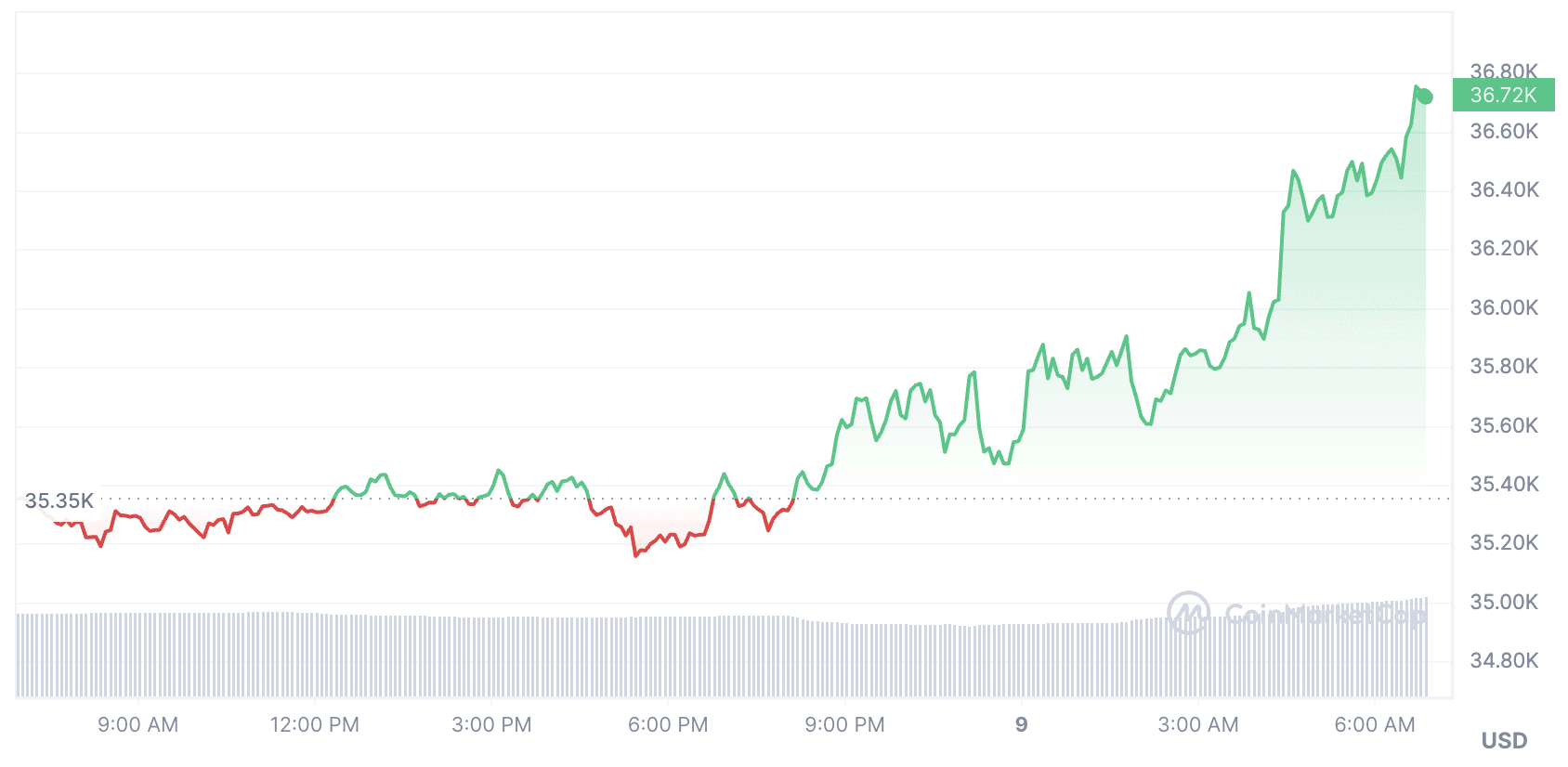

Bitcoin Surges to Almost $37K, Triggering Over $140 Million in Liquidations

The price of the primary cryptocurrency has soared once again, hitting a fresh 18-month peak of approximately $36,700 (per CoinMarketCap’s data).

Other leading digital assets, including Ether (ETH), Binance Coin (BNB), Cardano (ADA), Polygon (MATIC), Polkadot (DOT), and more, are also well in the green.

The latest green wave in the cryptocurrency market, specifically BTC’s rise, has resulted in millions of dollars of liquidations.

According to CoinGlass, the total liquidations for the past 24 hours have soared to almost $150 million, with more than 80% of that amount being short positions.

Bitcoin trades comprised over $65 million of the total figure, while Ether followed second with around $16 million.

Multiple analysts, and even the AI-powered language model – ChatGPT, have assumed that BTC’s uptrend is nowhere near its end, predicting its price could tap a new all-time high in the following months.

The main factors that might contribute to such a jump could be the potential approval of a spot BTC ETF in America, mass adoption, the upcoming halving, and others.

Those curious to observe five price predictions coming from prominent figures could take a look at our dedicated video below:

The post Bitcoin Surges to Almost $37K, Triggering Over $140 Million in Liquidations appeared first on CryptoPotato.