Bitcoin Soars Towards $17K as Historic Accumulation and Bottom Signal Flashes

Bitcoin’s price has surged toward $17K, charting an increase of 5% for the week and 2.5% for the day. This happens as an important historic sign flashes again and is usually the precursor for appropriate accumulation spots and cyclical bottoms.

- Increasing to a high of $17,162 (on Binance), Bitcoin’s price reached a 15-day high in a sudden surge earlier today.

- This also pushed the entire cryptocurrency market, and its capitalization added some $17 billion over the same period.

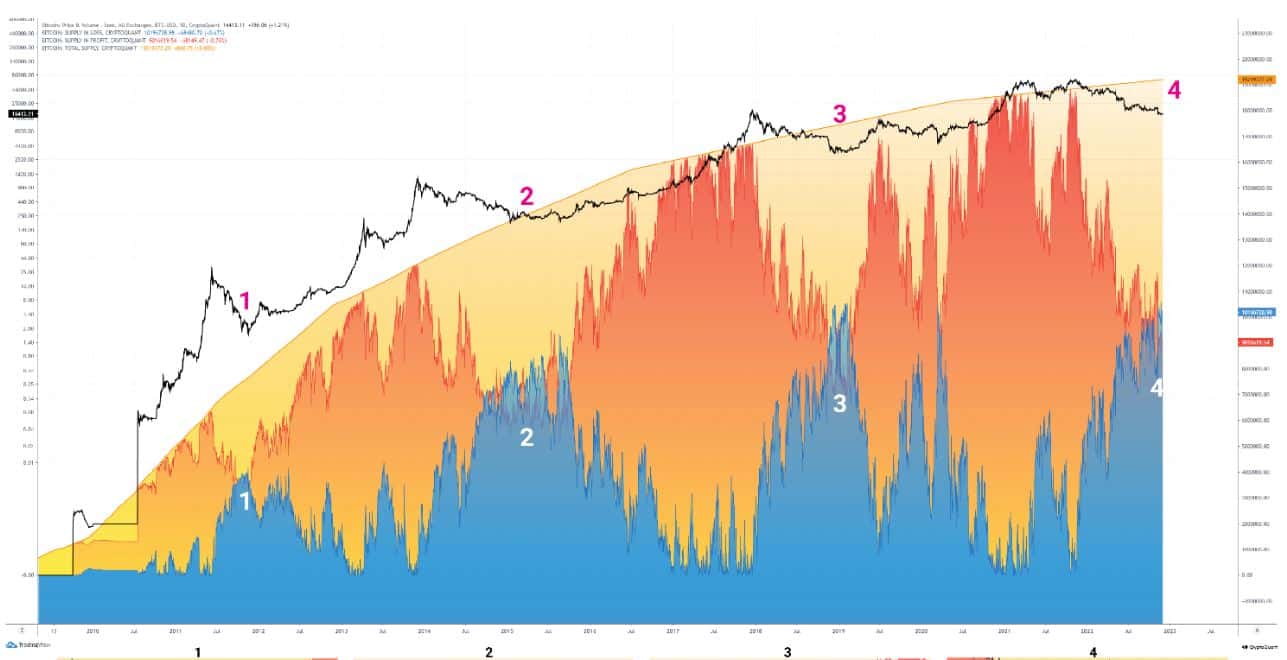

- An analyst from CryptoQuant pointed out that the market has reached a critical point where there’s an intersection between the supply in loss and the supply in profit – something that happens historically near cycle bottoms.

Over nearly 13 years, with four cycles, we have all noticed an area of intersection between supply in loss and profit every time the price is in the bottom zone. Even in the early stages, when Bitcoin was valued at only a few dollars, this are existed.

It seems that there is an equilibrium rule that has run for more than a decade.

- He pointed out that throughout the current bear market, “it was only when the price dropped to the current level” that he saw this intersection area pop out.

- The above led to the following conclusion:

The existence of this area will be long enough for the market to clam down after the hurt, and the price can go down a few more percent, but this is undoubtedly the best area to accumulate for a fresh start.

It is tough to target the lowest price, but it can be possible to realize where the bottom area is.

The post Bitcoin Soars Towards $17K as Historic Accumulation and Bottom Signal Flashes appeared first on CryptoPotato.