Bitcoin Traders Target $74K Next Week as BTC Spot ETFs Log Four Days of Inflows

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

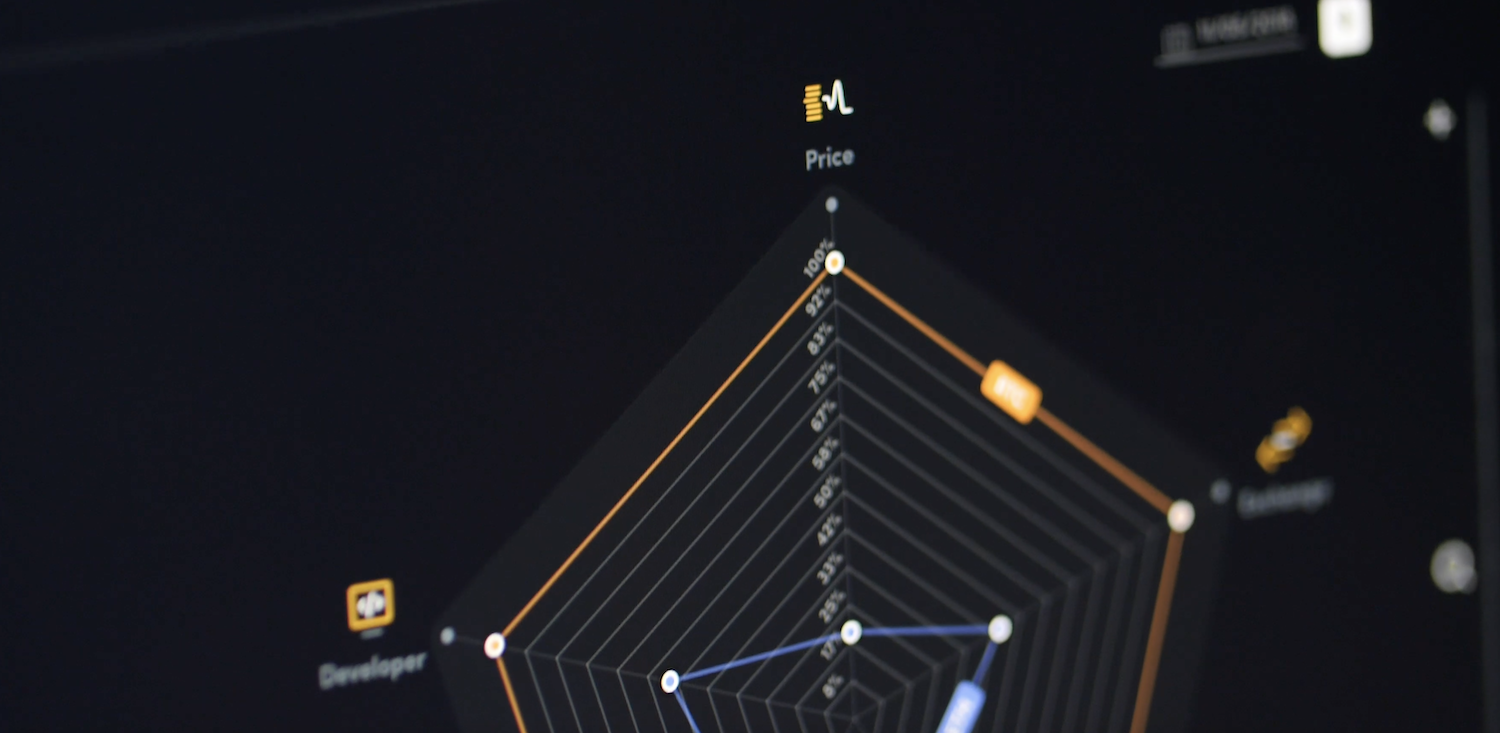

Bitcoin could potentially surpass its all-time highs of $74,000 as early as next week due to increasing institutional demand and risk appetite for assets.

-

The U.S.-listed spot exchange-traded funds (ETFs) tracking Bitcoin have seen four straight days of inflows, with BlackRock’s IBIT receiving $94 million on Thursday, signaling a shift in investment sentiment.

Institutional demand and rising appetite for risk assets could cause bitcoin to breach all-time highs of $74,000 as early as next week, some traders say.

“Bitcoin was pulling back towards $65K on Thursday but is already trying to regain its footing above $66K on Friday morning. If cryptocurrencies get support from the global risk appetite on Friday, Bitcoin could exceed $70K over the weekend,” shared Alex Kuptsikevich, FxPro senior market analyst, in a note to CoinDesk, referring to increased inflows from spot ETFs.

“A test of the $71K-$74K highs area, in our view, could happen as early as early next week, triggering a new episode of FOMO,” Kuptsikevich.

Singapore-based QCP Capital gave out similar price targets in a client note earlier this week.

Such bullish outlooks come as U.S.-listed spot exchange-traded funds (ETFs) tracking the asset have logged four straight days of inflows, ending Thursday at $257 million in net inflows. This is a nearly 180-degree turn from the action of the past few weeks – with some of the biggest ETFs seeing zero inflows on some days.

BlackRock’s IBIT received $94 million in inflows on Thursday, the largest among peers. GrayScale’s GBTC, which has mostly seen outflows since its January listing, received over $4.6 million in inflows.

Earlier this week, multiple regulatory filings showed that several big-name funds, such as Millennium Management and Elliot Capital, held millions worth of bitcoin ETFs in their portfolios.

The softer-than-expected US Consumer Price Index (CPI), which rose 0.3% versus 0.4% in March amid economist forecasts for 0.4%, triggered a break out of the range for BTC on Wednesday. The asset regained the $66,000 mark for the first time since April and posted its biggest single-day gain since March.

Edited by Oliver Knight.