Bitcoin Taps 3-Week High, Cardano Explodes 17% and Reclaims $1 (Market Watch)

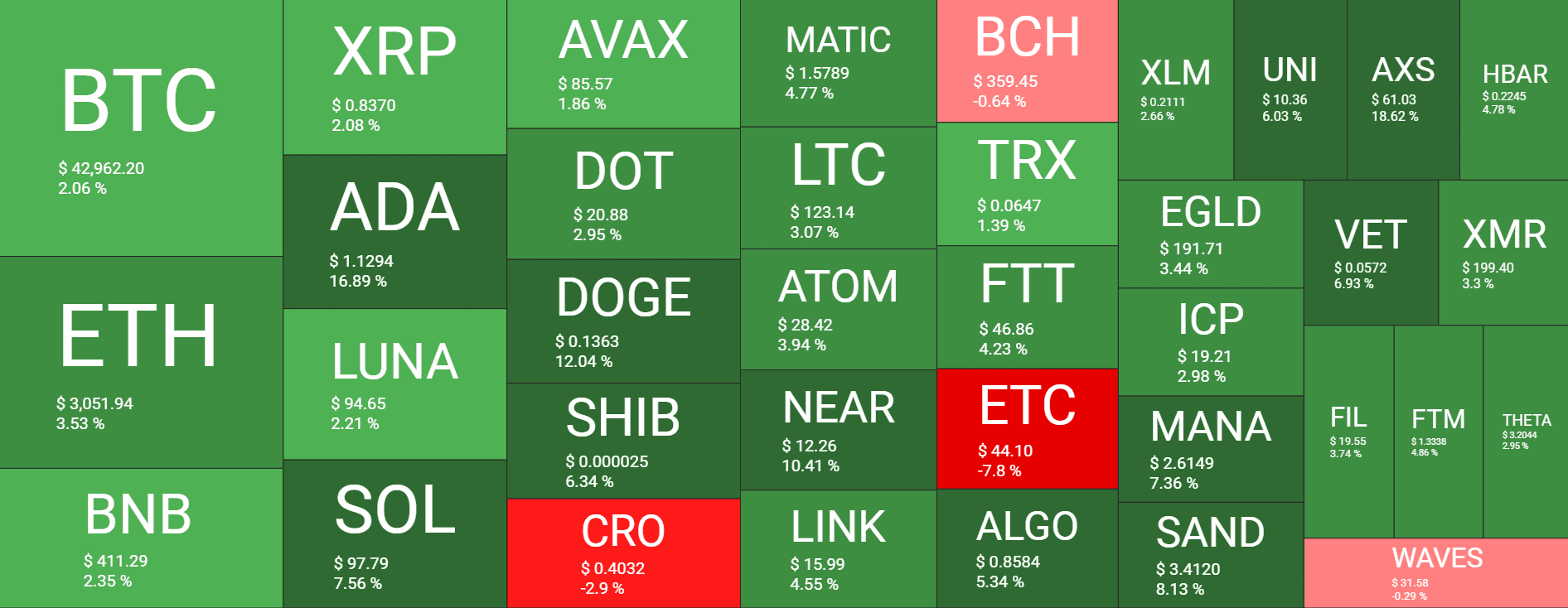

Yesterday’s price dip was short-lived as bitcoin went on the offensive again and charted a new three-week high above $43,000. Most altcoins have also turned green, with Cardano, Dogecoin, Shiba Inu, and NEAR Protocol stealing the show.

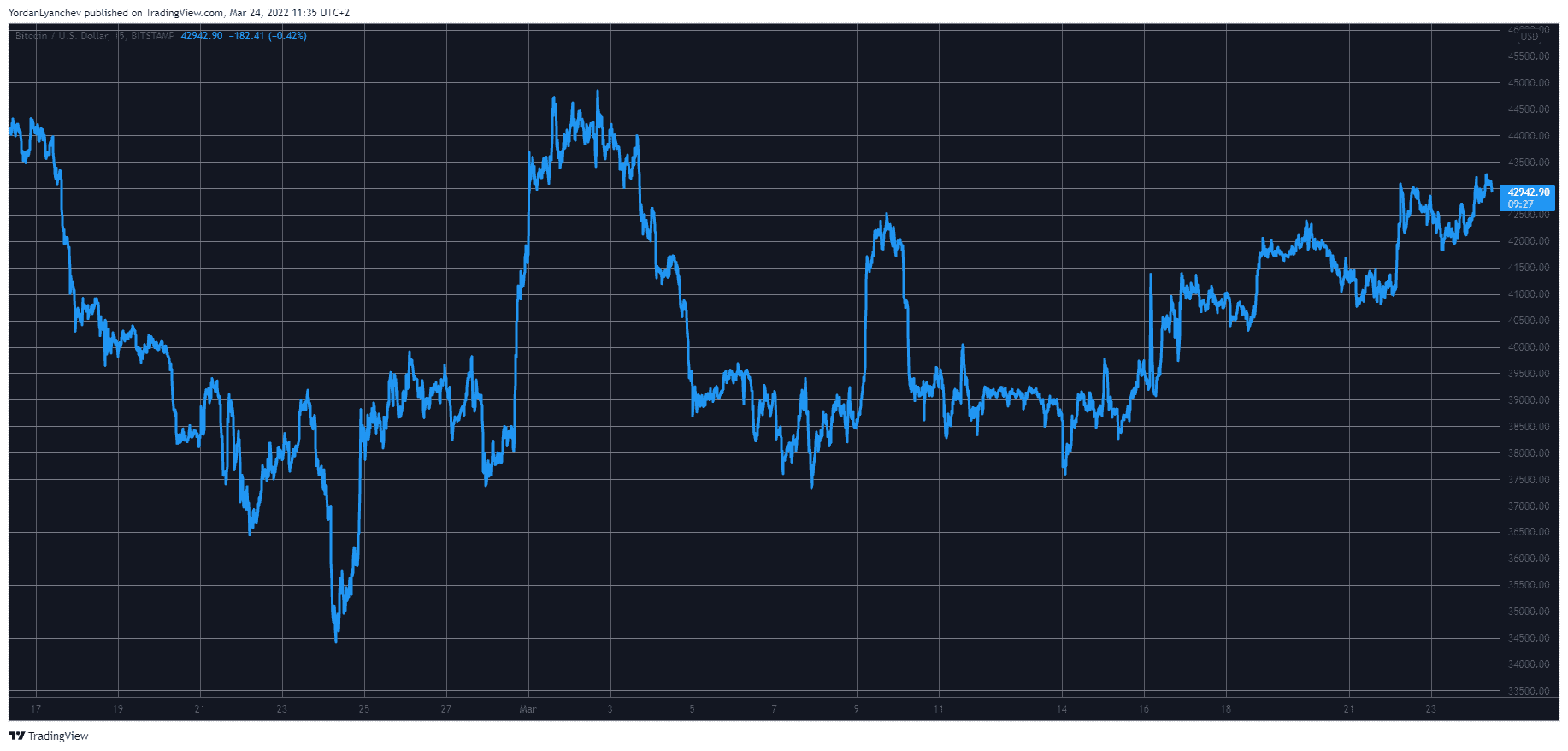

Bitcoin’s New 3-Week Peak

It was less than a week ago when the primary cryptocurrency dropped to just over $40,000, and the community feared that the asset could decline below that coveted line. However, the situation quickly changed, and BTC initiated an impressive leg up, resulting in touching $42,000.

A brief retracement followed, which brought bitcoin down to $41,000. Nevertheless, the bulls stepped up once again and pushed BTC north. This time, the cryptocurrency touched and briefly exceeded $43,000 for the first time since March 3.

As reported yesterday, though, bitcoin retraced by around a thousand dollars and slipped to $42,000. It went back on the offensive hours later and currently stands around $43,000, marking a new three-week peak earlier in the day.

As a result, its market capitalization has increased to around $820 billion.

ADA, SHIB, DOGE, SOL, and NEAR See Massive Gains

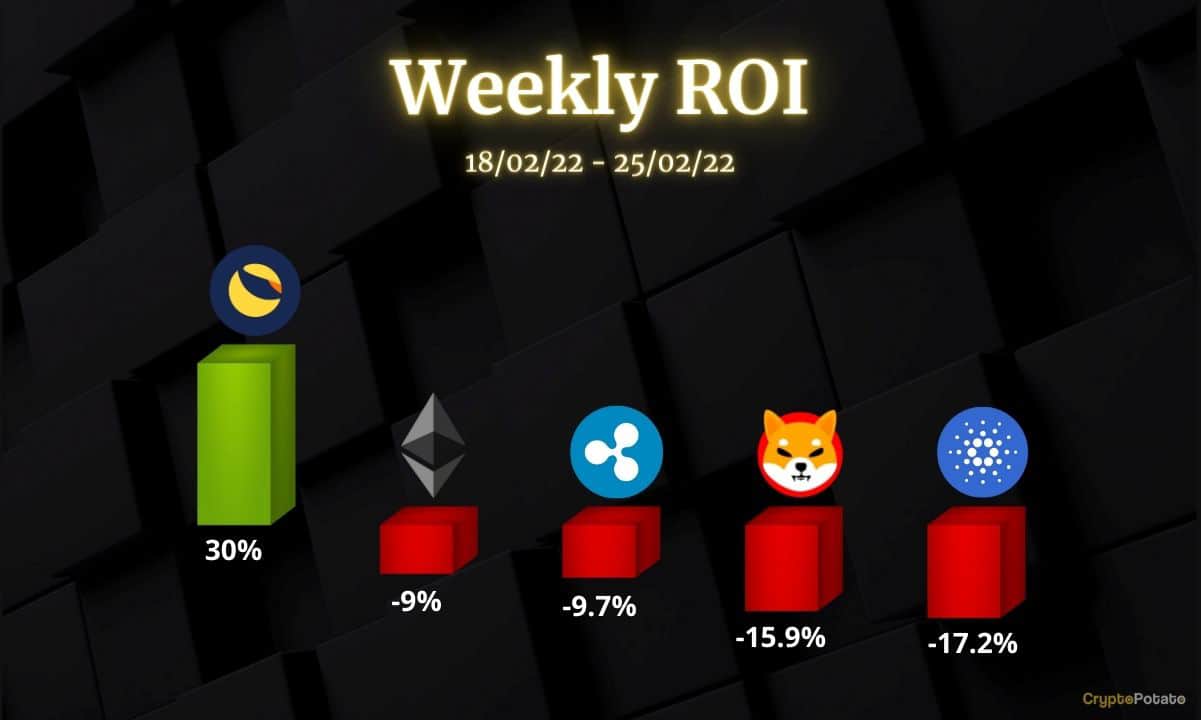

The altcoins were also slightly in the red yesterday, but the landscape is entirely different today.

Ethereum touched $3,000 two days ago but failed to remain there and dipped below $2,900 24 hours later. As of now, the second-largest digital asset stands above $3,00 once again, following a 3% daily increase.

Binance Coin, Ripple, Terra, Avalanche, and Polkadot have also charted minor daily gains.

Cardano is the best performer from the larger-cap alts. ADA has soared by almost 20% in a day, following a Coinbase announcement, and now stands well above $1.1.

Dogecoin follows suit with a 13% increase. This comes after Bitcoin of America ATMs added support for the popular memecoin.

Solana (7%), Shiba Inu (7%), and NEAR Protocol (11%) have also charted impressive gains.

The crypto market cap is up by around $60 billion since yesterday’s low and is close to $2 trillion.