Bitcoin ‘V-Shape’ Recovery Opens Way for $76K Price Target: Swissblock

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

Bitcoin’s sharp rebound from Tuesday’s plunge indicates a start of a new rally targeting $76,000, Swissblock said.

-

QCP Capital forecasted that bitcoin will break higher in the near term after “extremely impressive” bounce.

-

U.S.-listed spot bitcoin ETFs saw massive inflows during the plunge, indicating that investors bought the dip helping prices recover

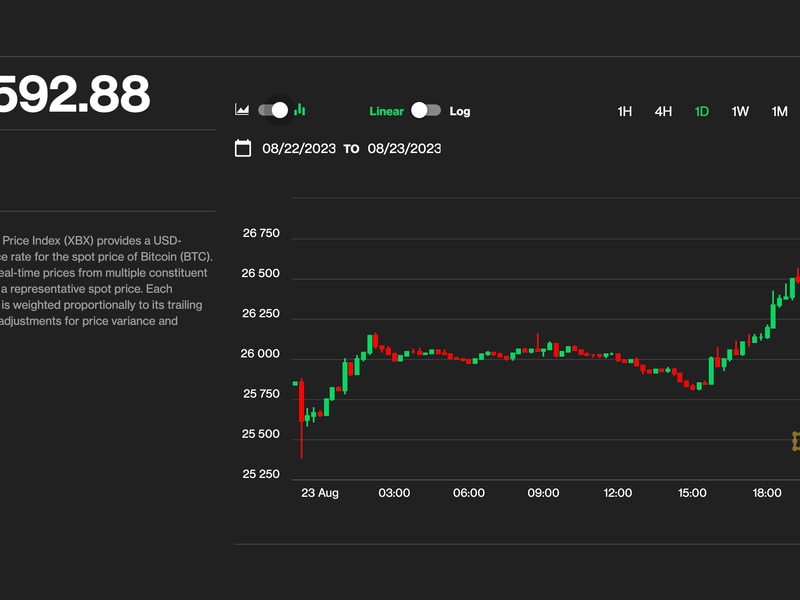

Bitcoin’s (BTC) record-setting move above $69,000 quickly turned into a bloodbath on Tuesday, but its rapid recovery to $67,000 one day later may foreshadow another imminent run for new all-time highs, according to crypto analytics firm Swissblock.

Swissblock analysts noted that with yesterday’s plunge, bitcoin successfully retested the $59,000-$62,000 price area, where it recently consolidated for a week before marching on to the all-time high.

“V-recovery – and onwards towards new all-time highs,” Swissblock said in a Wednesday Telegram update.

According to a chart shared by Swissblock, bitcoin’s quick break back above the $62,000 level marked the start of a fresh uptrend targeting the $76,000 price level.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PACCDUWVI5EUFA2HQXJLYOPSWA.jpeg)

Singapore-based digital asset trading firm QCP Capital also forecasted an imminent leg higher for bitcoin.

“The bounce has been extremely impressive,” QCP analysts wrote in a Wednesday market update. “The dip was bought up very quickly and aggressively, and $60,000 proved to be a good support level.” “With some of the leverage taken out, the path higher has now opened up and we look to a near-term break higher as the uptrend resumes immediately,” QCP added.

U.S.-listed spot bitcoin ETFs attracted massive inflows during Tuesday’s drop, indicating that ETF investors were unfazed by the plunge and bought the dip.

The ten new ETFs combined saw $648 million in net inflows, the largest daily allocation since their debut day in Jan. 11, data compiled by BitMEX Research shows. The BlackRock iShares Bitcoin ETF (IBIT) broke its daily record, enjoying $788 million of fresh investment and adding 12,600 BTC to the fund.

At press time, BTC was trading at $67,200, up over 7% over the past 24 hours and outperforming the broad-market CoinDesk 20 Index’s (CD20) 2.5% advance during the same period.

Edited by Stephen Alpher.