Bitcoin to End 2022 With a 65% Yearly Drop: Weekend Watch

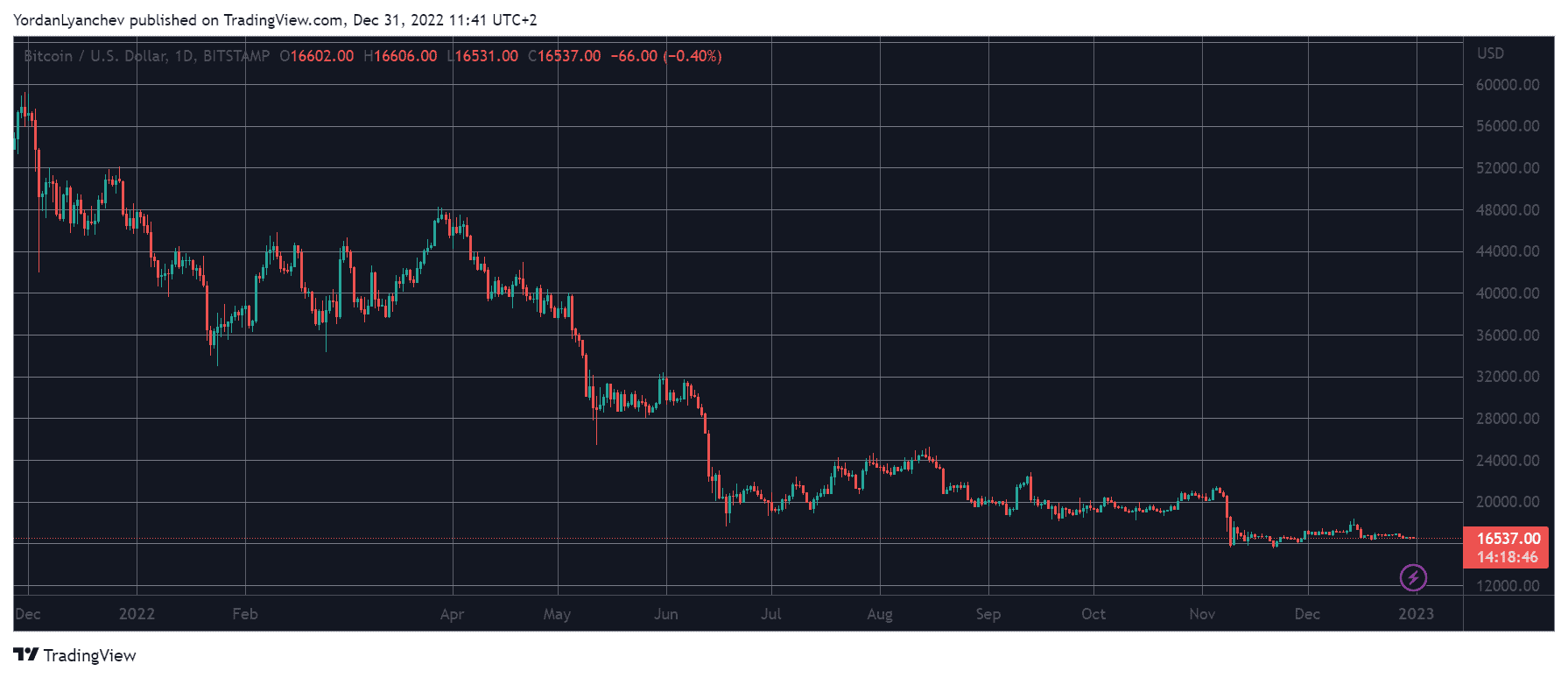

For better or worse, 2022 is about to end, and the bitcoin bulls are in a hurry to send this rather violent year packing. The asset’s price tumbled amid macroeconomic hurdles, industry collapses and scams, and everything in between.

The micro scale doesn’t give much hope either, as BTC slipped to a new 10-day low of way below $16,500 yesterday.

Bitcoin’s Nightmare Year Comes to an End

After the massive bull market of 2021, in which bitcoin skyrocketed to an all-time high of $69,000, all eyes were on the asset to double down and keep charting new peaks. Recall that many expected the $100,000 milestone to be next, hence the countless laser-eye profile pictures on Twitter.

The cryptocurrency entered 2022 at just under $50,000, but only a few could have predicted what would happen next. The start of a “special military operation” (a.k.a. war) in the middle of Europe was just more fuel thrown into the massive fire that became the galloping inflation worldwide.

Crypto had numerous internal blows that started with the sudden collapse of the Terra ecosystem. This exposed the highly intertwined nature of the industry. The domino effect took down other former giants such as 3AC, Celsius, Voyager, and others.

BTC’s price was falling amid all of this. As it finally seemed to have settled in November, then came the even more sudden FTX debacle. Another hit for bitcoin, which now dumped to consecutive two-year lows.

Despite trying to recover some ground, BTC has remained stuck well below the coveted $20,000 line. The past several weeks were quite uneventful in terms of price action as the asset keep struggling around $16,500. This means bitcoin will close the yearly candle with a 65% decline unless there’s some miracle about to happen in the next several hours.

As such, its market capitalization is still beneath $320 billion, while its dominance over the alts is calm at 40.1%.

Solana Recovers 8%

The alternative coins also suffered a lot in 2022, but we will focus on their most recent price moves now. Solana has been among the worst hit due to his exposure to Alameda and FTX. The past week brought a 25% decline in its price, but SOL has bounced off by 8% and trades closely to $10.

Most of the market is in green as well, with minor recovery attempts. ETH is still under $1,200, even with a 0.5% daily increase. Binance Coin, Ripple, Cardano, Dogecoin, Polygon, Polkadot, Tron, and Litecoin have jumped by up to 2%.

OKB is among the best performers, following a 4% daily increase. As a result, OKX’s native coin trades at $26. The overall crypto market cap is close to $800 billion.

The post Bitcoin to End 2022 With a 65% Yearly Drop: Weekend Watch appeared first on CryptoPotato.