls into a full blown currency crisis, the demand for bitcoin will increase. This means any information related to individuals who are in possession of bitcoin becomes more valuable. With the sovereignty of nations threatened and the masses left to fend for themselves, survival depends on adaptability and the ability to remain anonymous.

Thinking adversarially, as any responsible self-custody advocate should, imagine what happens when a Ledger-style data breach occurs on an exchange with more detailed personally-identifiable information and the individual’s Bitcoin addresses. I’m not even talking about the security of the bitcoin in the exchange’s possession, I’m talking about customers’ identifying information linked to their bitcoin holdings being breached.

Now, imagine a complete currency collapse of the U.S. dollar coupled with an inversely proportional rise in bitcoin demand. Meanwhile, your name, physical address, photograph and the amount of bitcoin you own is publically available. This may sound like I’m being an alarmist, but this will be an unfortunate reality that many people will have to face. People who are known to have bitcoin will be targeted and attempted kidnappings, ransoms or worse will occur. Start using the tools to protect yourself now.

It is already known that major exchanges actively partner with law enforcement agencies. Take, for example, the Coinbase/IRS/DEA announcement. These corporations are not your friends, they do not have your best interests in mind, they will protect themselves first and foremost and they will obey the government’s commands to make sure that they can stay in business and to make sure you are the product.

Consider another attack vector: If the government knows your identifying information and your bitcoin holdings, then you are more likely to become a target of theft through unrealized capital gains taxes, enforcement of a 6102-style executive order or full forfeiture of your assets as a matter of “national security.” When the sovereignty of a nation-state is threatened, nothing will stand in the way of isolating that threat. Even if it means imprisoning swaths of the population.

Keep in mind that the whole reason Bitcoin was created is because the ruling authorities completely messed up the money to begin with. Not by accident, but by systematically and methodically destroying the functions of money to purposefully enrich the few and create debt slaves out of the many. For generations, the majority of society has been harvested and used as fuel to keep the machine running. Now that Bitcoin has fixed the money, this thwarts the efforts of those in power to remain in power. They will not give up easily and they will try to drag you down with them.

Furthermore, KYC information polluting the Bitcoin ecosystem cripples the permissionless state of the network and opens the door for censorship opportunities.

Spend some time reflecting on these war games. Hope for the best, be prepared for the worst. Users can mitigate all of the issues listed above and more by taking the radical responsibility of self custody over their non-KYC bitcoin. The first step in doing that is to install a wallet on your Android, iPhone or desktop.

This is a guest post by Econoalchemist. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.