Bitcoin Traders Can Now Bet on $40K Price With New Deribit Options

Crypto derivatives exchange Deribit has listed bitcoin options contracts that allow traders to bet on a potential price rally to $40,000 next year.

- Options at a $40,000 strike price expiring in March 2021 and June 2021 went live on Deribit early on Friday, as noted by research firm Skew.

- In effect, the new contracts will allow market participants to express a long-term bullish view on bitcoin.

- They will appeal to traders expecting a price rally to above $40,000 on or before the above expiries.

- Options are derivative contracts that give the buyer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price on or before a specific date.

- The new contracts come at a time when bullish expectations are high due to rising institutional participation and mainstream adoption.

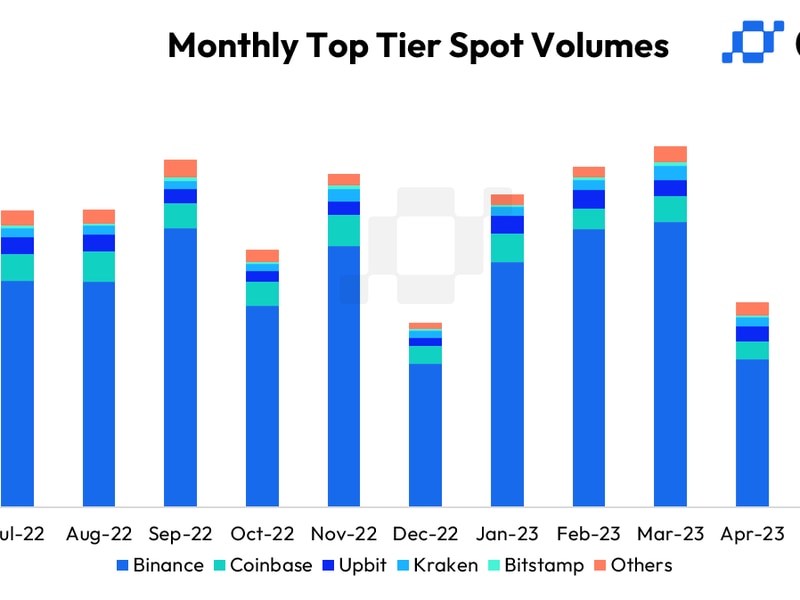

- So far today, Deribit, the world’s largest crypto options exchange by trading volume, hasn’t registered any activity for the $40,000 options.

- Bitcoin is currently trading at $13,290, representing an 85% gain on a year-to-date basis.