Bitcoin Tends to Become More Volatile Around Monthly U.S. Inflation Releases: Kaiko

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

On Wednesday, at 8:30 AM ET (12:30 UTC), the U.S. Bureau of Labor Statistics will release the consumer price index (CPI) for April.

The headline CPI inflation figure is forecast to stay unchanged at 5% and the core figure, which excludes the volatile food and energy component, is forecast to have increased by 5.5% following March’s 5.6% increase, according to Reuters estimates published by FXStreet.

Bitcoin (BTC) has historically seen increased intraday volatility in the six-hour window before and after the inflation data, according to Dessislava Aubert, a research analyst at Paris-based crypto data provider Kaiko.

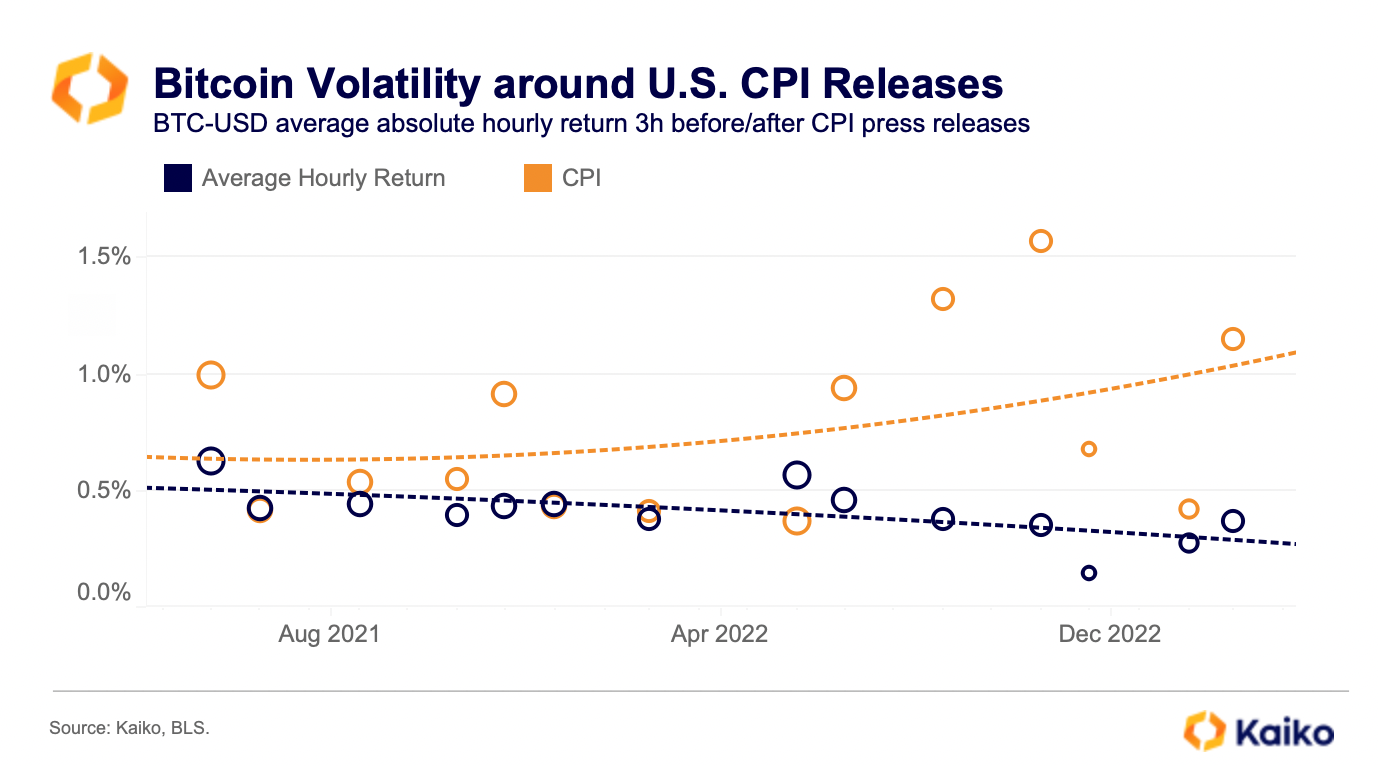

The cryptocurrency tends to see heightened price turbulence in the six hour window entered around the monthly inflation readings released at 8:30 ET. (Kaiko)

In the above chart, the blue line indicates the average hourly volatility for the month as measured by the absolute hourly price return. The orange line represents volatility within the six-hour CPI window.

The blue line has steadily declined over the past two years, with the orange line trending north, particularly since April 2022. The orange circles have consistently printed above the blue circles, a sign the monthly inflation data tends to inject extra volatility into the market.

“The intraday volatility, especially around data releases, remains above average. This trend will continue as the U.S. Federal Reserve made it clear last week that monetary policy will be even more data-dependent,” Aubert said in an email.

In other words, bitcoin could see heightened price turbulence (price swings in either direction) later today. The leading cryptocurrency by market value is currently trading flat at around $27,620, per CoinDesk data.

The Federal Reserve (Fed) raised rates by 25 basis points last week, lifting the benchmark borrowing costs to the 5%-5.25% range. While the policy statement opened the doors for a pause in the rate hike cycle, Fed chair Jerome Powell maintained the data-dependent stance during the post-meeting press conference.

Therefore, an above-forecast inflation reading might strengthen the case for continued rate hikes, bringing pain to risk assets, including cryptocurrencies. On the flip side, bitcoin may see volatility on the higher side if the data misses expectations.

The Fed kicked off its tightening cycle 14 months ago to control rampant inflation and has raised rates by 500 basis points since then. The liquidity tightening roiled cryptocurrencies last year.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.