Bitcoin: Solving The Elusive Monetary Problem

This deep dive explores what problems plague our modern monies, and how bitcoin cures these issues.

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” -Abraham Lincoln

To understand the implications of a paradigm changing technology, one must intimately understand the problem that is being addressed. If we do not understand the problem at a granular level, how can we ever determine what may be a suitable solution? Bitcoin has been obtuse to many, the reason being that most simply do not understand the problem of money; if you are one of these people, don’t be hard on yourself — very few do understand. With this writing, the aim is to help the novice learner become familiar with our current problem of money. Once the problem is understood, the solution becomes obvious. When speaking to radical disruption, humans have a hard time adapting to a new reality. This is not only due to fear of change, but more so, we are psychologically conditioned to our environment — we cannot see that something is broken when it is all we have ever known.

“If I had asked people what they wanted, they would have said faster horses.” — Henry Ford

Everyone that is now a Bitcoin evangelist was once a Bitcoin skeptic — this rule applies with very few exceptions. Bitcoin is an excruciatingly complex system that requires a working knowledge of economics, computer science, open-source software, game theory, the global political landscape and investment strategy. Bitcoin is an open-source, globally distributed protocol for transferring and storing value; but, just as important, it has a vast technology stack being built out on top of the base protocol — drastically expanding Bitcoin use cases. Bitcoin can mean a wide variety of things to different people with different motivations and has a near infinite number of potential use cases. From this worldview, Bitcoin dominates without rival on three core applications:

- Finite and programmatic money supply issuance with no risk of debasement (inflation) — in essence, the wealth you own will not degrade over time.

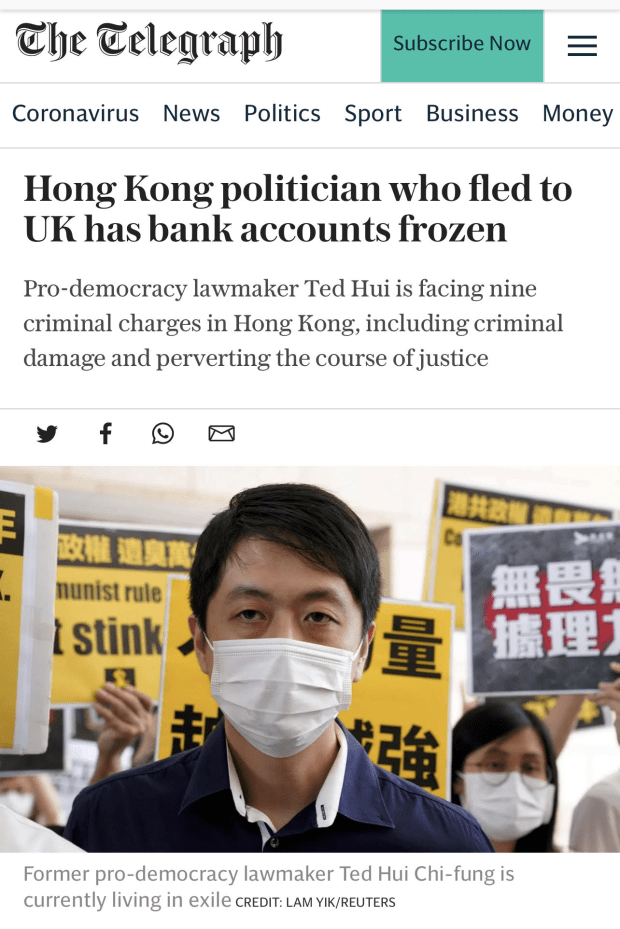

- Nearly unconfiscatable wealth. Globally, 4.2 billion people live under oppressive regimes and dictatorships that confiscate wealth from citizens either through force or capital controls — these citizens do not have the option to leave as their bank accounts will be frozen.

- Uncensorable speech in the form of money. Around the world, authoritarians use banking and money as a primary tool to silence their opposition through freezing accounts and prohibiting funding. This inability to fund an oppositional voice can lead to drastic imbalances of power, in which the prevailing regimes can commit unilateral atrocities against their citizenry.

In my view, these three applications are critical to Bitcoin’s success, and the expanding universe of subsequent applications are icing on the proverbial cake. Many newcomers to Bitcoin, believe these three use cases of Bitcoin to be unimportant or a “solution in search of a problem.” Which is understandable as it is common to look at things through the lens of Western democracy. Economics, central banking and money are very boring concepts to most. People are busy raising families, advancing careers and trying to make ends meet — we trust that “experts” have these things figured out. We don’t have time in our busy lives to dig into quantitative easing, interest rate policy, RePo markets, currency game theory among competing nations, the rationale for negative yielding bonds, why economic inequality has become so staggering, and how everything has become “so damn expensive?” Bitcoin can and is a solution to many of these topics; however, we will never understand why Bitcoin until we understand the underlying problem it solves. As Abraham Lincoln said, “If you give me six hours to chop down a tree, I will spend the first four sharpening the axe.” Just as sharpening the axe is key to chopping down the tree, understanding the problem is key to Bitcoin enlightenment. Let’s work to understand the problem, time to sharpen the axe.

What Is Money

It could be argued that money is the most important technology of any society. It quite literally represents half of every transaction that occurs within a society. Despite our daily use of money and how it controls our lives in many ways, we collectively have a very poor understanding of what gives money value. In short, money should simply be an abstraction of value that frees us from the inconvenience of barter — or easier said, a ledger of who owns what.

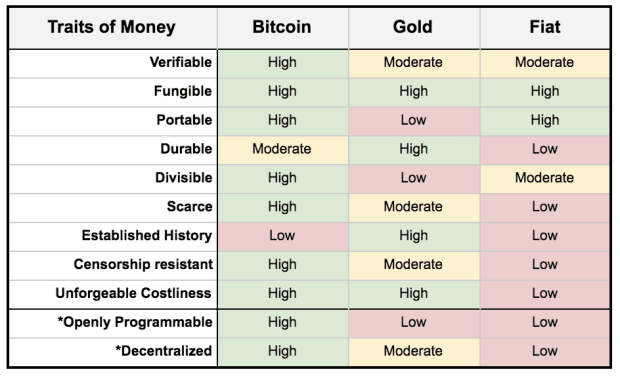

The below list are the defining characteristics that make up for a stable and dependable monetary good:

I will spare the reader the laborious task of going through each of these characteristics in great detail; but I will instead focus on the key deficits in our current monetary system and how the Bitcoin protocol fixes them. We must first have an elementary understanding of monetary history and how we got to the precarious precipice we find ourselves in today.

A common resounding artifact of any culture is the type of money that each culture utilized. Money, in many cultures, started out as beads, feathers and other rare artifacts. These systems of money didn’t work well primarily due to the fact the monetary good was not fungible. To illustrate this lack of fungibility would be the example of seashells used in many cultures. No seashell is exactly the same as any other seashell in terms of size, shape, aesthetic appeal and condition. With these disparities, it led to a lack of fungibility and the buyer and seller had to resort to negotiation of the value of the particular seashell in question — making pricing difficult. Another key component, and arguably the most important of all currencies, is scarcity. We cannot use rocks as currency evidenced by supply being near infinite; no rational economic person will trade finite goods and services for an infinite amount of money. As Andreas Antonopoulous points out, “One can look at archaeological dig sites, in which mountain civilizations used seashells as currency because it comes from the coast, and coastal communities utilized quartz as currency because it comes from the mountains — as long as this resource is not naturally occurring where you live, it has the potential to be a good money.”

In 600 BC, a major breakthrough was reached to solve this issue of fungibility, scarcity and, in many instances, portability. Portability is the ease at which a monetary good is transacted throughout space. The minting of rare metal coins became the solution to a lot of challenges plaguing early monetary systems.

Gold and silver have served as sound money for millennia and their track record is undeniable. If you had one Roman denarius coin, it was exactly equal in value to any other Roman denarius coin, solving the fungibility issue. Coins were small enough that they were fairly portable (albeit with risk of theft), but it did drastically improve upon the portability of previous barter systems; one didn’t have to bring a flock of chickens or a cow with you wherever you went to settle a transaction. Lastly, precious metal-minted coins solved the fundamental problem of scarcity. Gold and silver are a finite resource on our planet, despite our most ardent attempts to extract more, it remains a finite quantity. The entire quantity of all gold mined in human history would only fill four Olympic-sized swimming pools; it is one of the rarest resources on our planet. Gold being so scarce by nature gives it outstanding salability through time. Salability through time refers to the ability of a monetary good to retain its value through time. The above Roman coins have a higher value today than they did when they were first minted — gold and silver have outstanding salability through time.

Gold and Silver drastically improved early economic systems but were not without their own limitations. In respect to gold,the yellow metal is not easily divisible, if you were to pay for lunch with gold it would be cumbersome to break off a piece of a gold bar that would be commensurate with any low value transaction. Divisibility is a major drawback to any precious metal. The biggest drawback to gold, however, is that it is a physical bearer asset which can be easily stolen or confiscated. A bearer asset means that if a gold “token” is in your possession, you, by default, own it. These shortcomings of theft, portability and divisibility led to our global societies moving from physical bearer tokens (gold coins) to ledgers.

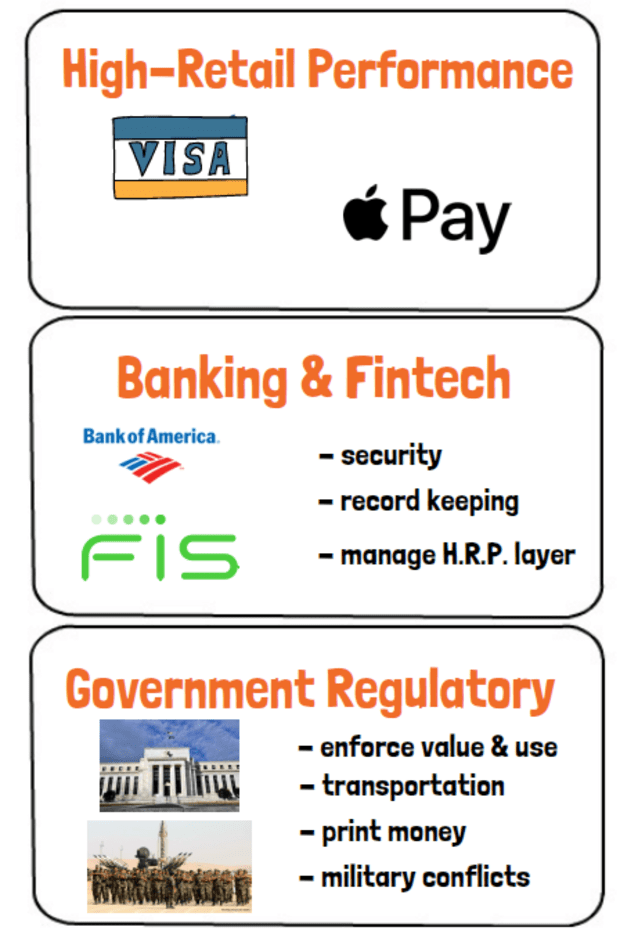

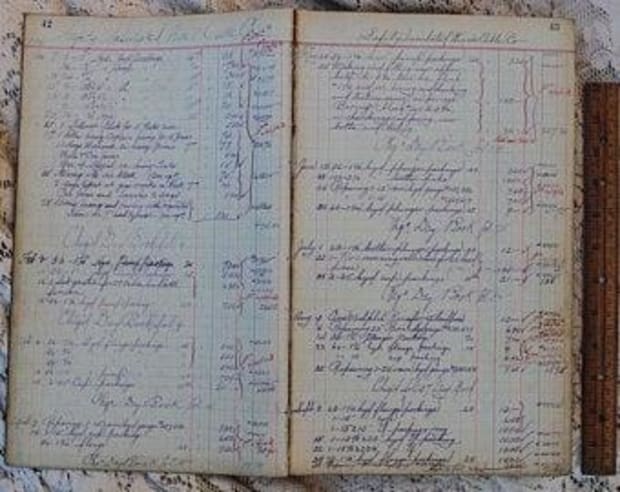

Centralized ledgers (banking) have the benefit of mitigating theft (storing wealth in a bank is more secure than your home), and it helps rectify the divisibility issue of gold coins. To solve these two issues, governments created gold certificate dollars (essentially an IOU). The idea was to keep gold in a central vault and issue the depositor a certificate that is directly redeemable for gold in direct proportion to the certificate (or dollar). If you were to deposit one ounce of gold, you would receive gold certificate “dollars” in direct proportion to your gold deposit. These paper certificates could be used to easily spend, as they were more divisible and exhibited less risk of theft — the best of both worlds! We now had money that was divisible (came in a wide variety of denominations), fungible and backed by a scarce resource (gold). This became a centralized ledger system, as we now relied on the banks to keep a ledger of what is owned. There is one glaring problem with centralized ledgers: You place all your trust in that party maintaining that ledger not to debase the “certificates” (dollars) and to keep the scarce resource (gold) that is backing the currency in direct proportion to the certificates outstanding. Sadly, this trust has been catastrophically compromised in every single example of central banking.

The above picture on the top is an early American five dollar bill. It very clearly states “Redeemable for 5 dollars of Gold Coin.” Do you notice anything different from our current $5 dollar bill? It now says “Federal Reserve Note” — this is no longer redeemable for gold. Our money is now just a piece of paper and has been since 1971 when the United States diverged from the gold standard. Scarcity, the most important characteristic of money, is now directly in control of the United States Federal Reserve (which is neither federal nor has any reserves — a conversation for another day). Gold has maintained a 2,500-year track record of keeping money valuable due to its strictly limited supply in the earth. No one, regardless of how powerful or influential, can create more. By moving to paper money, backed by nothing, we now trust one body of bureaucrats to keep our money scarce — to say they are failing at that may be the understatement of the century.

“Your ATM is safe. Your banks are safe. There’s enough cash in the financial system and there’s an infinite amount of cash in the Federal Reserve.” — Neel Kashkari, Minneapolis Federal Reserve President

“Paper money eventually returns to its intrinsic value: zero.” — Voltaire

Inflation and Wealth Destruction

It has become increasingly common to hear statements along this line of thinking: “$24 for lunch? Everything is getting so expensive! Health care, housing, insurance, education for my kids, I can barely afford to live!” To this end, it begs one very simple question: What is more likely, every good and service you are consuming is inexplicably becoming more expensive; or, is the one common denominator in all these things (money) becoming worth less? Think on this question for a moment. How could it be that nearly every good or service is becoming less affordable? Given the massive advancements in computing, engineering, automation and manufacturing throughout the last 30 years, shouldn’t things become less expensive, not more expensive?

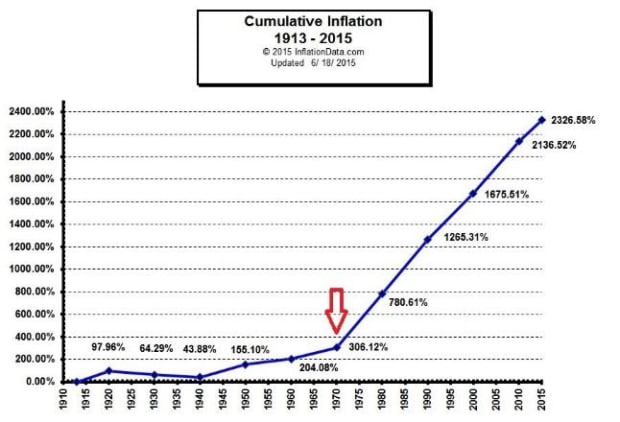

The truth is the wealth you’ve accrued in state-issued currency is losing its value every single year. Every single year. A baseline definition of inflation may be a phenomena in which general price levels rise, and each unit of currency buys fewer goods and services. Inflation is a monetary phenomenon, not a price phenomenon. Prices go up because inflation is happening, not the other way around. If you have $1,000 today and let it sit in a checking account, next year you may only be able to purchase $950 worth of goods and services, and this loss is compounding every single year. The even more unfortunate news is that this devaluation is rapidly accelerating (losing value faster and faster). To give a simple analogy, let’s say you are a wheat farmer and the wheat market has been very profitable for you. Last season, all competing wheat farmers’ crops were destroyed by a flood; but, you alone had no losses and had a great harvest. You made a fortune due to the fact you could charge such a high price being the only game in town for wheat — we chubby Americans are willing to pay a lot more to make sure we get some wheat for our cakes. Let’s say the next year, for some inexplicable reason, wheat starts growing naturally, everywhere. Wheat is growing in people’s yards, to the point it becomes a noxious weed — wheat “ery’where.” The wheat market becomes saturated, as the supply is now ubiquitous. Your wheat now becomes worth nothing as the supply has exploded. This same phenomena is happening with our money, its paper — with infinite quantity.

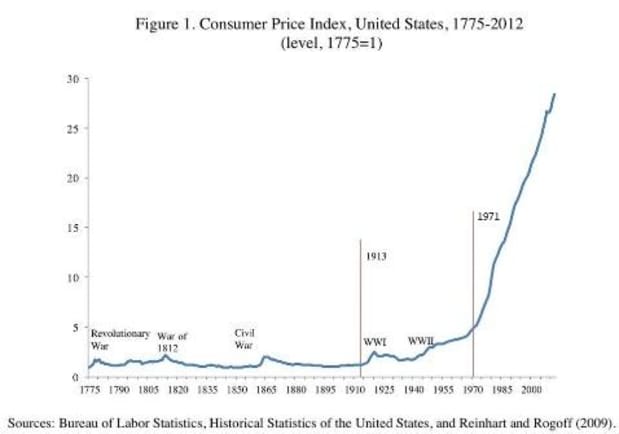

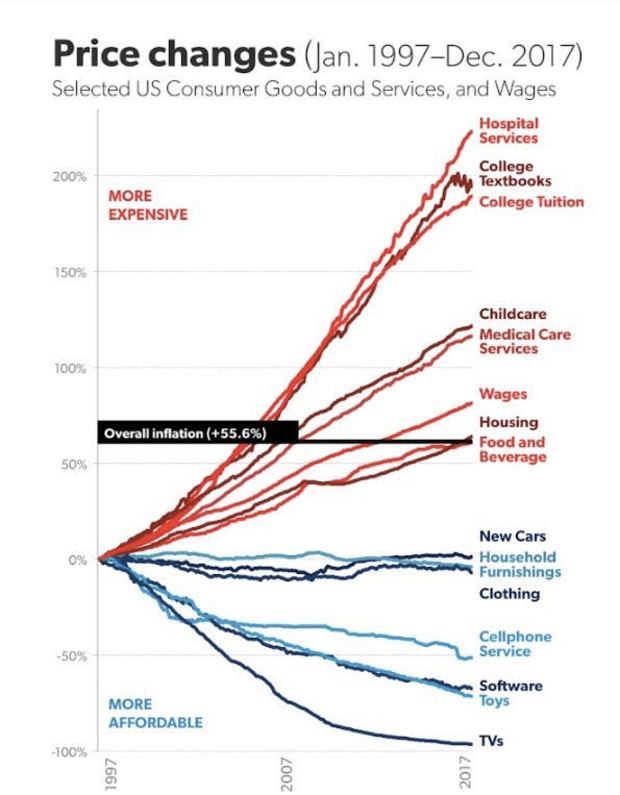

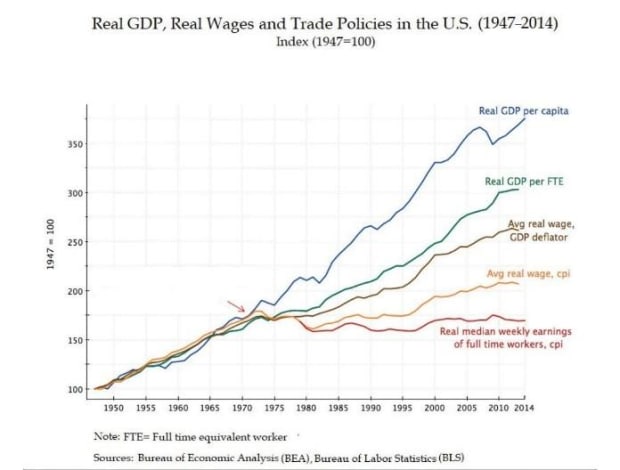

It doesn’t require a PhD statistician to look at the above graph to recognize the inflection point that set off accelerating inflation. When we removed the scarce component (gold) from the dollar, it enabled printing of “infinite paper” and massive inflation ensued. This is a perpetual “get out of jail free card” for governments, as they can now just print money to meet expenditures without having to collect revenue through the arduous and contentious task of raising people’s taxes. You are being taxed, just in a different way; you are being taxed through the loss of your savings. As you can see below, this money printing trend is accelerating:

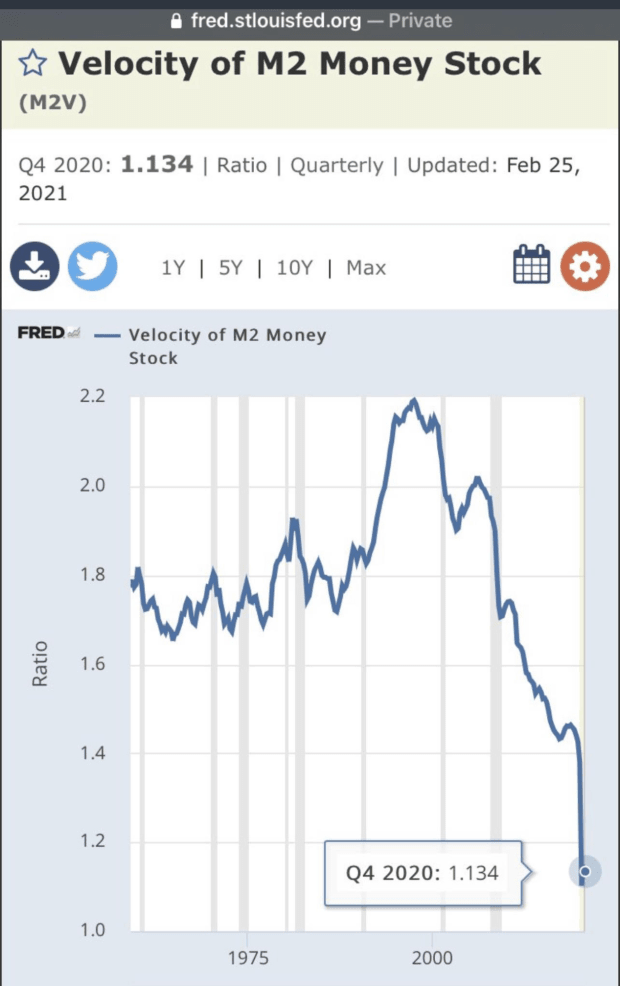

As you can see from the graph on the left, if you are holding your wealth in dollars or any other paper currency, your lifelong accrued “monetary energy” is getting diluted away and quickly. Bigger problems begin to occur when the velocity of money slows down. Velocity refers to the number of times that a unit of currency is used to purchase goods or services within a given time period. To maintain purchasing power, informed individuals have been putting their dollars into scarce assets to protect themselves. To name a few of these “flight to safety assets,” fine art, equities, real estate, precious metals and bitcoin have become favorites. A rational human has no choice; you must move your assets into a vehicle that cannot be diluted through the *theft* of time. In other words, we need a monetary good that is salable through time and that requires scarcity.

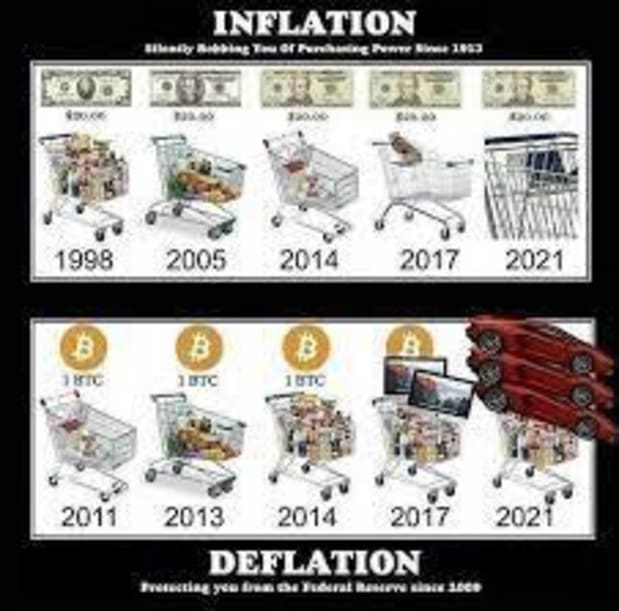

Memes can speak a thousand words:

A Critique Of CPI

The Bureau of Labor reports inflation statistics to the public using a metric called CPI — or the consumer price index. To arrive at a monthly CPI, the U.S. Department of Labor takes a weighted average of prices of various things that consumers purchase and claims to find the various proportions of different items in a typical household budget. In essence, they get to handpick what they include in this market basket of goods. A common criticism lies in the weighted average of goods they include in this basket. What is arguably underrepresented are assets. Home prices, education, equities, health care, vehicles and services to name a few. In many ways, this is analogous to a teacher telling a student to go home every month, study, take the test and just report back with the results. How do you think that report will come back? Perhaps they may come back with the yearly report of achieving 2% inflation? If you look at home prices in your area, your education expenses, how many hours needed to work to buy one share in the S&P 500 index, would you say this has been appreciating at more or less than 2%? You don’t have to know anything about economics to understand this fallacy.

Common consumer goods are, for the most part, inherently deflationary (the price naturally comes down over time); the advancements in manufacturing, automation, software, machine learning and efficiencies in supply chains make this a reality. Digital goods (Netflix subscriptions, software, etc.) are also inherently deflationary as the variable cost to produce more is essentially zero. If a company creates software, the cost to create additional copies is near zero. The only marginal cost of additional copies is the customer service aspect.

In short, electronic, technological and digital goods are inherently deflationary. It is commonly argued these things are far overweight when calculating CPI, leaving for a distorted view of reality, and, to this end, I very much agree.

A germane topic to address is that inflation is a global problem. There are seven billion people living with inflation that is even more pernicious than the United States, with hundreds of millions of global citizens experiencing hyperinflation. In 2018, for example, Venezuela experienced inflation of 130,060% — this is a population of 28 million people who have lost everything. Inflation is a humanitarian crisis.

Publicly traded companies like Tesla, Microstrategy and Square, to name but a few, have been converting cash on their corporate balance sheets to bitcoin in an effort to preserve their “economic battery.” In the background of this, bitcoin reached $1 trillion dollar market capitalization, making it the fastest moving asset in the history of humankind to reach $1 trillion.

“Cash is no longer an asset for any company, it’s a liability — it is a melting ice cube.” — Michael Saylor, CEO of Microstrategy

“In retrospect, it was inevitable.” — Elon Musk, after moving a portion of the Tesla balance sheet to bitcoin

I know the inflation issue can seem dreary and dark, but the good news is we have brilliant sunlight in the form of Bitcoin. A global, voluntary system of money that no one controls — that no one can ever control. There will only ever be 21 million bitcoin, this is mathematically imposed — no one can change it. Currency units in this system are programmatically brought into existence, and the supply is easily auditable by every person in the world. Transparency in money, at last.

Wealth Inequality In The Fiat System

Wealth inequality is one of the most destabilizing factors in any society. This can be witnessed in the French Revolution where the bourgeoisie were met with guillotines in the street. If one were to look at our current distribution of wealth, it is demoralizing at best, along with modern U.S. politics. Our politicians and citizenry seem to talk past each other, finding common ground is a radical exception. It could be posited that part of the reason we cannot find common ground in our political sphere is that we cannot agree on a common problem. Using vague, commonly perceived generalities in addressing our national financial problems, one prevailing ideology tends to cast blame at immigrants and the welfare state, while the opposing ideology aims to blame anyone with financial success and is seen as demonizing productive citizens.

If we all worked to understand one of our most destabilizing issues (money) a little better, we may realize that we have more in common than we want to believe. Our current economic system creates perverse incentives and misallocation of capital; both sides of the argument are simply trying to navigate this broken economic system. The Titanic is sinking, team red and team blue are arguing how to best arrange the chairs on the deck. A very strong argument could be made that wealth inequality has more to do with a broken economic system than any policy issue. It would be naïve to contend that a broken system of money is the only factor contributing to inequality; however, this writing will go on to show it does contribute enormously to the problem. In Bitcoin, there is a very common ethos, “Don’t trust, Verify.” Please verify this hypothesis and data for yourself:

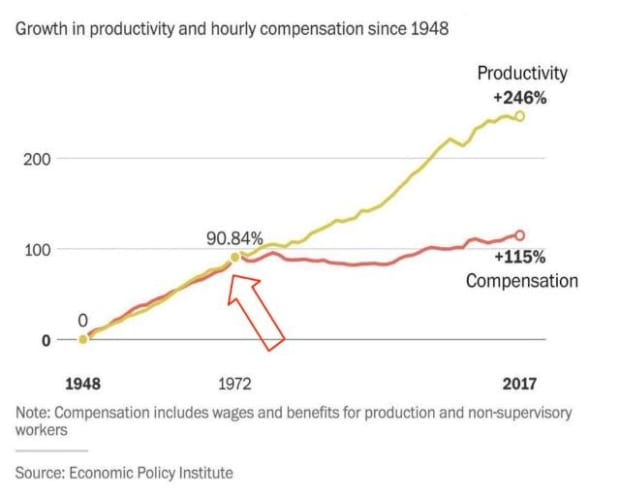

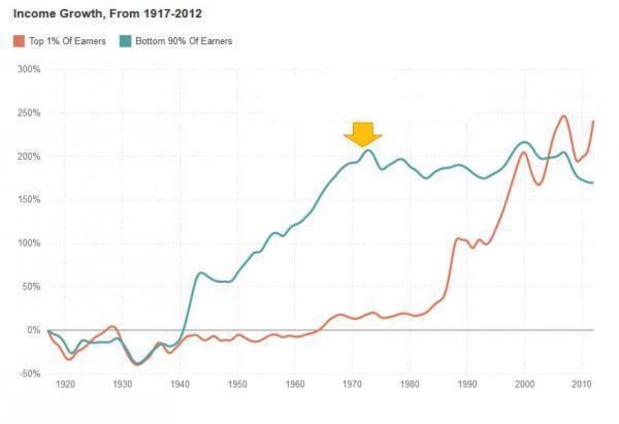

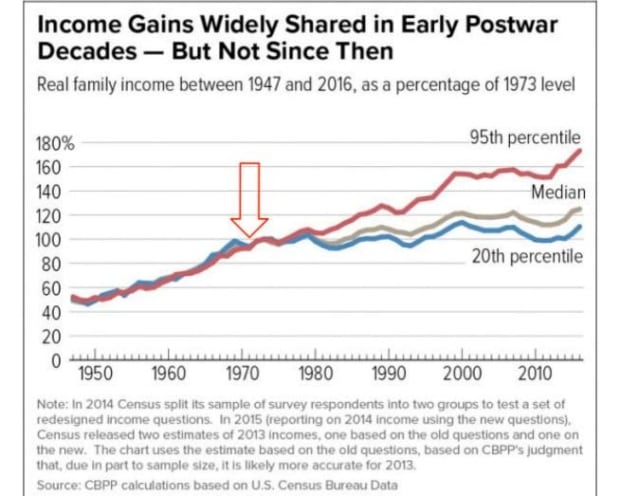

As you can see from the above graph (top), there was a violent divergence between gains in productivity and hourly wage earner’s share of that productivity growth after 1971. The graph on the right highlights the gains of the U.S. economy realized by the top 1% since moving to limitless paper money. This highlights the fact that capital markets have drastically outpaced wage earners. Simply put, wages do not keep up with inflation. Another way to look at it is, because you are a wage earner, you haven’t had excess capital to keep in the stock market and because of this you’ve missed out on all the inflation gains that have occurred in the stock market. Now, you have to pay for other inflated assets: housing, cars, health care, and so on, and your wages have been dismal in keeping up with the rising prices. Anyone in America feeling this? Hundreds of millions of Americans. Those who can afford to invest in assets see their wealth keep pace with inflation, with those who cannot afford to invest being left behind. The reality has led to the near complete eradication of the middle class, leaving us with two economic classes: the wealthy and the poor.

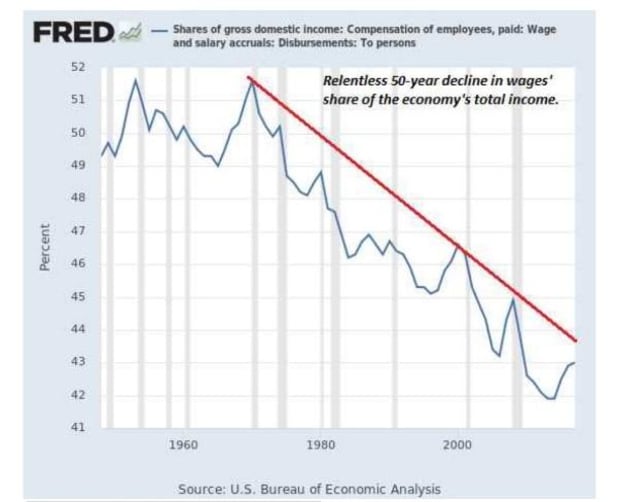

Income gains for the median and lower percentile have clearly been outpaced by the upper class since moving to strictly paper money. The graph on the right is a very compelling representation of the impressive growth in real GDP per citizen but also sadly depicting those gains are not being shared by a large part of the population. To explain the wealth gap, this idea can be further supported by the below graph demonstrating the decline in wages share of the economy’s total income.

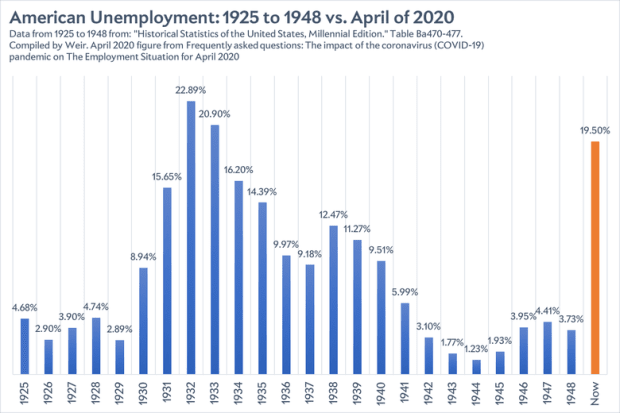

You may ask, “How does paper money contribute to this problem?” To answer that, we need to understand how the government injects liquidity (money) into the market. Economists use all kinds of esoteric terms: quantitative easing, rehypothecation, interest rate targeting, and a universe of convoluted terms and concepts the average person doesn’t have time to concern themselves with (I don’t blame you). In short, the problem lies in using money as a political tool. I subscribe to the belief that neither central bankers nor politicians have a nefarious agenda when it comes to economic management, they simply want to appear successful during their time in office. We all know the most commonly referred to indicator of U.S. financial success in a given year — the performance of the stock market, albeit to be painfully naïve. No single variable has a stronger influence on the American stock markets than the Central Bank policy and this is not even up for debate. If you are skeptical about this point, that is to be expected; however, I implore you to ask yourself one question: In 2020, during the greatest public health crisis we have seen in three generations, with nearly the highest unemployment rate in the history of the United States, how was the stock market still reaching all-time highs? Ponder that for a moment; take your time.

As you can see, unemployment reached levels just below the Great Depression, with the stock market (S&P 500 index) reaching all-time highs, or a 16% return during one of the highest periods of unemployment. In the entire history of the United States, it is estimated that 22% of the circulating US dollar was printed in 2020 — from 1776 to 2020, 22% of the money was printed in a single year.

“Stocks only go up.” — Dave Portnoy, Barstool Sports

The skinny: Our markets are not free or even close to it, and they haven’t been for some time. Inequality happens as the government uses printed money to artificially stabilize stocks and other assets without allowing the free market to adjust them to a fair valuation based on economic circumstances. People with excess capital get wealthier as “stocks only go up”; however, this is being subsidized through rising asset prices at the real cost of the poor and middle class which, sadly now, may never afford a home.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.”— F.A. Hayek

We have reason to remain optimistic: Bitcoin is the sly roundabout way.

Money As A Tool Of Control: Censorship

“This is a world where you have billions of people whose bank accounts can potentially be frozen based on their opinions or ideas.” – Alex Gladstein

Cash has served as a primary means of peer-to-peer economic exchange for decades. Cash has advantages and disadvantages depending on your motivations. In many areas of the world, cash acts as a lifeline, as it can be used without surveillance, and transactions can be conducted privately. Cash can provide privacy and freedom of speech. Cash can also be used for illegal activity, and this is a universal favorite for illicit activity. One man’s privacy is another man’s illicit activity.

It has become very evident that the vast majority of transactions taking place are now digital, either through cards or web-based applications, with all of these digital applications of money being controlled by a central authority. Having a central ledger (banking) has given authoritarian governments the ability to surveil and censor money they don’t agree with. Governments around the world are working to eliminate cash from circulation and are moving to a purely digital concept. Before the conspiracy accusations are thrown around, below are a few of the thousands of headlines that have been taking place — this is no secret.

If you are a Russian dissident and maintain an opinion that is in opposition to Putin, you would prefer to support the opposition party anonymously out of fear of reprisal from the ruling regime. Putin’s regime has effectively silenced any challengers to his power through the use of several coercive tactics, including wealth confiscation. With opposition parties depleted of resources, Putin enjoys his nearly 17-year reign over Russia in a cozy echo chamber.

The Hong Kongese citizens have lived their entire lives espousing western ideals of individual freedom and democracy. Many are trying to flee the country with the impending tyrannical communist rule taking place, or at the very least, support the pro-democracy movement. In this scenario, with complete governmental control over banking, relocation becomes but a dream and democracy an idle prayer.

The list of instances in which money is being used as a tool for oppression globally is endless: Burma, Myanmar, Venezuela, North Korea and broad swathes of the Middle East. It is estimated that 4.2 billion human beings live under oppressive authoritarian governments.

Bitcoin is a censorship-resistant technology that enables human rights globally. Anyone with an internet connection can use Bitcoin. Bitcoin doesn’t care about your color, religion, political persuasion, sexual preference or value to society; Bitcoin recognizes human value. Bitcoin objectively facilitates the human-to-human exchange of value, purely independent of any other variables or factors.

Monopolies of any kind destroy societal value. Monopolies in industry stifle innovation and crush consumers. Monopolies in government stifle innovation and crush citizens. Bitcoin provides citizens a tool to exit a nation state that no longer services them. With Bitcoin, one becomes a global citizen, able to access their wealth anywhere in the world with an internet connection. The idea is that Bitcoin creates competition to monopolized money, so governments will have to treat their citizens like a valued customer again.

Bitcoin Fixes This

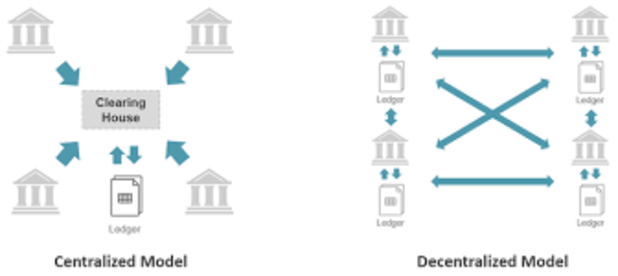

A common phrase in Bitcoin circles you’ll often hear is “Bitcoin Fixes this,” which is applied to a myriad of issues. For the scope of this writing, I would like to describe how Bitcoin fixes the problem of centralized ledgers that have led to inflation, wealth inequality and censorship, as previously discussed.

We’ve discussed the benefits of money being managed by a centralized ledger to that of a physical money being improved in fungibility, divisibility and security from theft, albeit with the enormous drawback of trusting that this central party will not debase the currency you’ve chosen as the battery to store your life’s energy. Bitcoin fixes this.

Bitcoin is radically scarce. The Bitcoin protocol will only ever mine 21 million bitcoin into existence — this is mathematically imposed. This also cannot be changed, as Bitcoin relies on a globally distributed system of consensus in which no one can change the rules, including you. With Bitcoin, you can independently and authoritatively validate and verify that the monetary supply is adhering to the agreed-upon protocol rules; this is called running a node. A common lexicon of speech in Bitcoin circles is “Don’t Trust, Verify.” With Bitcoin, we verify the monetary system and ensure that regulations of the protocol are being enforced.

Bitcoin is infinitesimally divisible. One bitcoin is divisible into 100 million units, these units are called satoshis, or sats for short. As it stands right now, $1 dollar can purchase around 1,700 sats. The number of sats one dollar can buy you is coming down nearly every day, demonstrating the increasing purchasing power of bitcoin and the decreasing purchasing power of dollars. I fully envision a future $1 = 1 sat; I view that as inevitable.

Bitcoin is fungible. One bitcoin is the exact same quality as any other bitcoin in existence, the software you run can independently verify that it is real and is not a counterfeit. When I say “software you run” I am referring to a Bitcoin app you use on your phone. Don’t stress; this software will only become easier to run over time — you boomers. Nothing but love for my boomers.

Bitcoin is perfectly portable. Bitcoin is data, and you can move anywhere in the world simply by carrying a thumb drive or a memorized phrase of words to access your wealth.

Bitcoin is censorship resistant and confiscation resistant. If you take possession of your private Bitcoin keys, no one can access that wealth unless you give them permission. Bitcoin guarantees the scripts you run; if you choose to send money to someone no one can stop that transaction from happening. This enables cross border commerce with low friction and low latency.

Bitcoin is programmable money. The applications that can be built out on top of Bitcoin are endless; smart contracts, escrow, streaming money and immutable messaging applications are able to be built on top of this technology stack. Bitcoin is a decentralized immutable (unchangeable) database. If you paid attention to the most recent election, shouldn’t everyone be in favor of an immutable database no one can manipulate or be accused of manipulating? There would need to be no more accusation and no more defense. Bitcoin data cannot be tampered with. Most databases are a computational “etch a sketch, Bitcoin is computational amber” (Szabo). We will vote on Bitcoin someday.

Bitcoin is global money. The human rights issues we’ve analyzed from inflation, confiscation and censorship are a global phenomenon. Bitcoin is fighting to solve some of humanity’s biggest problems (whether everyone knows it or not) — join the fight.

“The internet is uncontrollable. And if the internet is uncontrollable, freedom will win. It’s as simple as that.” — Ai Weiwei, Chinese Dissident

JPK

For more resources on Bitcoin, I would urge you to visit this website.

I would like to thank Andreas Antonopoulous, Dan Held, WTF Happened in 1971, and the United States Federal Reserve for making it easy to dunk.

This is a guest post by John Paul Klaboe. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.