Bitcoin Tops $70K for First Time in More Than Four Months

-

Bitcoin rose above $70,000 for the first time since June in the early evening U.S. hours on Monday.

-

It remains about 5% below its record high around $73,700 from early March of this year.

-

Rate cutting cycles among most major economies, renewed big inflows into the spot ETFs and rising betting market odds of a Trump victory next week are among the catalysts for the recent run higher.

01:01

Bitcoin Breaks $64K While Gold Soars

00:56

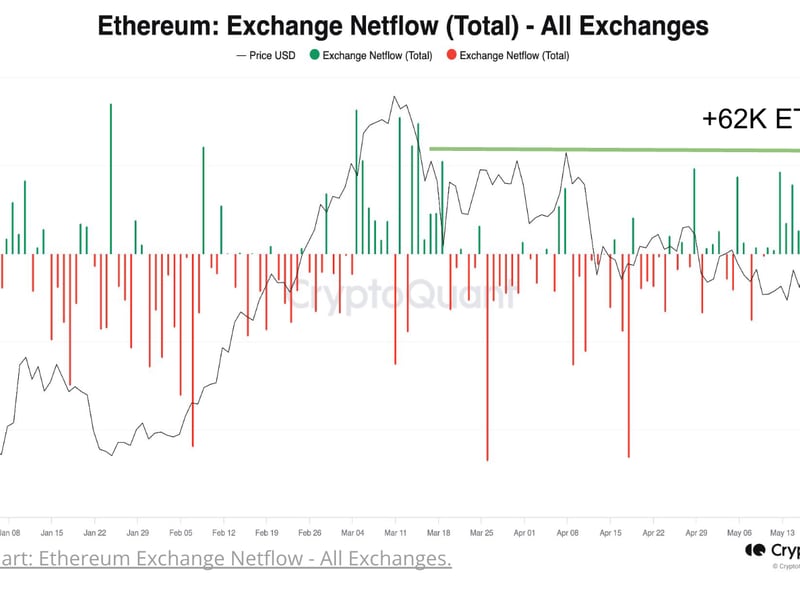

ETH/BTC Ratio Slid to Lowest Since April 2021

00:57

Is Bitcoin Losing Its Bullish Momentum?

After an excruciating (for the bulls) more than seven months of sideways to lower price action, bitcoin (BTC) appears set for another challenge of its all-time high of roughly $73,700 hit in early March.

Following what is now looking like a final washout plunge in the opening days of September that brought the price down to the $53,000 area, bitcoin has mostly been in rally mode since and finally took out the $70,000 level minutes ago.

A fresh rate-cutting cycle from the major Western central banks (except the Bank of Japan) combined with sizable monetary and fiscal stimulus out of China may or may not be the key catalysts for this latest bull move. Also possibly at play are renewed big inflows into the U.S.-based spot bitcoin ETFs and the surge in prediction markets for the presidential election chances of crypto-friendly GOP candidate Donald Trump.

The days ahead are likely to be busy ones, including what promises to be a frenzied end to the U.S. election season, the election itself on Nov. 5, a Federal Reserve rate decision on Nov. 6 and the U.S. October employment report on Nov. 8.

This latest move higher brings bitcoin’s year-to-date gain to about 65%. Gold and the S&P 500, both of which have been regularly notching new record highs over the past weeks, are ahead 32% and 24%, respectively.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/86c43cde-6640-4a7c-98af-5e25273f0e17.png)