Bitcoin Traders Pare Bullish Bias as Spot ETF Deadline Nears

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

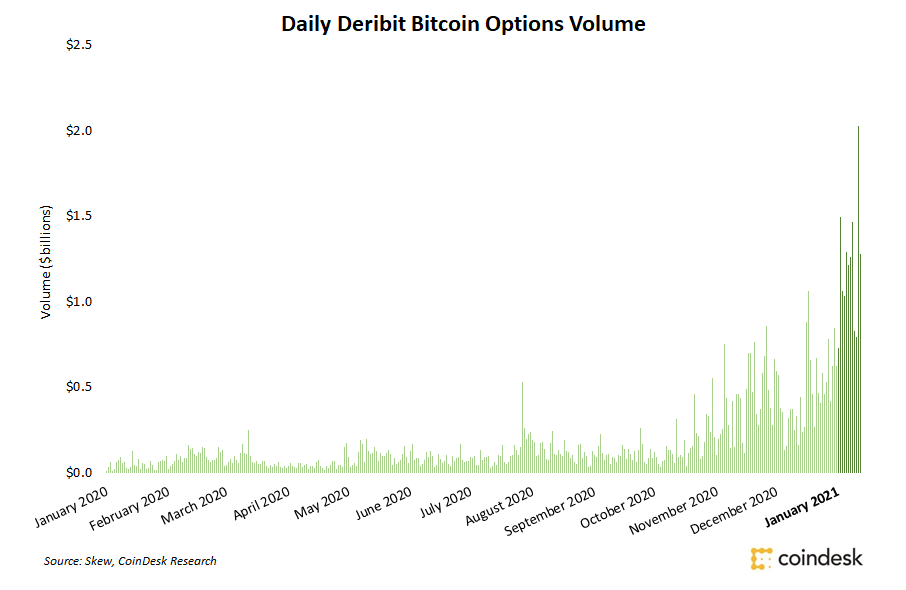

The way bitcoin options are priced shows traders paring their bullish bias as the U.S. Securities and Exchange Commission’s (SEC) Jan. 10 deadline to approve spot exchange-traded funds nears.

Options skew tracked by Amberdata show calls expiring in one week, one, two, and three months trading at a premium of around 2% to puts versus 8% in early November. The steady retreat is reflective of more measured bullish sentiment toward bitcoin.

Calls give the buyer the right but not the obligation to purchase the underlying asset at a predetermined price at a later date. A call buyer is implicitly bullish on the market, while a put buyer is bearish. Options skew gauges relative demand for calls versus puts.

Perhaps traders are in a wait-and-watch mode ahead of the expected ETF decision. Per some analysts, the cryptocurrency, having surged by 61% in three months on the back of ETF expectations, is likely to drop once the highly anticipated offerings go live.

The weakening of call bias in longer duration skews is also consistent with the out-of-consensus analysis that says billions of dollars in inflows into ETFs will likely happen over time rather than immediately.

Market poised for action?

The one-week options ATM implied volatility, which shows the market’s expectations for price turbulence over the next seven days, have almost doubled to an annualized since Dec. 29, surpassing longer duration gauges.

It’s a warning for traders to stay alert in the lead-up to and immediately after the Jan. 10 deadline.

Longer duration implied volatility gauges have seen more minor upticks; a sign traders expect ETF announcements to have a fleeting impact on the degree of price volatility. Moreover, some analysts expect ETFs to weigh over price turbulence in the long run.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/6ORUMXKPDJALHO55JPD2NZZ6WA.png)

Edited by Oliver Knight.