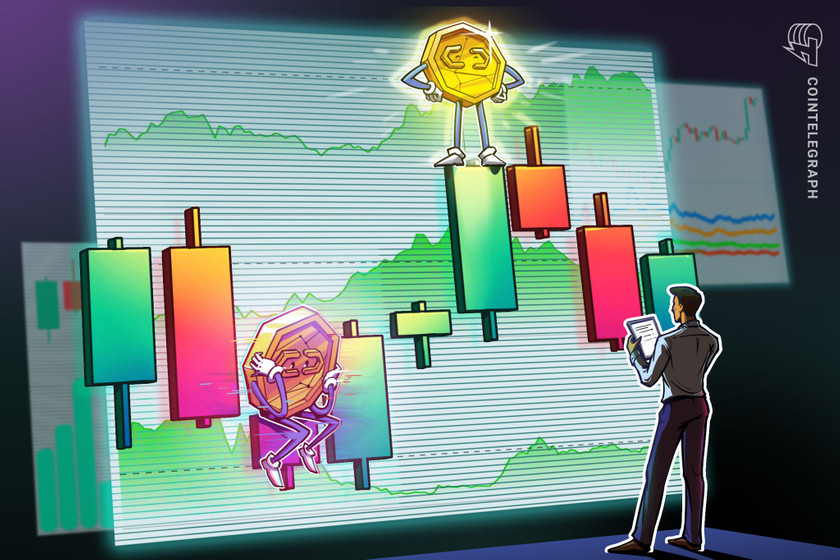

Bitcoin, stocks and commodities correct after Fed chair mentions policy change

BTC, stocks and commodities took a hit after the Federal Reserve acknowledged that inflation is more than just a “transitory” problem and hinted that tapering could occur sooner than expected.

322 Total views

9 Total shares

Global financial market took a hit on Nov. 30 after comments from U.S. Federal Reserve Chair Jerome Powell hinted that inflation and the Omicron Covid-19 variant are growing threats and that the bank’s easy money policies could end sooner than anticipated.

Prior to Powell’s comments, Bitcoin (BTC) had been on the rise and the digital asset had rallied 6% from a low of $55,840 in the early trading hours on Nov. 30 to an intraday high at $59,200, but the price was hammered back below $57,000 after the Fed’s remarks.

At the time of writing, Bitcoin has managed to climb back to $58,000 but a series of technical indicators signal that traders are not confident about BTC’s next move.

Stocks and commodities take a hit

It wasn’t just Bitcoin that was hard hit by the Fed’s comments. According to economist and CryptoQuant analyst Jan Wuestenfeld, the dollar index (DXY) increased while the DOW, gold and other equities indexes pulled back.

Wuestenfeld said,

“US dollar index appreciating on Powell remarks that the FED might speed up taper (no matter how believable). Everything else going down. Gold included.”

Related: Vladimir Putin says cryptocurrencies ‘bear high risks’

The Fed “behaves in a binary way”

Deeper insight into the actions from the Fed was provided by market analyst and former treasury employee Nik Bhatia, who highlighted the fact that the Fed “doesn’t have the ability to react to dynamic conditions” and instead “behaves in a binary way.”

Bhatia said,

“If things are going well, it can tighten policy. If the economy is in trouble, it eases policy.”

According to Bhatia, “inflation is running hot in the United States” with “headline statistics pointing to multi-decade high increases in aggregate price levels.”

At the same time, the Fed has implemented “a monetary policy at essentially the easiest it has ever been,” leading Bhatia to caution that “with inflation waking up, this will soon come to an end.”

Bhatia said,

“The Fed is clearly heading into a policy error in which it tightens policy despite longer-term growth and inflation expectations coming down, due to tighter monetary policy itself (that’s why it’s called policy error).”

It’s no longer “transitory inflation”

Interstingly, Powell’s comments acknowledged that the year-long mantra of “transitory inflation” is now coming to an end, with the Federal Reserve chair suggesting that it’s time to “retire” the transitory narrative.

Federal Reserve Chairman Jerome Powell just suggested that we stop using the word “transitory” when speaking about inflation.

“I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

It was never transitory and everyone knew that.

— Pomp (@APompliano) November 30, 2021

While it’s refreshing to see a bit more honesty coming from the Fed, cryptocurrency pundit Anthony Pompliano pointed out tha the average person knew all along that the inflation was anything but “transitory” in nature and will likely remain an issue well into 2022.

The overall cryptocurrency market cap now stands at $2.638 trillion and Bitcoin’s dominance rate is 41.2%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.