Bitcoin Steady Above $9,000 Anticipating The New Week’s Start: Sunday’s Crypto Market Watch

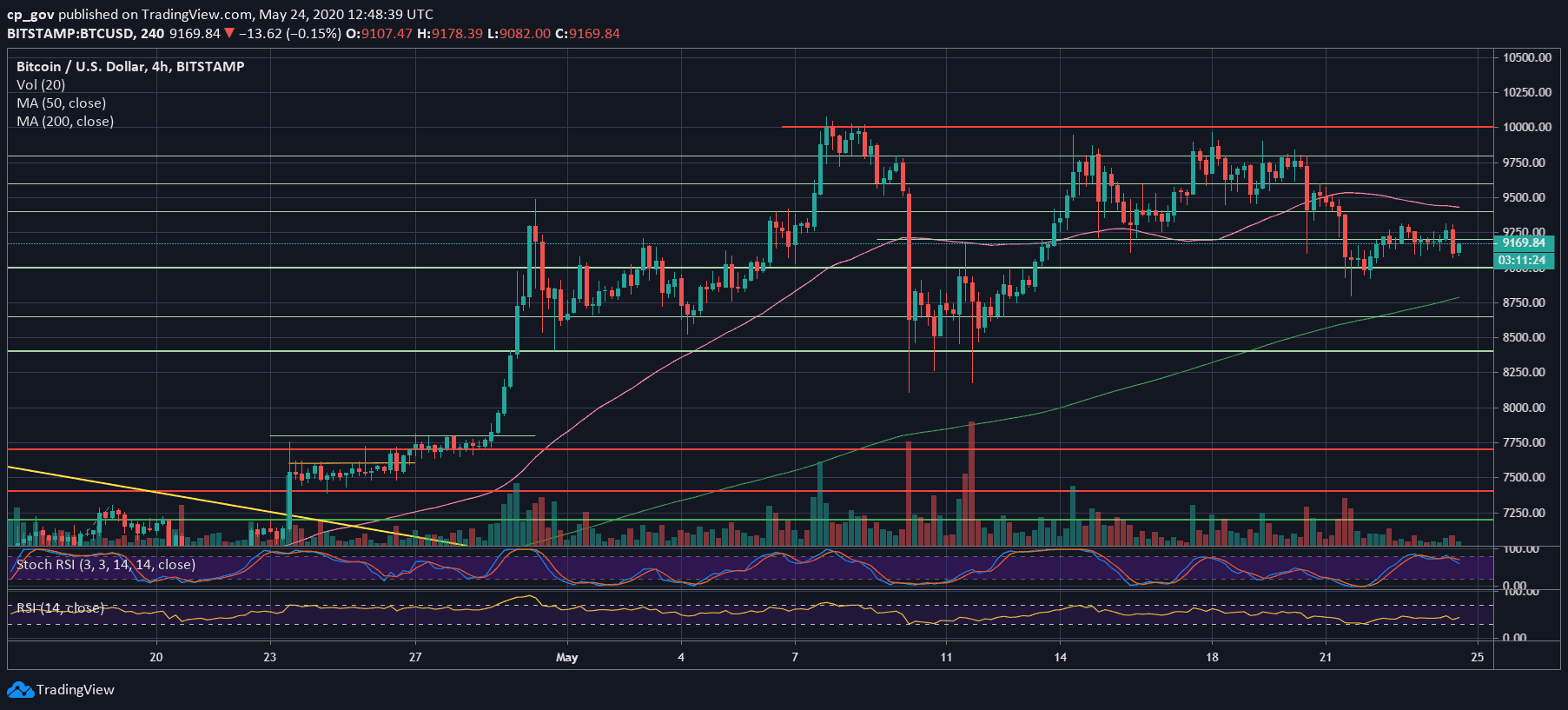

The past 24 hours have been relatively calm for the leading cryptocurrencies by market capitalization. As of writing these lines, Bitcoin is trading today in a tight range around $9,200.

From a technical standpoint, the range between $9,200 – $9,300 is the first significant resistance level for the primary cryptocurrency. If it breaks it successfully, then BTC would have to conquer $9,500, $9,600, and $9,800 as the next resistance levels, on its way to test the psychological mark of $10,000 again.

Alternatively, if the price of Bitcoin dives, the first significant support lines lie at $9,000, followed by $8,800 and $8,650.

Most of the top ten altcoins haven’t registered any notable price moves since yesterday. Ethereum couldn’t break the $210 mark and is now trading at $207. Both Binance Coin and Tezos are marking slight increases and are now at $16.6 and $2.77, respectively.

The major news here came yesterday when the most widely adopted stablecoin – Tether (USDT) – surpassed Ripple and is now occupying the third place in terms of total market capitalization.

Total Market Cap: $255B | Bitcoin Market Cap: $168B | Bitcoin Dominance: 66.5%

Major Crypto Headlines

Russia’s State Duma Reportedly Considers Jail Time For Bitcoin Ownership And Complete Ban On Cryptocurrencies. News broke earlier this week that the Russian parliament is contemplating a new law to ban any cryptocurrency usage within the country’s borders.

Should the legislation be implemented, individuals and businesses operating with digital assets could receive massive fines and even up to seven years in jail.

All Funds Are SAFU: BitMEX Outage On Tuesday Due To Server Restart. The popular Bitcoin margin trading exchange went offline on May 19th for a few hours. The company published a blog post explaining that it was a “result of an unexpected trading server restart” and all funds were safe.

Tron’s Justin Sun Accused of Criminal Conspiracy and Theft by Lawyer. An Australian lawyer offered his pro bono legal opinion on the situation regarding the recent Steem hard fork. He claimed that Justin Sun’s actions during that process made him guilty of theft and criminal conspiracy.

Significant Daily Gainers And Losers

Theta Fuel (114%)

While most of the market is trading sideways, a few exceptions exist. None is more impressive today than TFUEL, with its triple-digit surge against the dollar to $0.014. The increase against BTC is identical to the 151 SAT. TFUEL is trading mainly on Binance.

The decentralized video streaming company behind the coin is preparing to launch its mainnet 2.0 in three days.

Electroneum (18%)

ETN is next in the list of the most impressive gainers throughout the day, with a nearly 18% increase against both the dollar and BTC. The price development means that ETN/USD is trading now at $0.0075, while ETN/BTC is at 82 SAT.

The project recently introduced phase two of its development stage.

OmiseGO (-13%)

On the other hand, stands OMG, with the most substantial losses in the past 24 hours. OMG has lost 13% of its value against USD and Bitcoin and is currently standing at $1.68 and 18400 SAT, respectively.

The veteran US exchange Coinbase recently listed OmiseGO on its platform, which initially caused a serious price pump and a classic “sell the news” afterward.

The post Bitcoin Steady Above $9,000 Anticipating The New Week’s Start: Sunday’s Crypto Market Watch appeared first on CryptoPotato.