Bitcoin Soars in the New Year but Altcoins Dominate the Market: This Week’s Crypto Recap

It’s been an interesting week. While most of the cryptocurrencies are trading well in the green, the entirety of these gains happened after New Year’s Eve. In fact, the total market capitalization current sits at around $3.57 trillion, which is up by around $110 billion compared to the same time last week. And what is more, the majority of this comes from positive developments in the altcoins space.

Bitcoin is trading more or less flat on the week, currently sitting at $96,600 after a tumultuous price action throughout the past seven days. The bears were hoping to push it back below $90,000 after Christmas and, to be frank, they almost succeeded. The price dropped to a low close to $91,000 before the bulls finally decided to stand up and show some strength.

Once the new year arrived, the buyers stepped into the market and started pushing forward. BTC recovered to where it was trading before the Christmas shennanigans, which, for its part, propelled the entire market into positive territory.

Turning to altcoins, a lot of them had better time than Bitcoin, which is also reflected in the latter’s market dominance. It’s down by about 2 percent in the week that passed.

Some of the better performers include Ripple’s XRP, which increased by 11%, Solana (SOL) – up 13%, DOGE – up 14%, ADA – soared by 21%, and so forth. All in all, it’s been a good week for top-tier altcoins.

At the same time, though, the growing narrative around artificial intelligence has also helped coins focused on AI agents to explode as well. In just a few days, their total market capitalization surged by more than 25% and some experts are even arguing that they will be chipping away at the dominance of meme coins.

It’s interesting to see how the market will pan out in the coming days but if one thing is certain, it’s that volatility is like to ensue, given that Donald Trump is set to assume his position as the next US President on January 20th.

Market Data

Market Cap: $3.57T | 24H Vol: $132B | BTC Dominance: 53%

BTC: $97,000 (+0.6%) | ETH: $3,510 (+3.5% ) | XRP: $2.43 (+11%)

This Week’s Crypto Headlines You Can’t Miss

MicroStrategy Stock Down 36% From November High Despite Continued BTC Accumulation. CryptoPotato reported earlier this week that MicroStrategy’s shares had tumbled since their November peak by 36%. However, their price performance only worsened in the following days, going down to and even briefly below $300 as of Thursday’s closing bell.

Tether Expands Bitcoin Reserves by $700M Amidst FUD Over USDT’s Status in Europe. Tether faced some FUD at the end of the year due to the official start of the MiCa regulations in the European Union. However, the company’s CEO refuted the demise rumors while also indicating that the firm has continued to expand its BTC reserves by another $700 million transfer.

Investors Are Moving Their BTC Away From Exchanges, What Does This Mean? Bitcoin investors have moved their holdings off exchanges in big portions over the past several months. In fact, trading venues recently saw the lowest levels of deposits in years, while the withdrawals are on the rise. Such developments typically lead to price appreciation for the underlying asset.

These Price Levels Hold the Key to Bitcoin’s Resilience or Deeper Correction (Glassnode). BTC ended the year on the wrong foot, dumping to a monthly low of $91,300 on Monday before it managed to recover some ground. Glassnode used the opportunity to outline certain support zones of high importance that could help the asset in case of another correction. The company said that the level around $88,000 will be crucial if BTC heads south again.

US Investor Seller Pressure Drags Bitcoin Coinbase Premium Index to 12-Month Low: CryptoQuant. The US-based spot Bitcoin ETFs registered some painful net outflows at the end of the year, which showcased the overall investors’ sentiment toward the asset in the States. The Coinbase BTC Premium Index solidified the negative trend as it had dumped to a yearly low.

Terraform Labs Co-Founder Do Kwon Pleads Not Guilty in US Court. After a few appeals, Montenegro’s authorities ruled that Terraform Labs’ CEO, Do Kwon, has to be extradited to the US instead of South Korea. Almost immediately after landing, he pled not guilty to all the charges that he is facing in the States, including conspiracy to commit commodities fraud, wire, and securities, as well as money laundering.

Charts

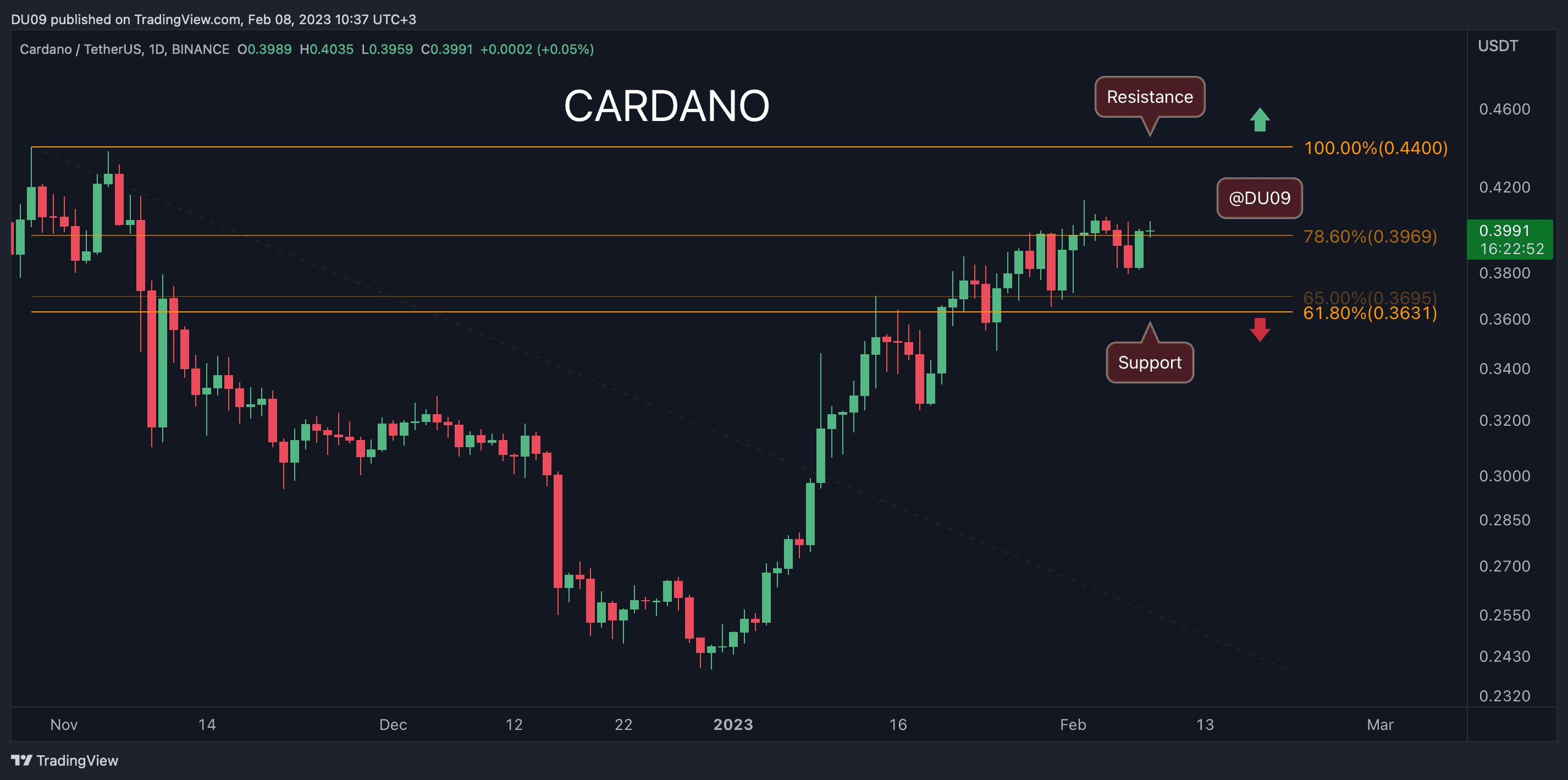

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Solana – click here for the complete price analysis.

The post Bitcoin Soars in the New Year but Altcoins Dominate the Market: This Week’s Crypto Recap appeared first on CryptoPotato.