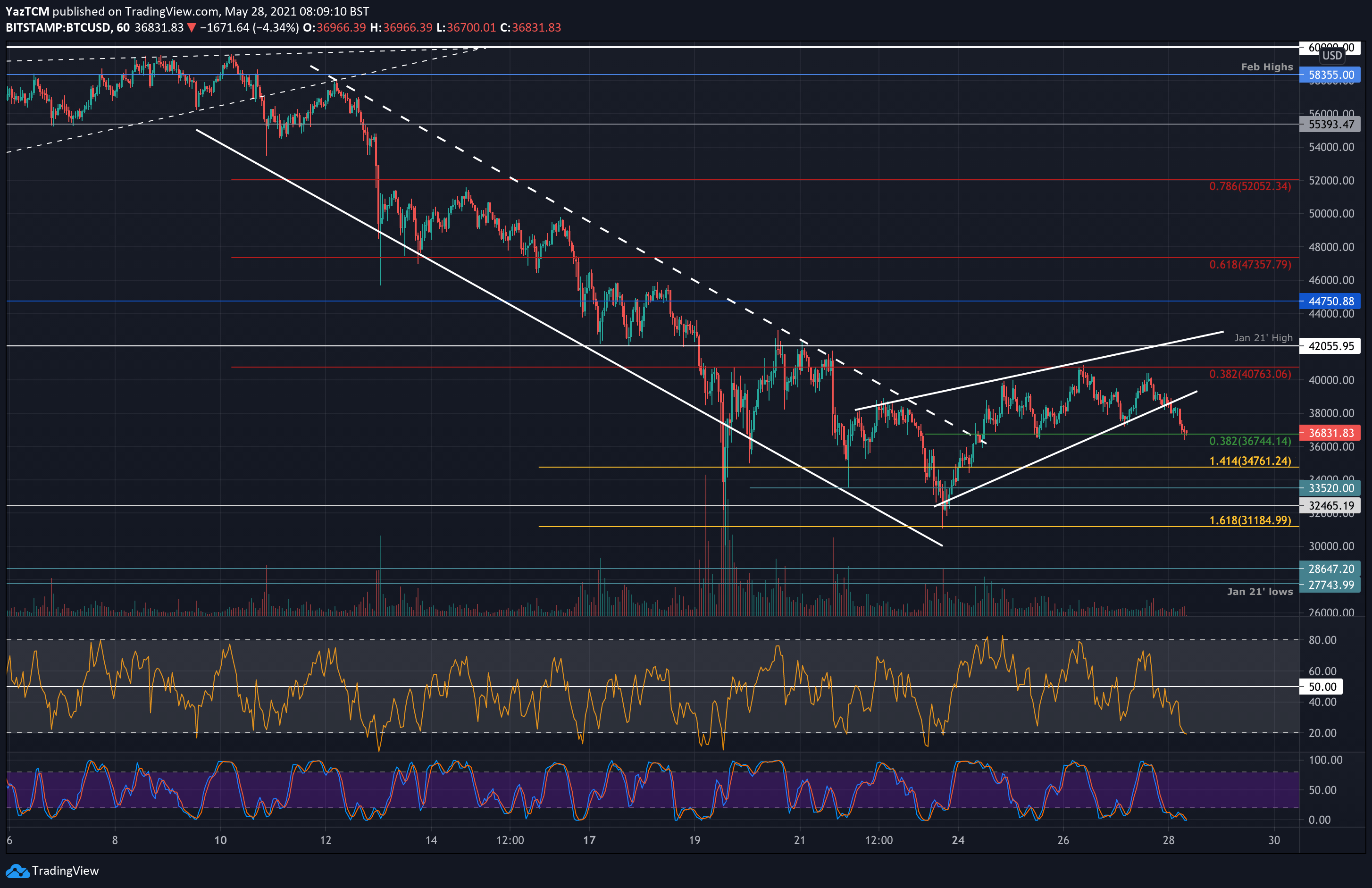

Bitcoin Steady But Fragile: Will a Volatile Weekend Sink the BTC Price to $8,500?

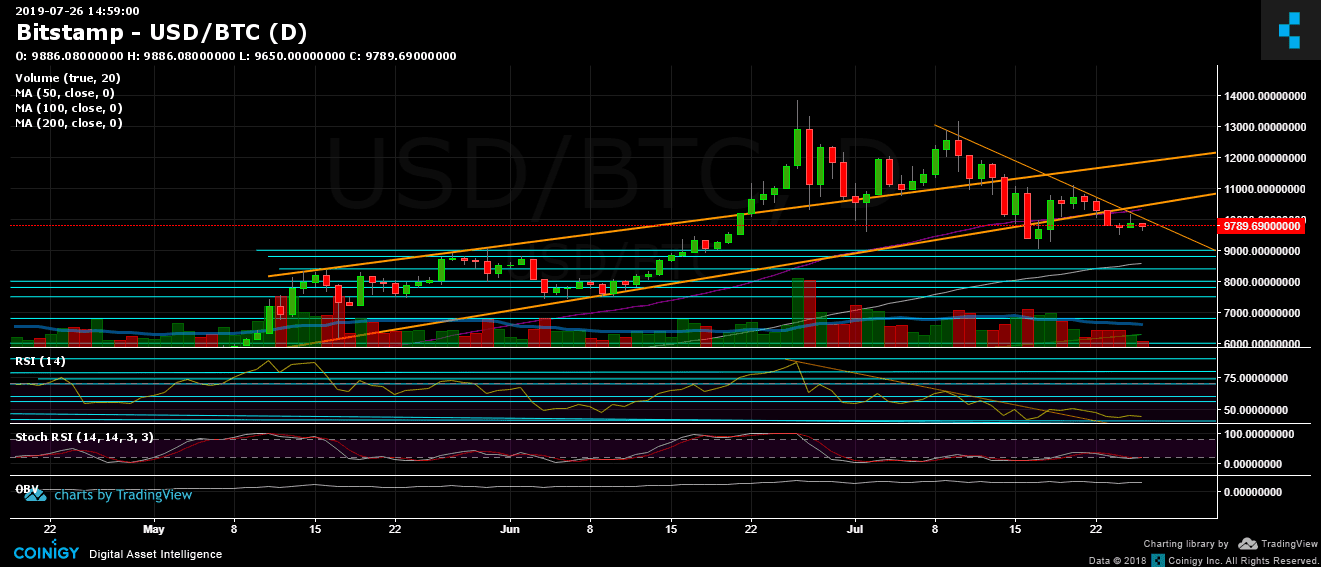

Since our previous price analysis and over the past three days, Bitcoin has been trading in a tight range of $9,600 to $10,200. The top of that range is exactly where the 50-day moving average line (marked in purple on the daily chart) lies.

During this time, trading volume has been relatively low. However, since reaching the 2019 high of $13,880, Bitcoin has been showing bearishness, creating lower lows. The recent test of $11,000 a week ago was rejected. Until it breaks that level and forms a lower high, it will be hard to see the Bitcoin market as bullish.

More evidence for Bitcoin’s bearishness is its RSI, which is showing weakness under the crucial 50 level (on the daily chart) in bearish territory with much room to go down.

The Bitcoin market appears calm in advance of the weekend. However, as mentioned above, things can change very quickly. In particular, Bitcoin loves to make sharp moves during weekends.

Total Market Cap: $272 billion

Bitcoin Market Cap: $175 billion

BTC Dominance Index: 64.4%

*Data from CoinGecko

Key Levels to Watch

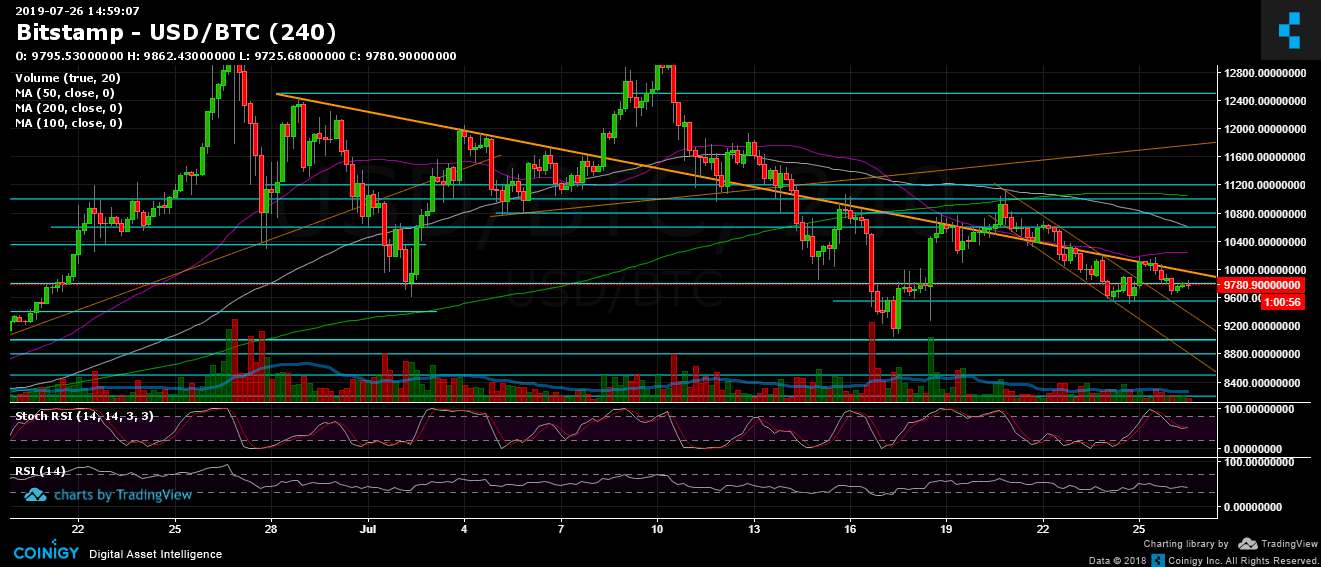

Support/Resistance: Looking at the 4-hour chart, Bitcoin is following a descending trend line which started to form a month ago. The last rejection occurred yesterday at around $10,200. That line, along with the $9,800 – $10K price area, is the nearest resistance level at present. Next is the aforementioned 50-day moving average line (~$10,200) before the $10,500 – $10,600 region. Further above is the previous daily high of $11K.

Bitcoin now possesses support at $9,500 – $9,600. Further below is $9,400, followed by the $9,000 area. Lower levels include $8,800 and $8,500, along with the CME futures gap.

Daily chart’s RSI: Discussed above.

Trading Volume: Discussed above.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

The post Bitcoin Steady But Fragile: Will a Volatile Weekend Sink the BTC Price to $8,500? appeared first on CryptoPotato.