Bitcoin Supply Inactive for a Year Slides to 18-Month Low of 65.8%

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

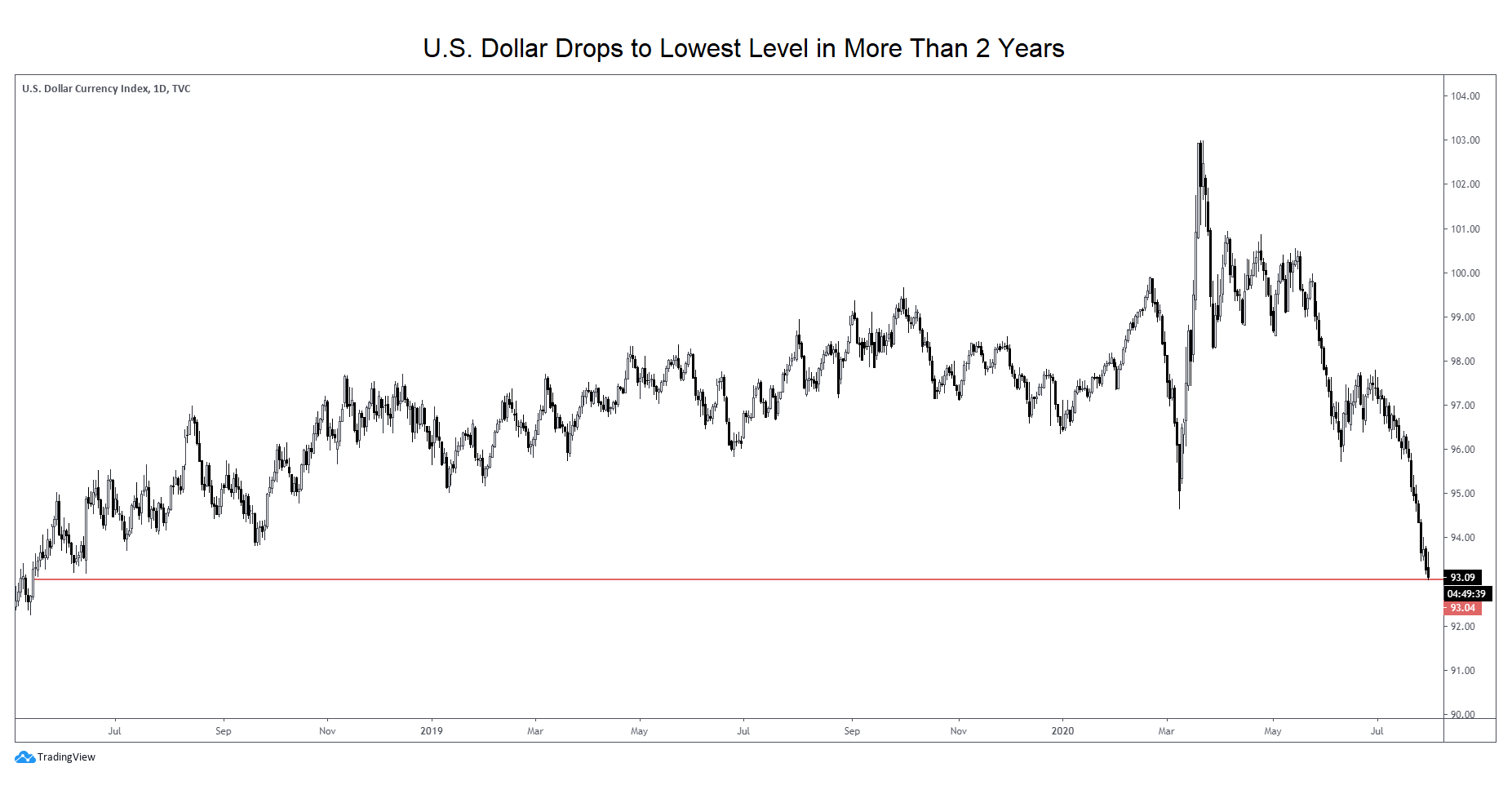

The percentage of bitcoin’s circulating supply last active at least a year ago has declined from 70% to 65.8% in three months.

-

The decline probably indicates profit-taking by some investors in a rising market.

The percentage of bitcoin’s circulating supply that last moved on-chain at least a year ago has declined to the lowest since October 2022, according to data tracked by blockchain analytics firm Glassnode.

On Monday, 12.95 million BTC, equating to 65.84% of the circulating supply of 19.67 million BTC, remained unchanged for over a year, the lowest percentage since October 2022. The metric peaked above 70% with the debut of nearly a dozen spot exchange-traded funds (ETFs) in the U.S. in mid-January and has been falling ever since.

Since late December, the percentage of the circulating supply that has not moved in at least two years has declined to 54.% from 57.4%.

The decline likely represents profit-taking by investors who held coins for one year and over and marks a shift from the holding strategy seen through 2023.

The urge to sell likely stems from bitcoin’s massive 148% price surge since April last year and the 50% rally since the ETFs began trading in the U.S. At press time, bitcoin changed hands at $70,400. However, it’s difficult to ascertain the exact percentage of bitcoin that left the inactive supply has been liquidated in the market.

According to the data tracking website MacroMicro, a decrease in the percentage of inactive BTC is a “leading indicator for the end of the bull run.”

Past data, however, show that bull markets tend to peak as the percentage of inactive supply bottoms out and begin rising.

Edited by Oliver Knight.