Bitcoin Spot ETFs Approval Partially Priced In, Coinbase Says

-

Approval of the highly-anticipated spot-based bitcoin exchange-traded funds (ETFs) is partially priced in, Coinbase Institutional’s David Duong Argues.

-

The expected deluge of money into the spot-based ETFs will likely happen overtime.

In financial markets, a particular asset often stands out on the back of unconfirmed good news, while the broader market suffers due to adverse macroeconomic developments.

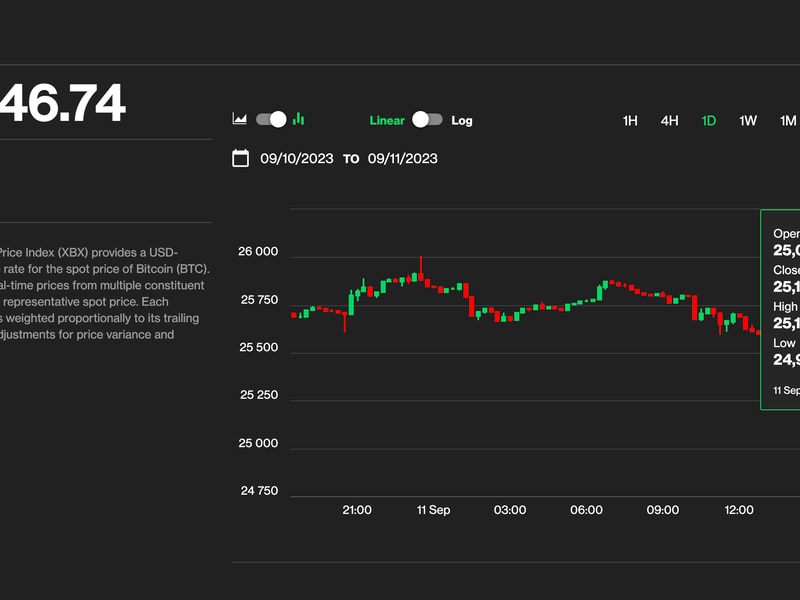

That’s precisely what has happened in the crypto market in recent months. Bitcoin (BTC) has outperformed other cryptocurrencies amid macroeconomic uncertainty, partially due to traders pricing a potential approval of spot-based exchange-traded funds (ETFs), according to Coinbase Institutional.

“We think the divergence in the performance of bitcoin and other tokens shows that the potential approval of one or more spot bitcoin ETPs has already been partially priced in. That makes it less clear how much more bitcoin could outperform if a favorable U.S. Securities and Exchange Commission (SEC) decision occurs,” David Duong, head of institutional research at Coinbase Institutional, said in the latest monthly report sent to subscribers on Thursday.

Since BlackRock (BLK) and other traditional finance heavyweights filed for spot-based BTC ETFs in mid-June, bitcoin has gained 8%. At the same time, ether, the second-largest cryptocurrency by market value and leader for alternative cryptocurrencies, has lost 7.5%, CoinDesk data show.

Bitcoin, a macro asset, outperformed the wider crypto market despite untoward developments in the term structure of the U.S. Treasury yield curve since mid-June, a sign other factors, including ETF expectations, have been at play in the BTC market.

The cryptocurrency rose even as the spread between yields on the 10-year and three-month notes ((3m10y slope) has increased (re-steepened) by nearly 70 basis points to -0.8% since mid-June as opposed to ether, which declined, retaining the inverse relationship with the Treasury yield curve’s term structure.

“Crypto prices have had an inverse relationship with changes in the term structure of the U.S. Treasury yield curve since mid-1Q23. But the strength of that relationship is very different for BTC (vs. the U.S. 3m10y slope) compared to ETH (vs the U.S. 3m10y slope),” Duong said.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4ZNPS4NG3JAQPBTQE54TTJZWGA.png)

The 90-day correlation coefficient between bitcoin and the aforementioned yield spread is 0.45, “a relatively weak linear relationship between bitcoin and the recent steepening in the yield curve,” according to Duong. Meanwhile, ether shows a strong inverse relationship with a correlation coefficient of 0.76.

“This deviation started to emerge in mid-June, around the time of multiple spot bitcoin exchange-traded product ETP filings in the U.S.,” Duong said.

The crypto market has waited for a spot-based bitcoin ETF for years in hopes that it would open floodgates for mainstream money. According to NYDIG, bitcoin spot-based ETFs could bring $30 billion in new demand for the world’s largest digital asset.

BTC outlook

Going by Coinbase’s analysis, bitcoin may lose its edge over the broader market for some time once the spot-based ETF is approved. We have seen this happen following the launch of the futures-based ETFs in October 2021.

“That [pricing of spot ETF) makes it less clear how much more bitcoin could outperform if a favorable U.S. Securities and Exchange Commission SEC decision occurs. That is, in the event of one or more approvals, we believe there could be meaningful net inflows, but these may take time to materialize while markets tend to be impatient,” Duong said.

That was the case with the SPDR Gold Shares ETF (GLD), the first spot gold ETF in the U.S., which debuted 19 years ago and currently has over $50 billion in assets. Bitcoin propounders consider the cryptocurrency as digital gold.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/6FA3SZ5BHNAHTBOSTJAKYH2QPA.png)

Per Duong, GLD drew just $1.9 billion in inflation-adjusted terms in the first 30 days from the launch, with the tally rising to $4.8 billion by the end of the first 12 months.

Duong, however, maintained that the impact of the potential launch of spot-based ETFs would go beyond flows, signaling a “tacit shift” in the regulatory environment, which could bode well for market valuations.

Edited by Parikshit Mishra.