Bitcoin Tops $30K, Here’s the Next Target If Bulls Keep it Up (Bitcoin Price Analysis)

Bitcoin’s price has been increasing consistently lately, continuing its bullish phase since the beginning of the year. However, the market is currently at a key resistance level, and its reaction is essential for the trend in the next few months.

Technical Analysis

By:Edris

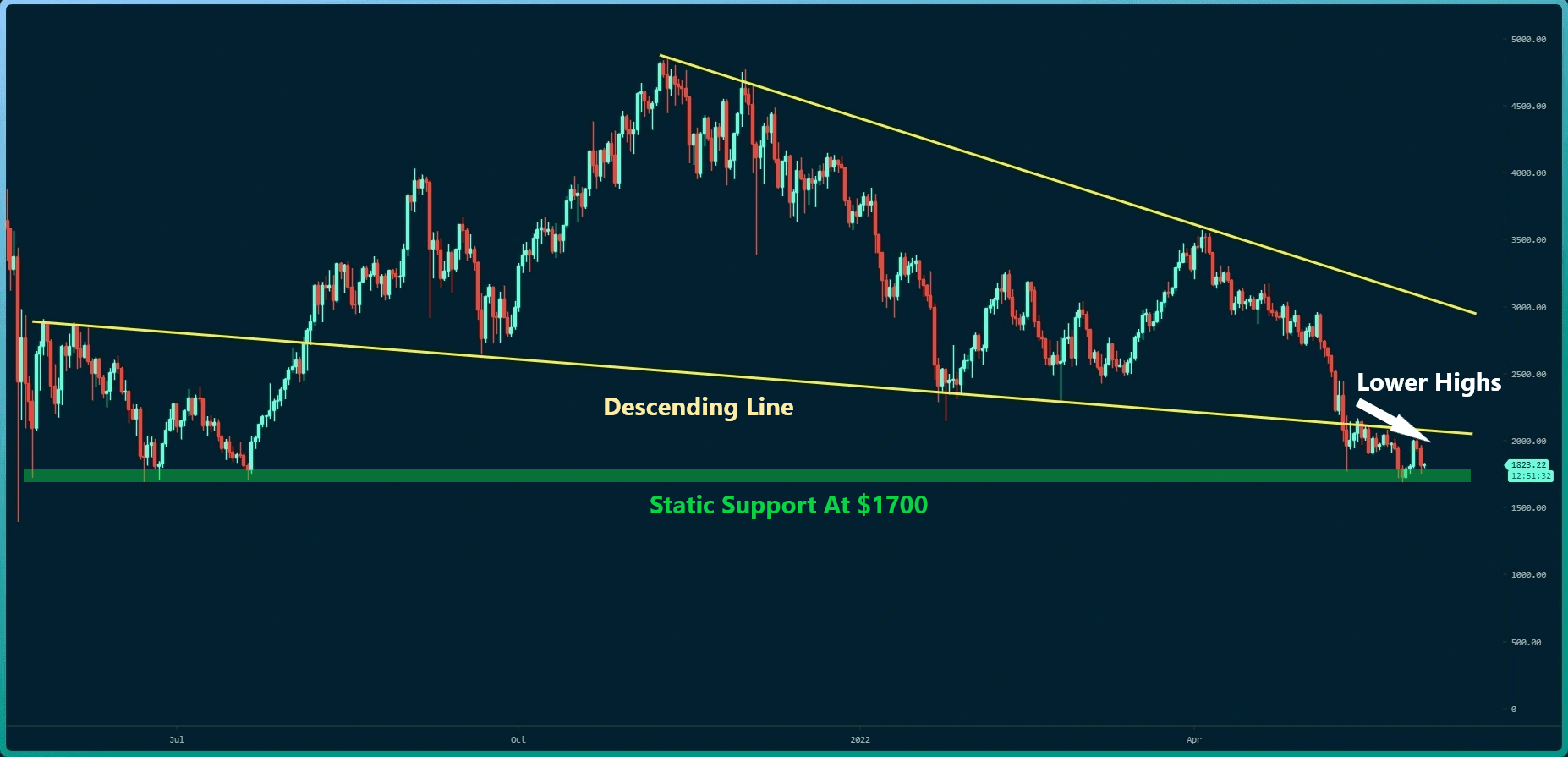

The Daily Chart:

On the daily timeframe, the price has finally broken out of the tight consolidation range around the $28K mark, aggressively attacking the $30K resistance. This level is both a crucial psychological and technical resistance area and would likely shape the short-term future of the crypto market.

A breakout could result in a bullish continuation towards the next significant resistance zone, which is located around the $38K mark, while a rejection would lead to a drop towards the 50-day moving average located around the $26K level and even the $25K support area.

Either way, the bulls can still be optimistic while the price remains above the 200-day moving average, which is an important bull/bear market indicator.

The 4-Hour Chart:

The 4-hour chart shows that the price is struggling to break past the $30K resistance level after rebounding from the $28K support area a few days ago.

The RSI indicator also demonstrates a clear bearish divergence signal, which hints at a potential consolidation or correction in the short term.

In this case, the $28K level could once more be counted on to hold the price, while the $25K area might also be retested in case of a deeper correction. All in all, there is no shortage of support levels, and the bulls could finally relax after almost a year of a gruesome bearish market environment.

On-chain Analysis

By: Edris

Bitcoin Short-Term Holders SOPR

Bitcoin’s price has been constantly rising, and many investors who bought at prices lower than $30K are now in profit. These holders are now expected to realize at least some of their profits, and the SOPR metric validates this analysis.

The short-term holders’ Spent Output Profit Ratio (SOPR) is a useful on-chain metric that measures the ratio of realized profits by holders who have bought their coins in the past six months. Values above 1 indicate profit-taking, and values below one are interpreted as investors selling their coins at a loss.

It is evident that short-term holders who bought their Bitcoin in the past few months have realized profits aggressively at a rate similar to the $69K all-time high range. While profit realization is a natural behavior in a bull market, it could result in a bearish reversal and even a bear market continuation towards lower prices if supply is not met with sufficient demand.

Therefore, this metric should be monitored constantly to determine whether the market is in the beginning stages of a new bull run or just another bull trap.

The post Bitcoin Tops $30K, Here’s the Next Target If Bulls Keep it Up (Bitcoin Price Analysis) appeared first on CryptoPotato.