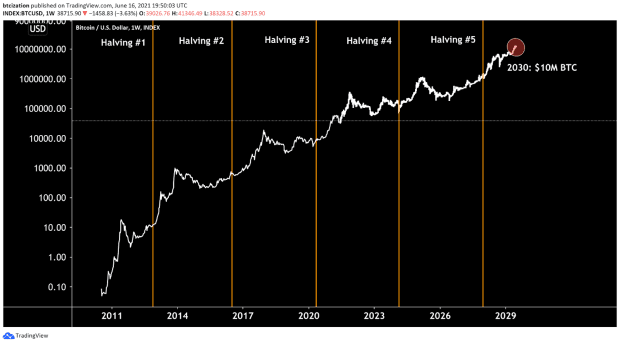

Bitcoin To $10 Million By 2030

It might seem hyper-bullish, but there is real reason to believe such an ascension in price could occur.

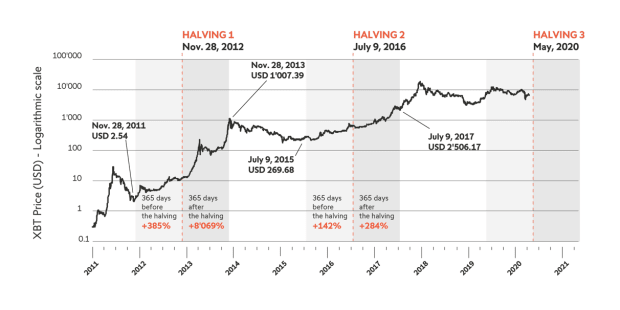

Bitcoin will experience three halvings this decade, the first in 2020, the second in 2024 and the third in 2028. Counting the 2020 halving that already occurred last year, Bitcoin has experienced a total of 3 halvings since its launch in 2009. Historically, in the year following each halving, the bitcoin price shoots up exponentially due to an increase in demand and decrease in supply in the market.

But there is a new type of demand in the market, one that weighs far heavier than the original demand by retail investors who have been buying for the past 12+ years. This demand mixed with the decrease in supply issuance andBTC being taken off the market is the perfect formula for wild price swings. I’ll get into what that new demand is later in this article, but for now let’s look at the past performance of halvings to see what we’re dealing with.

On Nov. 28, 2012, the first ever halving occurred, dropping the mining reward from the base start of 50 to 25 BTC. 365 days before the halving, the price of bitcoin was $2.54. Over the following year, as the supply shock took place, bitcoin rose all the way to $1,007 before cooling off a little, for an increase of over 8,000%.

On July 16, 2016, the second halving occurred, dropping the mining reward from 25 to 12.5 BTC. 365 days before the halving, the price of bitcoin was $269.68. Over the following year, as the supply shock took place, bitcoin rose all the way to $2,506 before cooling off a little, for an increase of 284%.

On May 18, 2020, the third Bitcoin halving occurred, dropping the mining reward from 12.5 to 6.25 BTC. 365 days before the halving the price of bitcoin was $7,300. Over the following year as the supply shock took place, bitcoin rose all the way to $64,840 for an increase of 788%.

At the time of writing, it is estimated that on May 8, 2024, Bitcoin will undergo its fourth halving, dropping the mining reward from 6.25 to 3.125 BTC. And sometime in the spring of 2028, Bitcoin will undergo its fifth halving, dropping the mining reward from 3.125 to 1.5625 BTC.

It is impossible to predict the exact amount of demand for bitcoin. Therefore, how much it will increase in price after these halvings is difficult to predict, but it’s safe to assume that price outlook is mega bullish and that the next nine years could look something like this (or better):

“B-b-b-but Nik, past performance does not guarantee future price gains!”

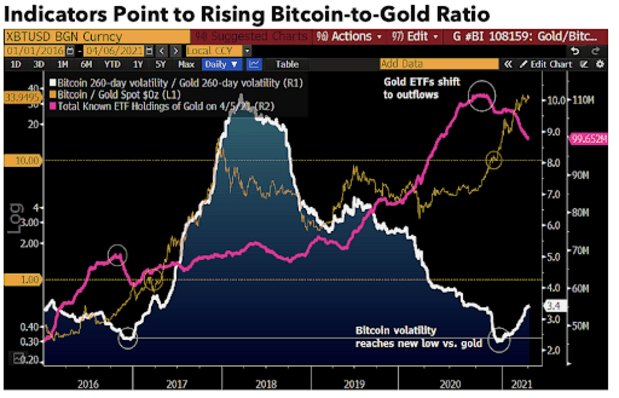

While this is true, it’s ignoring all the factors that lead into why bitcoin will keep skyrocketing up. The world has a store of value problem, and the free market has determined bitcoin as the solution to this problem. Wealth is now flooding into Bitcoin, with it poised to be the best-performing asset of the decade for the second decade in a row.

Bitcoin’s limited supply of 21 million combined with rising demand assures its price will continue to go up.

As I mentioned earlier, it is no longer just ordinary people buying and HODLing, who in the past have caused big price swings. Now billionaires and companies are putting it on their balance sheets and countries are making it legal tender. This is a global race to accumulate as much BTC as possible. They’re not making any more than 21 million, and everyone wants their piece of the pie.

The first domino has fallen and game theory is in play even harder than before since El Salvador became the first country to make bitcoin legal tender. Ready, set, go — all countries are now in a race to make bitcoin legal tender and put it on their balance sheet. In the bill that was passed in El Salvador, merchants are going to have to accept bitcoin as payment. This means big businesses there have to learn about and use bitcoin on a daily basis which, after seeing the many benefits of BTC, could make them eager to use bitcoin in other countries such as the US…

Some countries are already feeling the stress of not having adopted bitcoin, and the more that adopt it will only cause others to want it more. Gabriel Silva, member of Panama’s Parliament, said on the matter: “This is important. And Panama cannot be left behind. If we want to be a true technology and entrepreneurship hub, we have to support cryptocurrencies. We will be preparing a proposal to present at the Assembly. If you are interested in building it, you can contact me.”

Every single country on planet Earth that has not adopted a Bitcoin standard is falling behind the ones who do. Bitcoiners have all the wealth, and countries will want our business. The countries will provide tax benefits, citizenship to the country, open up government owned land to the public for new housing developments, bitcoin mining incentives, etc.

“We want Bitcoiners to move here.” said El Salvadoran President, Nayib Bukele. Soon, the leader of every single country will say these words. The ones who say it first will be the biggest winners.

This is going to cause a massive inflow of wealth into Bitcoin the likes of which we’ve never seen. The world is being repriced in bitcoin. You and I already know this, but the rest of the world has yet to figure it out.

This is a guest post by Nik Hoffman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.