Bitcoin: The Key to Unlocking the Dream of Homeownership for a Generation Priced Out

Picture this, dear reader: It’s 2016, and for the princely sum of $288,400, you could stroll into the American dream—your very own house. Now, fast forward to 2024, and that same slice of suburban heaven will set you back a staggering $434,700. Wages haven’t quite managed the same level of gymnastics, leaving many young folks clutching their wallets like they’re bracing for the next unexpected subscription charge.

But what if I told you there was a way to make homeownership not only possible but laughably attainable? Enter stage left: Bitcoin. Yes, the orange wonder coin that goes up, down, and all-around faster than a politician’s promises during election season.

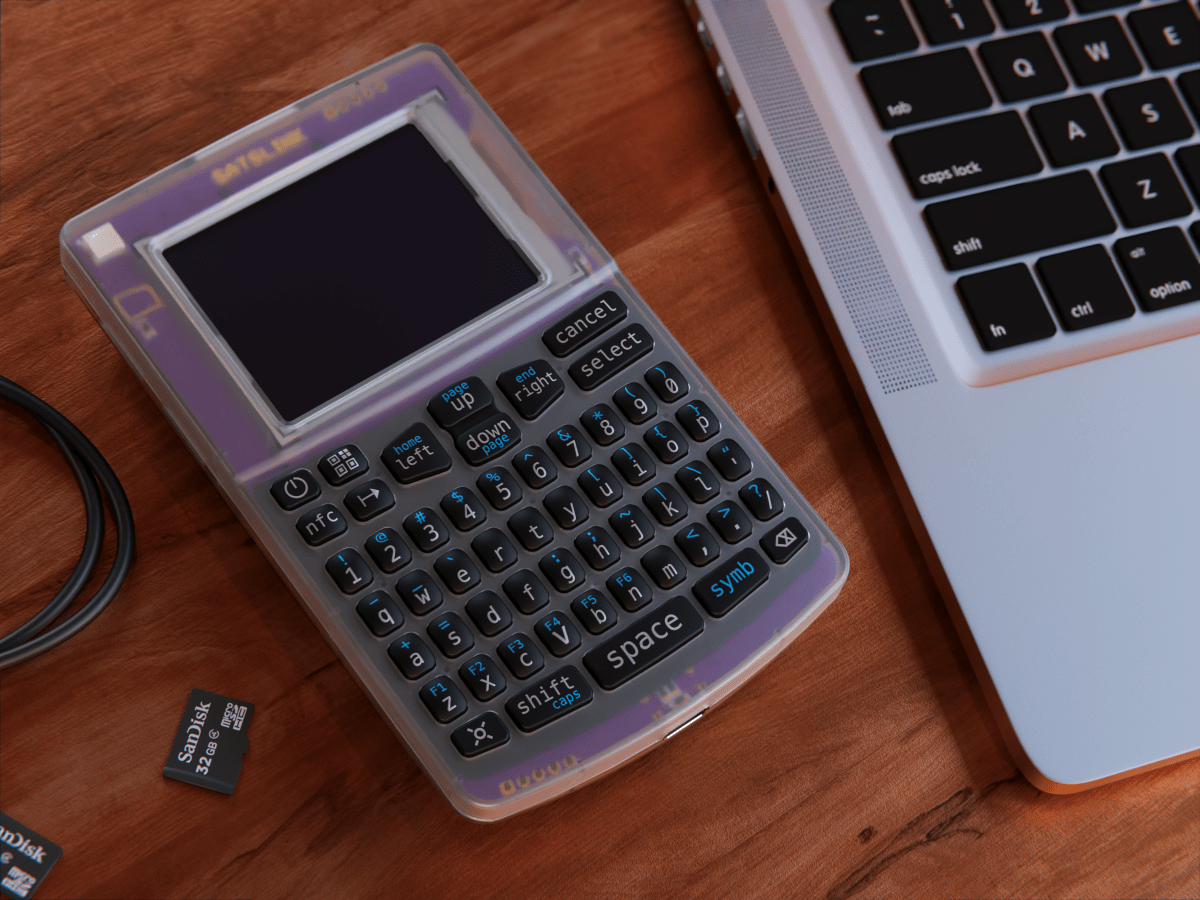

INSERT TWEET – https://x.com/BitcoinMagPro/status/1857064473472704563

Let’s Talk Numbers, Shall We?

In 2016, if you had 664 BTC burning a hole in your pocket, you could swap it for a median U.S. home. By 2020, that figure had plummeted to a much tidier 45 BTC. And now, in the grand year of 2024, a mere 4.8 BTC could snag you a place to call your own. At this rate, we’re only a few years away from buying a house with the change down the back of Satoshi’s metaphorical sofa.

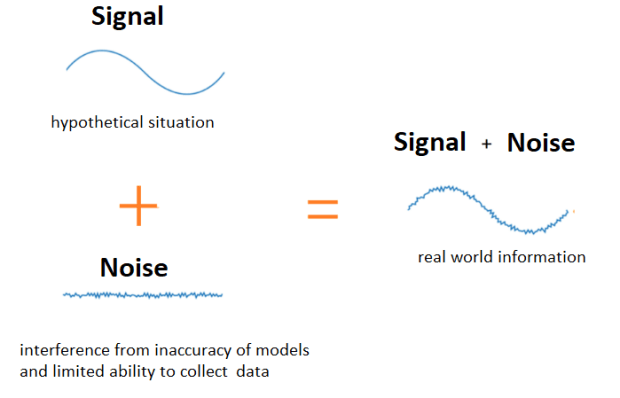

Let’s marvel at this for a moment: as house prices in fiat terms continue their relentless climb—like an escalator with no off switch—Bitcoin’s purchasing power has been heading in the opposite direction. It’s not just holding its own against inflation; it’s laughing in inflation’s face, stealing its lunch money, and then inviting it to watch while it buys a house.

A Glimmer of Hope in a Housing Crisis

For millennials, Gen Z, and the generations to come, the dream of homeownership has often felt like trying to catch smoke with bare hands. Wages are stagnant, the cost of living is skyrocketing, and central banks seem to be in a perpetual money-printing competition. But Bitcoin offers a way out. It’s not just a currency; it’s a lifeline—a savings instrument that actually rewards you for your discipline and foresight.

The Bitcoin Homeowner’s Playbook

Imagine saving up for a down payment in Bitcoin rather than fiat currency. While the dollar in your savings account loses purchasing power faster than an ice cream cone in the sun, your Bitcoin nest egg could be growing—not just in value, but in what it can buy. At the current pace, we’re hurtling towards a future where a single Bitcoin might well buy you a house, a car, and possibly even the white picket fence thrown in for good measure.

And here’s the kicker: the rapid decrease in the number of Bitcoins needed to purchase a house isn’t just a fluke. It’s a reflection of Bitcoin’s deflationary nature and its growing adoption as a global store of value. When priced in Bitcoin, houses are getting cheaper. When priced in dollars, they’re getting more expensive. It doesn’t take a financial wizard to figure out which one makes more sense to save in.

A Word of Caution (and Optimism)

Of course, Bitcoin is not without its volatility. There will be days when the price moves faster than a caffeinated squirrel. But for those with a long-term view, the trend is clear: Bitcoin is the best savings instrument humanity has ever seen.

So, to all the young families and would-be homeowners out there, take heart. The dream of owning your own home isn’t dead—it’s just been reimagined. The answer isn’t in working harder or saving more in a currency that loses value by the day. The answer is Bitcoin.

And one day soon, when you’re sitting on the porch of your very own house, bought with a single Bitcoin, you’ll raise a glass and say, “Cheers, Satoshi. You made this possible.”

Now, where’s that Bitcoin wallet?

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.