Bitcoin Spot ETFs Could See Inflows of $14.4B in First Year, Galaxy Says

Spot bitcoin (BTC) exchange-traded funds (ETFs) could attract at least $14.4 billion of inflows in the first year of issuance, crypto fund Galaxy Digital said in a research note on Monday.

An ETF could be a better investment vehicle for investors compared to currently offered products, such as trusts and futures, which hold over $21 billion in value, the fund said. The inflows could ramp up by $27 billion by the second year and $39 billion by the third year, it added.

“The U.S. wealth management industry will likely be the most addressable and direct market that would have the most net new accessibility from an approved Bitcoin ETF,” the note read. “As of October 2023, assets managed by broker-dealers ($27 trillion), banks ($11 trillion) and RIAs ($9 trillion) collectively totaled $48.3 trillion.”

Bitcoin spot ETF products could enable investors to obtain bitcoin exposure through a highly regulated list of partners, mainly traditional funds and banks with a history of strong customer protection and investment offerings.

And the demand is arguably outsized: A rumor last week sent bitcoin prices rocketing 10% within hours, while the discovery of the ticker BlackRock’s (BLK) proposed bitcoin ETF caused gains of 12% on Monday.

As such, Galaxy said the inflows could aid a 74% jump in bitcoin prices in the first year, considering liquidity and price impact of billions of dollars in investments.

Current products lacking

Galaxy said current investment products come with significant drawbacks for investors – such as high fees, low liquidity, and tracking error, these products are inaccessible to a wide investor population representing a significant portion of wealth.

A spot ETF, however, could be suited for any investor who wants direct exposure to bitcoin without having to own and manage the bitcoin through self-custody.

“Greater efficiencies through fees, liquidity, and price tracking,” the note said. “While fees haven’t been listed by bitcoin ETF applicants yet, ETFs generally offer lower fees compared to hedge funds or closed-end funds, and the high number of ETF applicants will likely aim to keep fees low to remain competitive.”

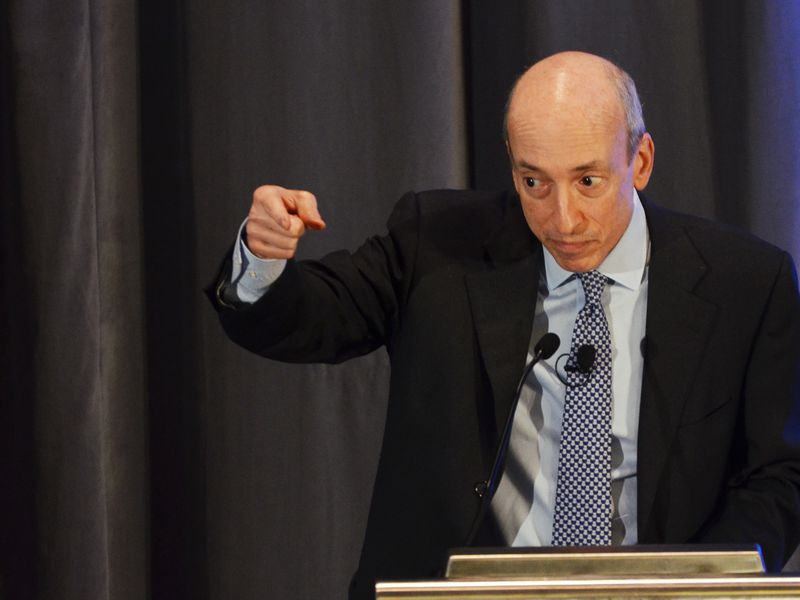

There are currently 12 spo bitcoin ETFs in consideration by the U.S. Securities and Exchange Commission (SEC). The applications are from Grayscale, 21Shares & Ark, BlackRock, Bitwise, VanEck, WisdomTree (WT), Invesco (IVZ), Galaxy, Fidelity, Valkyrie, Global X, Hashdex and Franklin.

Edited by Parikshit Mishra.