Bitcoin: The Ultimate Opportunity Cost

Upon realization of Bitcoin’s true value, one must reconcile their economic opportunity cost with their new reality.

Attention, fellow bitcoin wealthy plebs; I’ve been summoned to write about the corn, and there is one topic that’s constantly in the back of my mind, creeping into every decision:

The Bitcoin opportunity cost.

Whether you’ve just started your journey down the rabbit hole or you’re already telling billionaires to “have fun staying poor,” by now, you’ve learned about the functions and characteristics of money. This is one of the first things about Bitcoin that stood out to me, as I hadn’t learned about it before. The money a society uses should function as a store of value, a medium of exchange, and a unit of account. Diving deeper, I learned about money’s different characteristics (scarcity, divisibility, transferability, etc.) and started to understand how societies grade money based on these characteristics to decide which forms of it are more desirable than others.

Many have come to the conclusion that Bitcoin earns the best overall grade on the characteristics-of-money test, and this makes it the best form of money ever (cc: @thisisbullish). I fully subscribe to the thesis that bitcoin the asset is currently functioning as the best store of value in existence, and that this delays bitcoin from fulfilling the other two functions of money. Why would people use bitcoin to exchange value at scale when it is serving as the best store of value right now? In the future, when Bitcoin’s volatility calms down and global adoption is above 80 percent, people won’t feel like they’re giving up generational wealth when they use bitcoin as a medium of exchange, and then Bitcoin the network will shine. This is all to say that we are still very much in the adoption phase, and we are lucky to be here this early.

If you agree with that thinking, you may have entered into a new wormhole mindset in the last few years, as I did. When you go down this wormhole, you stop thinking about bitcoin as an investment, which implies you’re trying to exit at some point after squeezing out more money than you put in. Instead, you start to think about Bitcoin as the money, which exists in a better system that improves incentives, trade, friction, efficiency, saving, time preference, freedom, innovation, politics, and community. Once you get to that point, the opportunity cost of not owning Bitcoin creeps into every single decision.

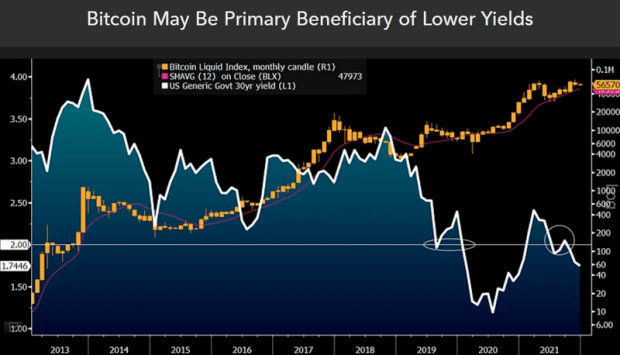

Today, money managers use the risk-free rate of treasury bills to calculate opportunity cost of financial decisions. This calculated yield basically represents the maximum amount of money you could make without taking any risk, and decisions should be weighed against this.

If you factor in the 2.3 percent annual government-targeted inflation rate via the Consumer Price Index (CPI), then most interest rates are already negative.

Now factor in the CPI being a farce.

Now factor in that nothing is risk-free and this yield is subject to a counterparty that operates like a failing business.

Finally, you have an opportunity cost that can’t ever be verified or agreed upon. As a result, we can’t trust the benchmark against which most investment decisions are calculated, and this leads to complete mispricing of assets.

Say you’re a bank and your group of investment analysts, pictured below, ignore all of that.

You are using the absolute worst-performing “risk-free” investment available as your opportunity cost. Bitcoin is basically a social experiment to see what happens if you try using the best-performing asset of all time as your opportunity cost instead.

Bitcoin Magazine’s @nikcantmine wrote about how he weighed his personal Bitcoin opportunity cost against college tuition. I went to college, and I can justify it because, in my opinion, it was a great time and I hadn’t heard of Bitcoin yet. But if I had, I probably would have made the same decision as Nik. In my mind, most purchases won’t outperform Bitcoin, so if I’m buying something, it better give me a large amount of enjoyment, and if I’m ever selling Bitcoin, it better be in exchange for large amounts of time. I’m not sure if it’s a blessing or curse to be at the point where every single decision, financial or otherwise, comes down to “Hey man, you should probably have more bitcoin instead.”

In summary: enjoy the ride, $500,000 is bearish, pleb forever, team surferjim, pray for Miami.

Thanks to @BTCization for the nod.

Play me off.

This is a guest post by Chad_Capital. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.