Bitcoin Transfer Volume Now Exceeds $15.8 Trillion

The “total amount of coins transferred on chain,” metric is equivalent to 70% of the United States Gross Domestic Product.

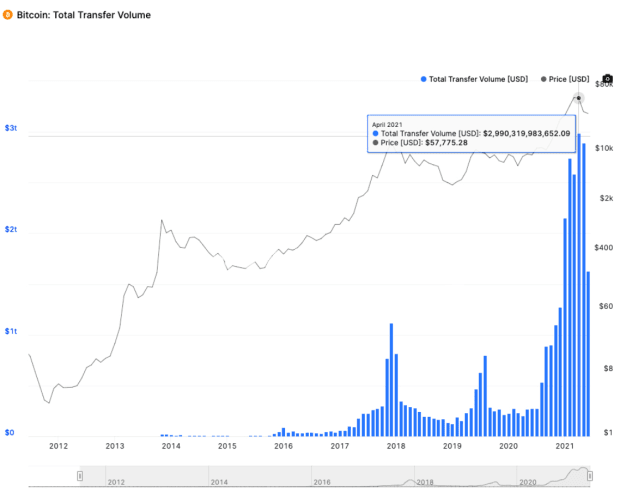

Bitcoin, the world’s most valuable cryptocurrency, recently saw its total transfer volume exceed $15.8 trillion for the first time in less than seven months of this year.

This means bitcoin’s total transfer volume currently represents 70% of the United States Gross Domestic Product of approximately $22 trillion.

Furthermore, bitcoin transfer volume has already surpassed the world’s largest economy’s entire 2010 and 2011 GDP of $15 trillion and $15.5 trillion, respectively.

Indeed, bitcoin transfer volume will soon cross the United States Gross Domestic Product for 2012 and 2013, which was standing in the range of $16 trillion.

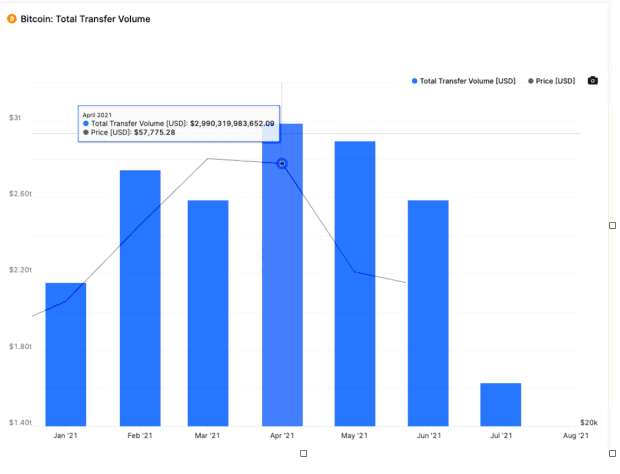

The massive growth in bitcoin price is among the major reasons for a durable growth in bitcoin transfer volume. Bitcoin transfer volume hit $2.99 trillion in April when bitcoin’s price peaked around $64,000.

Interestingly, the bitcoin price fell more than 50% from its April all-time high, but its transfer volume didn’t plunge with correlated intensity. Bitcoin is still settling $236 million worth of transactions per day, equivalent to the December level when bitcoin was trading in the $20,000 range.

This means that investors’ interest in bitcoin remains intact despite the gigantic price volatility, and reinforces the fact that the most valuable cryptocurrency is a viable alternative to the current economic system.

Why Is Bitcoin Transfer Volume Surpassing U.S. GDP?

Bitcoin is not only turning out to be an alternate investment vehicle, it is also becoming an alternate to the U.S. dollar and the entire economic system.

In 2021, the uptick in institutional interest along with significant growth in retail investments helped to bring bitcoin transfer volume to $15.8 trillion in less than seven months of this year.

Moreover, U.S. corporations’ strategy of holding bitcoin on their balance sheet to reverse the impact of inflationary fiat dollars and rising consumer costs added to bitcoin transfer volume.

Further bolstering bitcoin fundamentals is the fact the cryptocurrency is seeing wider acceptance across the financial system, a phenomenon that will fuel its transfer volume in the days ahead.

Bitcoin Is Just Beginning To Penetrate The Financial And Economic System

If the velocity of transfer value continues at its current rate, over the next five months Bitcoin will surpass the entire GDP of the world’s largest economy. At the same time there are currently eight Bitcoin Exchange Traded Funds filings pending before the Securities and Exchange Commission, seven of them filed this year. Several Bitcoin ETFs — such as Purpose, Evolve and CI Galaxy — are already trading on Canada’s Toronto Stock Exchange.

“The complications of not approving [a Bitcoin ETF application] become stronger, because people are looking for other ways to do the same kinds of things that they would do with an exchange-traded product,” asserted SEC Commissioner Hester Peirce.

“Bitcoin now is so decentralized. The number of nodes that are involved in Bitcoin is large, and the number of people who have an interest in keeping that work decentralized is very large,” she said.

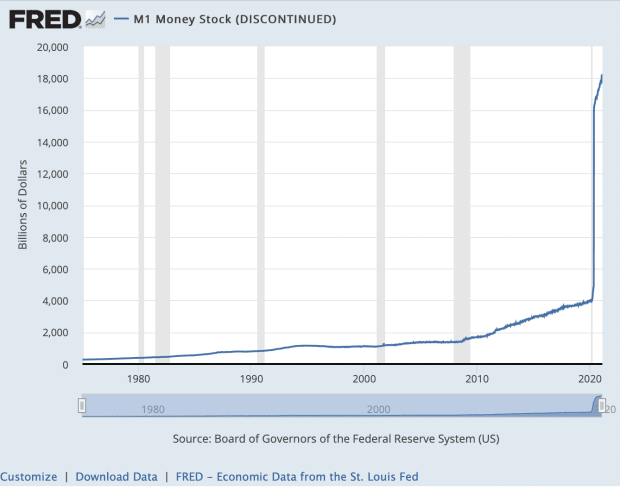

Furthermore, U.S. representatives like Mayor Scott Conger believe that Bitcoin is the ultimate hedge against the inflation of fiat. The Federal Reserve itself has stopped recording the increase in the M1 and M2 money supply after recording an increase of 450% in one year.

This is a guest post by Portfolio Insider. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.