Bitcoin Traders Position for ‘Bullish July’ as BTC ETFs Record $124M Inflows

-

Since April, Bitcoin’s price has ranged between $59,000 and $74,000, but historical trends suggest a potentially bullish July.

-

Seasonal cycles, such as profit-taking around tax season in April and May, and increased demand in December, can influence cryptocurrency prices, leading to predictable changes.

Bitcoin (BTC) bulls may have reason to cheer in the coming weeks as possible seasonal cycles boost prices of the largest cryptocurrency after months of declines and rangebound trading.

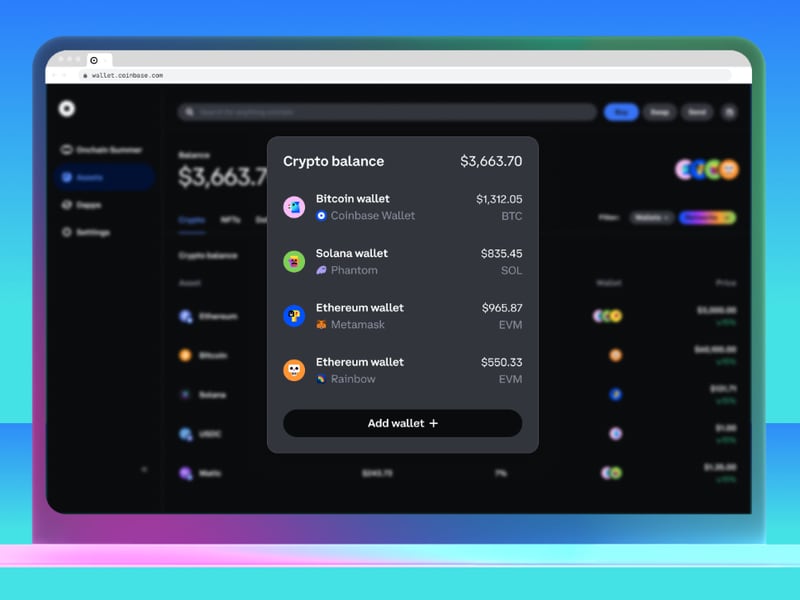

BTC has traded between $59,000 and $74,000 since April, weighed down by billions in sales, upcoming selling pressure, outflows from exchange-traded funds (ETFs), and peak negative sentiment among retail traders.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VY37PS6NDZFZHDXARQR5FHT73M.png)

But a historically bullish month of July could soon change that. The first day of the month saw U.S.-listed ETFs record nearly $130 million in inflows – their highest since early June after more than $900 million in outflows over the month.

“Bitcoin has a median return of 9.6% in July and tends to bounce back strongly, especially after a negative June (-9.85%),” Singapore-based QCP Capital flagged in a Telegram broadcast Monday.

“Our options desk also saw flows positioning for an upside move last Friday into the month-end, possibly in anticipation of the ETH spot ETF launch. Many signs point to a bullish July,” QCP added.

Over the last decade, bitcoin has gained by an average of more than 11% in July, with 7 out of 10 months showing positive returns, data shows.

Crypto fund Matrixport said in a 2023 report that July returns from 2019 to 2022 have been around 27%, 20%, and 24%, respectively.

Seasonality is the tendency of assets to experience regular and predictable changes that recur every calendar year. While it may look random, possible reasons range from profit-taking around tax season in April and May, which causes drawdowns, to the generally bullish “Santa Claus” rally in December, a sign of increased demand.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter