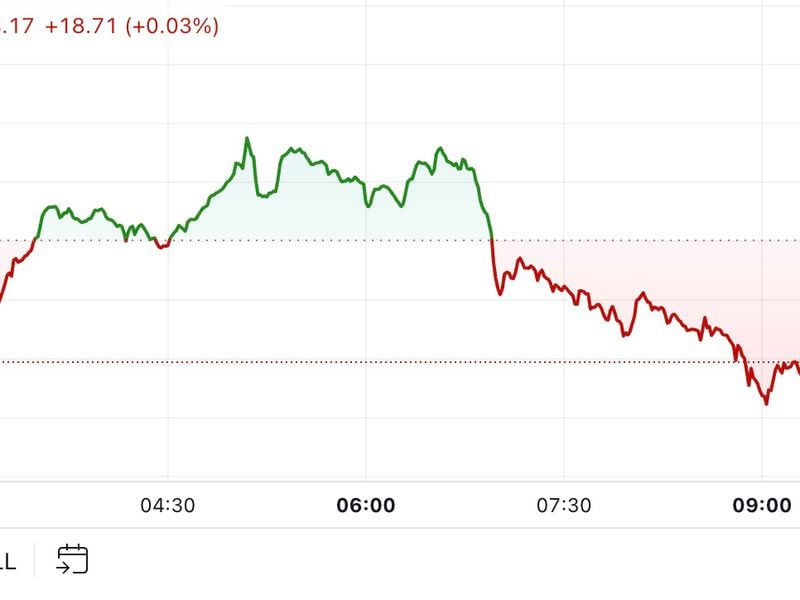

Bitcoin Volatility Hits Longs and Shorts as $175M Liquidated, $1B in Open Interest Wiped

Bitcoin climbed to over $30,000 during the Asian evening hours on Wednesday on hopes of favorable monetary policies in the U.S, some market analysts opined. That move didn’t last long, however, as sudden sales drove prices to the $27,700 level following the U.S. market open.

Related Posts

Blockchain Bites: Bitcoin’s Edge as a Hedge and Crypto’s Reaction to the STABLE Act

Dec 3, 2020 at 5:05 p.m. UTCBlockchain Bites: Bitcoin’s Edge as a Hedge and Crypto’s Reaction to the STABLE ActAt stakeDestabilizing Act?Crypto Twitter, like the U.S. Congress, is largely divided between warring factions and in-groups. But for once it looks unified. All it took was a proposed bill to further regulate stablecoin issuers, the so-called…

First Mover Americas: Hong Kong Spot Bitcoin ETF Applicants Claim Approval

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.Latest PricesTop StoriesMultiple Hong Kong bitcoin exchange-traded fund (ETF) applicants, including China Asset Management, Bosera Capital and others, posted to social-media platform WeChat (Weixin) that they had been

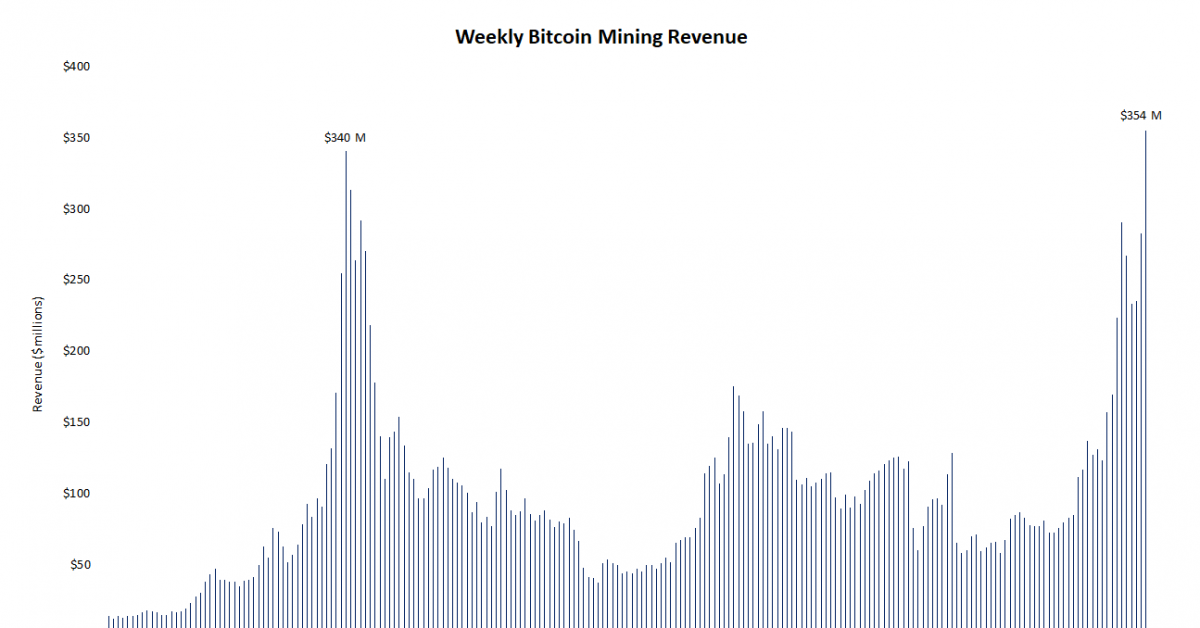

Bitcoin Miners Posted $354M in Revenue Last Week, Breaking Record From 2017

Last week's mining revenue eclipsed the previous record set in mid December 2017. Weekly bitcoin mining revenue estimates since 2017Feb 15, 2021 at 1:44 p.m. UTCBitcoin Miners Posted $354M in Revenue Last Week, Breaking Record From 2017Bitcoin miners set a new record for weekly revenue after bringing in $354.4 million last week. Mining revenue growth…

First Mover Americas: BTC Peeps Above $69K as Macro Favors Bulls

This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day . Latest Prices 00:52 Ether ETFs Saw Biggest Outflows Since July 01:01 Bitcoin Breaks $64K While Gold Soars 00:56 ETH/BTC Ratio Slid to Lowest Since April

Bitcoin Cash Undergoes ‘Halving’ Event, Casting Shadow on Miner Profitability

Apr 8, 2020 at 12:21 UTCUpdated Apr 8, 2020 at 12:33 UTCBitcoin Cash Undergoes ‘Halving’ Event, Casting Shadow on Miner ProfitabilityBitcoin Cash – the blockchain that forked off Bitcoin in 2017 – has just reduced its block rewards by half, causing many miners to see gross margins drop to near zero.The world's fifth largest cryptocurrency…

Dish Network Files Patent For Blockchain-Based Anti-Piracy System

Jan 13, 2020 at 12:17 UTCUpdated Jan 13, 2020 at 12:21 UTCOne of the largest U.S. television providers has published a patent application for a new "anti-piracy management system" that uses blockchain to enable owners to track how their content is being used. Dish Network's application outlines a system that allows owners to embed an…

World’s Most Influential Central Banks’ Balance Sheets Look to Have Troughed

Featured SpeakerAlex ThornHead of Firmwide ResearchGalaxyHear Alex Thorn share his take on "Bitcoin and Inflation: It’s Complicated” at Consensus 2023.Omkar Godbole is a Co-Managing Editor on CoinDesk's Markets team.Featured SpeakerAlex ThornHead of Firmwide ResearchGalaxyHear Alex Thorn share his take on "Bitcoin and Inflation: It’s Complicated” at Consensus 2023.The world's leading central banks appear to have…

Starbucks, McDonald’s Among 19 Firms to Test China’s Digital Yuan: Report

Apr 23, 2020 at 07:31 UTCUpdated Apr 23, 2020 at 07:43 UTCStarbucks in China. (Credit: Shutterstock/testing)Starbucks and McDonald's are reportedly among 19 restaurants and retail shops that will be involved in testing China's central bank digital currency in the country's Xiong'An new district.The Reformation and Development Commission of the Xiong'An district in Hebei province reportedly…