Bitcoin Soars 12% Weekly, BCH Charts 25% Increase in a Day (Market Watch)

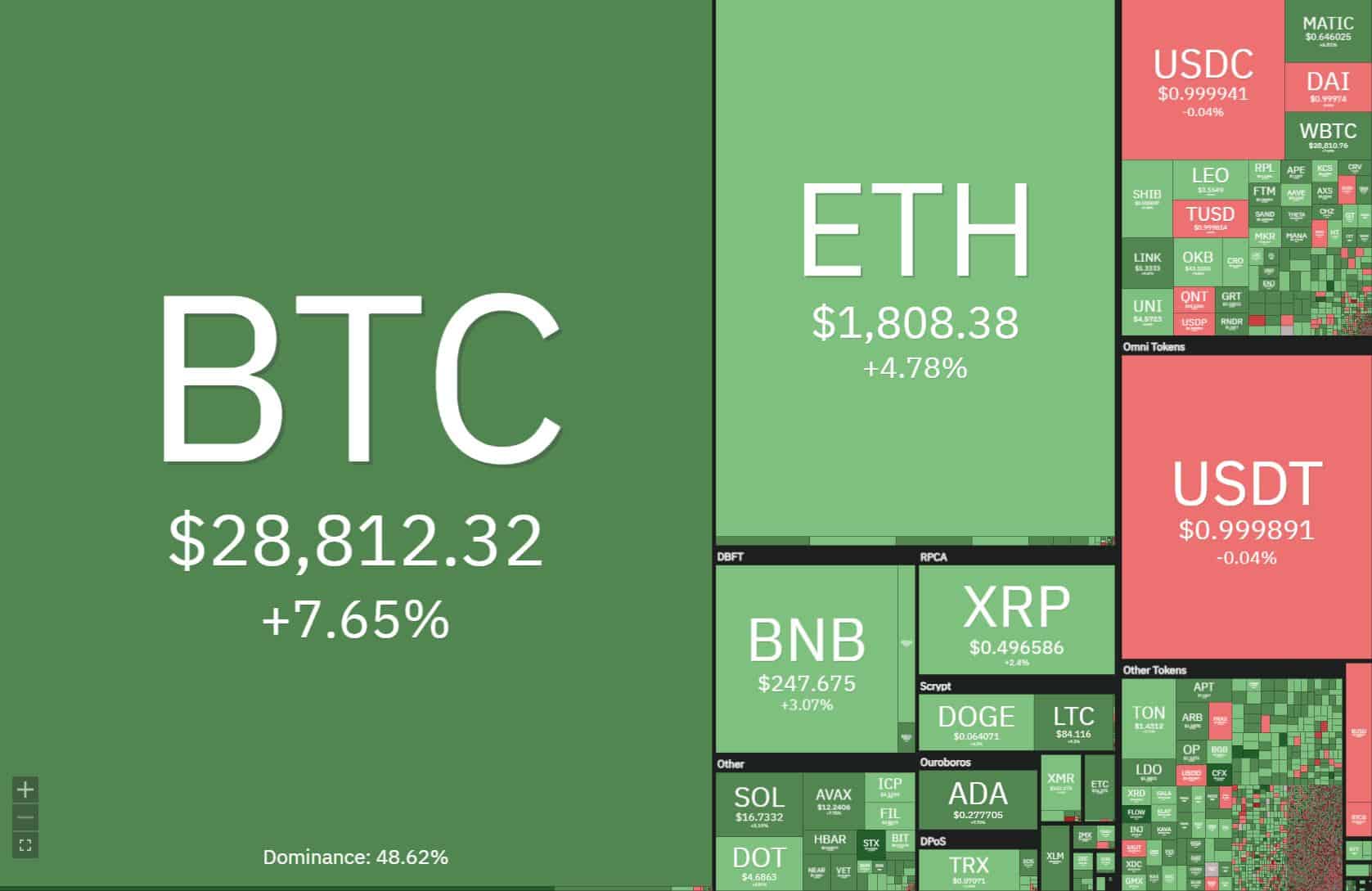

The past 24 hours saw the market turn green, with the majority of cryptocurrencies charting notable gains.

Some of the reasons for the surge could be the recently-filed BlackRock ETF application, followed by those of WisdomTree and Invesco, as well as the fact that the Wall Street-Backed cryptocurrency exchange EDX just went live.

Let’s dive in.

Bitcoin’s Price Soars to $29K

Following a brief period of stability and consolidation, market participants seem to have decided on a direction. Bitcoin’s price soared to $29K overnight in a few impressive green candles, as depicted on the chart below.

The price is currently trading at around $29,000, painting gains of around 7.8% in the past 24 hours alone. This brings up Bitcoin’s weekly increase to around 11.5%.

Interestingly enough, its dominance over the rest of the market has increased by around 2% in the same period. It indicates Bitcoin’s current strength and momentum, which is obviously stronger than most altcoins.

The reasons for this could be multiple. BlackRock, Invesco, and WisdomTree filed applications for spot Bitcoin ETFs with the SEC. EDX – a cryptocurrency exchange backed by Fidelity, Charles Schwab, and other Wall Street heavyweights, went live today.

Altcoins Slower, But Bitcoin Cash (BCH) Explodes

The altcoin market is slower to pick up Bitcoin’s gains, but there are some notable exceptions, the wildest of which is Bitcoin Cash (BCH). The cryptocurrency is up a whopping 25% through the day, making it the best performer on our list.

One reason for that could be that EDX (see above) will initially only trade BTC, LTC, ETH, and BCH.

In any case, this is how the market is currently looking like:

In general, the overall sentiment has shifted to be rather positive. There are very few cryptocurrencies, which failed to capitalize on today’s increase, but almost all of the top 100 are trading in the green.

The post Bitcoin Soars 12% Weekly, BCH Charts 25% Increase in a Day (Market Watch) appeared first on CryptoPotato.