Bitcoin Touched $60K on Reports that SEC-Approved Futures ETF is Closer than Ever

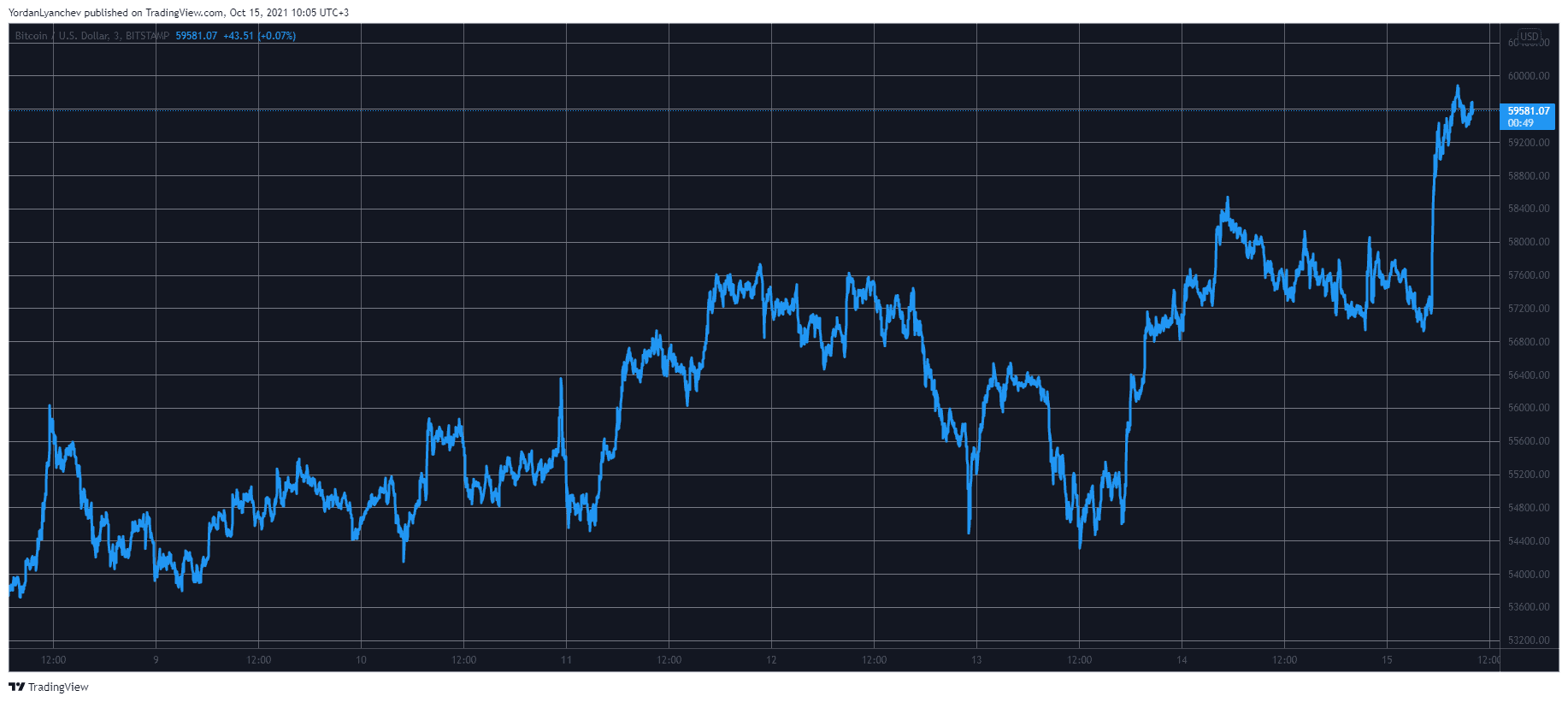

Following reports that the SEC could greenlight a Bitcoin Futures ETF as early as next week, the price of the cryptocurrency skyrocketed to a six-month high above $60,000.

- Citing people familiar with the matter, Bloomberg said earlier on October 15th that the Securities and Exchange Commission has changed its year-long negative stance on BTC ETF.

- The agency has rejected countless applications for an exchange-traded fund tracking the performance of bitcoin in the past several years. However, Bloomberg’s sources claimed that the Commission “isn’t likely to block” a Bitcoin Futures ETF from going live next week.

- The particular product that is said to be approved is an application made by ProShares and Invesco LTD and, as the name suggests, is based on futures contracts.

- The SEC’s Chair, Gary Gensler, previously asserted that the futures option provides “significant investor protection” because those contracts are filed under mutual fund rules.

- It’s worth noting that the number of Bitcoin ETF applications surged this year in the US, following several approvals in Canada and Brazil.

- Moreover, Bloomberg’s senior strategist Mike McGlone noted last month that the Commission could indeed greenlight a BTC Futures ETF by the end of October.

- Shortly after today’s report went live, the price of the cryptocurrency reacted with a massive surge from $57,000 to $60,000. Thus, BTC tapped the $60,000 mark for the first time since mid-May.