Bitcoin Vs. Ethereum As Settlement Networks

Comparing the volume and efficiency of settlement on the base layers of the Bitcoin and Ethereum networks.

The below is from the latest monthly report by the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

“We need to move NFTs onto the Layer 2 ecosystem to cut fees. However, doing that *right* requires good cross-rollup portability standards, so the ecosystem can avoid getting locked into one particular L2.” – Vitalik Buterin, Creator of Ethereum

Many people are familiar with the recent none-fungible token (NFT) craze that has occurred over recent months, with digital images of rocks and pixelated characters selling for millions of dollars. Bubble, fad, or the start of something much bigger? That, we cannot know, and we aren’t going to discuss the validity of NFTs as an investment (read: speculation) in today’s Daily Dive, but rather we are going to dive into the comparison of Bitcoin versus Ethereum as monetary settlement networks, as Ethereum proponents have attempted to frame ETH as “ultrasound money” increasingly over the course of 2021.

Today, we will examine various metrics comparing the volume and efficiency of settlement on the base layer of the Bitcoin and Ethereum networks.

The first thing that is key to distinguish is the difference between transfer volume and change-adjusted transfer volume.

For an in-depth description of how change outputs work, click here.

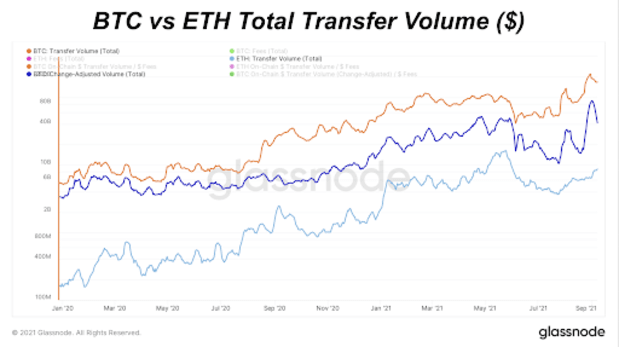

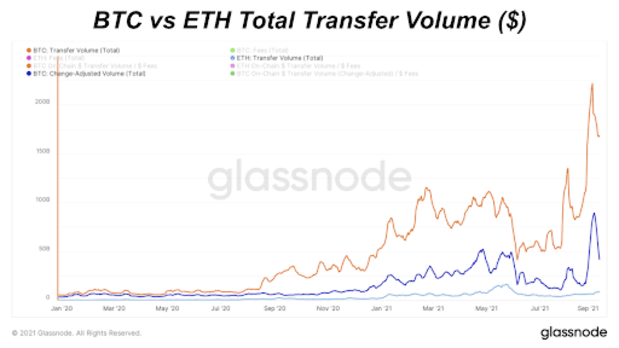

When looking at total transfer volume across the base layer of the Bitcoin and Ethereum networks, the seven-day average for transfer volumes are as follows:

BTC: $168.5 billion

BTC (change adjusted): $41.8 billion

ETH: $8.7 billion

Below are the charts in both linear and logarithmic scale:

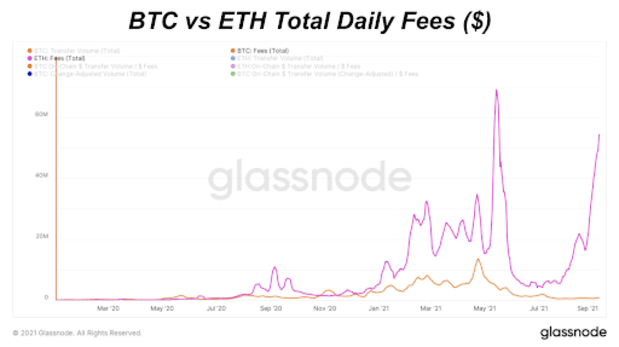

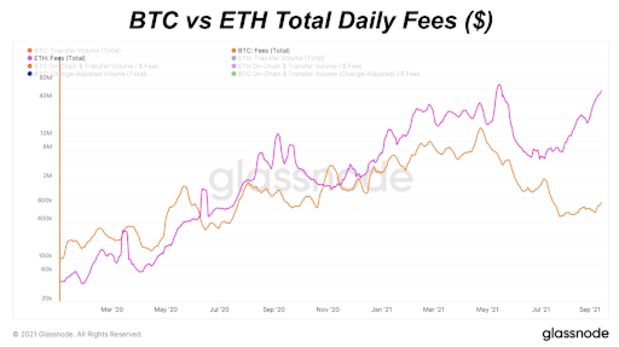

Here is the comparison of the average daily fees on the base layer of both blockchains over the last week:

BTC: $0.8 million

ETH: $54.3 million

When comparing the efficiency of settlement (total daily value transfer divided by daily fees) of the two blockchains, the comparison couldn’t be more clear.

Bitcoin is purpose built for one thing: value storage and settlement. It is the world’s first and only perfected monetary settlement network, and it is actively scaling to serve the entire globe.

Below is the comparison of settlement efficiency (total daily value transfer divided by daily fees) between the two blockchains:

BTC: 206,989

BTC (change adjusted): 51,428

ETH: 160