Bitcoin Stalls at 2022 Highs On the Way To $50,000, While Traders Back This Stake-to-Mine Token For Post-Halving Gains

Bitcoin is up by an impressive 14% from the lows placed last Monday but has found resistance at the 2022 highs on its way toward $50,000.

Despite this, traders are still incredibly bullish for the number-one-ranked cryptocurrency’s future, believing the Bitcoin block halving will push $BTC beyond its all-time-high price.

With the block halving imminent, traders are also positioning themselves into a stake-to-mine ecosystem, capable of delivering significant returns following the block halving.

Bitcoin Finds Resistance at 2022 Highs – Pullback Coming Or More Gains?

Bitcoin has found resistance at the 2022 highs as it makes its way toward $50,000.

The cryptocurrency started its first retracement in months following the official launch of the BTC ETF but found support at the 100-day MA to rebound.

Last week, it continued to break above a short-term symmetrical triangle, allowing the cryptocurrency to surge by 15% and reach the 2022 highs at $48,285.

At the time of writing, the market has stalled since hitting this level as traders start to expect a short-term pullback;

Looking ahead, if the buyers break the resistance at the 2022 highs, the first level of higher resistance lies at $50,000.

This is followed by resistance at $52,146, $52,900 (1.414 Fib Extension), $55,400, $57,000 (1.618 Fib Extension), and $58,350 (Feb 2021 highs).

On the other side, the first support lies at $47,000. This is followed by $46,000, $44,750 (Feb 2022 resistance), $45,450, and $42,000 (Jan 2021 highs).

Bitcoin Block Halving Narrative Driving Scarcity Narrative

Bitcoin has continued to push higher this week as the block-halving scarcity narrative drives optimism.

The Bitcoin block halving is now just an estimated 66 days away, and traders are positioning themselves ahead of the event to capitalize on any price pumps.

The block halving will slash the Bitcoin block reward from 6.25 BTC per block to just 3.125 BTC, reducing the number of newly minted coins entering the market.

As a result, traders believe that the huge demand for Bitcoin following the SEC’s ETF approval will cause a period of scarcity within the market following the halving, leading to much higher prices.

What Tokens Can Be Directly Impacted From The Halving?

It’s not just Bitcoin prices that the block-halving event will directly impact.

Traders are now positioning themselves into newly emerging projects capable of delivering higher returns due to the block halving.

In particular, the newly trending decentralized cloud mining platform, Bitcoin Mientrix ($BTCMTX), is stealing traders’ focus as it crosses the $10.6 million milestone this week.

Bitcoin Minetrix Raises $10.6 Million As Investors Back Stake-to-Mine Ecosystem.

Bitcoin Minetrix ($BTCMTX) continues gathering momentum as traders position themselves in the stake-to-mine ecosystem before the Bitcoin block reward halves.

As a result, the fundraising has officially crossed the $10.6 million milestone this week, demonstrating investors’ confidence in its ability to impact the cloud mining industry.

Bitcoin Minetrix intends to make mining accessible for everyday users through its novel stake-to-mine ecosystem.

The project is tokenizing the cloud mining industry, removing the prevalent scams that have plagued the sector by putting control back in the hands of token holders.

Cloud mining allows users to easily mine Bitcoin without having to buy or maintain expensive hardware.

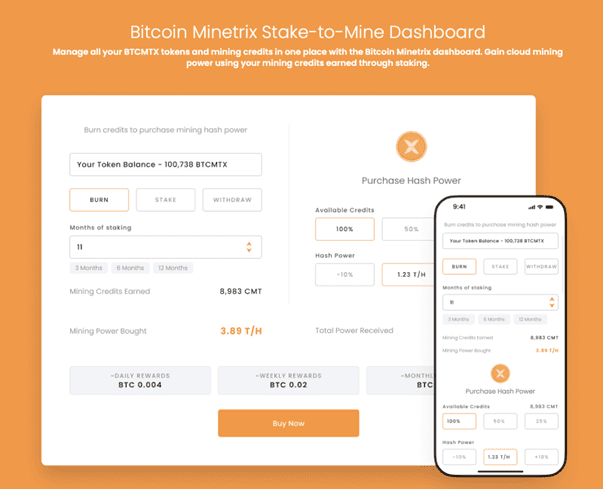

To start mining, users buy and stake $BTCMTX tokens to earn Mining Credits.

Mining Credits are non-transferrable ERC20 tokens that can be burnt in exchange for a designated time on the Bitcoin Minetrix cloud mining solution.

Miners can be sure to receive their expected mining earnings as smart contracts handle user allocations. Furthermore, they’re free to unstake their $BTCMTX and sell it at any time and aren’t locked into long-term mining contracts.

Furthermore, passive earnings are doubled on the platform through staking earnings, which currently provide holders a 63% APY.

The overall goal for Bitcoin Minetrix is to create a decentralized and trustless solution that will let everyday users mine Bitcoin following the block halving event.

Given the impressive climb beyond $10 million in fundraising, investors are clearly backing Bitcoin MInetrix as a disruptive force in the cloud mining sector.

Bitcoin Minetrix ($BTCMTX) can currently be purchased at presale for $0.0134. The rising pricing strategy means those entering earlier benefit from lower entry prices.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Bitcoin Stalls at 2022 Highs On the Way To $50,000, While Traders Back This Stake-to-Mine Token For Post-Halving Gains appeared first on CryptoPotato.