Bitcoin Up 365,999% Since Krugman Dismissed It at $7

Twelve years ago, economist and Nobel laureate Paul Krugman first addressed Bitcoin and his opinion was skeptical to say the least.

In that now-famous article, penned for The New York Times on September 7, 2011, Krugman criticized and dismissed the cryptocurrency, which was then trading at an average of $7.03 per Bitcoin across exchanges.

Fast forward to today, and Bitcoin’s remarkable journey has proven Krugman’s skepticism to be one of the most costly missed opportunities in financial history, as demonstrated by the reaction to an X post today by Bitcoin Historian Pete Rizzo.

When Krugman’s article was published, Bitcoin was still in its infancy. The digital money, created by the pseudonymous Satoshi Nakamoto, had only been around for a couple of years. It was largely unknown to the mainstream, with a small but passionate community of early adopters and tech enthusiasts.

In his article, Krugman argued that Bitcoin was a bubble waiting to burst. He questioned its viability as a currency, criticized its decentralized nature, and expressed skepticism about its long-term prospects.

At the time, Bitcoin’s price of $7.00 seemed trivial, and many shared Krugman’s doubts.

However, history has proven Krugman and other early Bitcoin skeptics wrong. Bitcoin has not only survived but thrived over the past 12 years. Its price has experienced unprecedented growth, reaching highs of over $69,000 in early 2021.

At the time of writing, Bitcoin is trading at around $25,000 per coin, representing a staggering 365,999% increase from its price when Krugman penned his critique.

Still, it’s worth noting that Krugman acknowledged at the time that Bitcoin had been a good investment, even while he questioned it could serve as a currency, writing:

“The dollar value of that cybercurrency has fluctuated sharply, but overall it has soared. So buying into Bitcoin has, at least so far, been a good investment. But does that make the experiment a success? Um, no. What we want from a monetary system isn’t to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich. And that’s not at all what is happening in Bitcoin.”

In addition, he criticized Bitcoin for being deflationary, adding that there is an “incentive to hoard the virtual currency rather than spend it.”

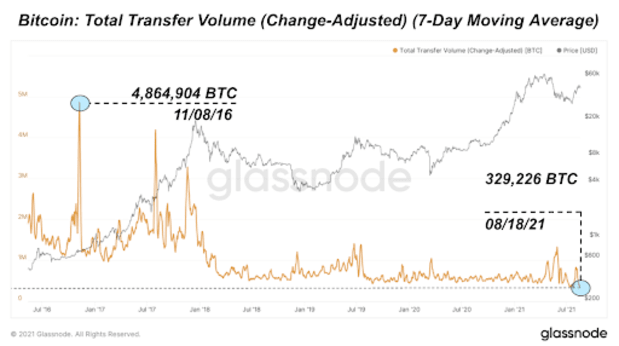

But while this has proved largely true, Krugman’s claims have been undermined by Bitcoin’s continued utility as a currency, BTC’s rise to $25,000 demonstrating its potential as a means of transferring value across borders with relative ease.

Bitcoin has even been adopted as a currency in El Salvador, where it serves alongside the U.S. dollar as a form of legal tender, in wide use by small merchants. Further, Bitcoin, 15 years on, retains a niche in online commerce.

All this in mind, in retrospect, Krugman’s dismissal of Bitcoin at $7 serves as a reminder of the unpredictability of financial markets and the potential for revolutionary technologies to reshape the world.