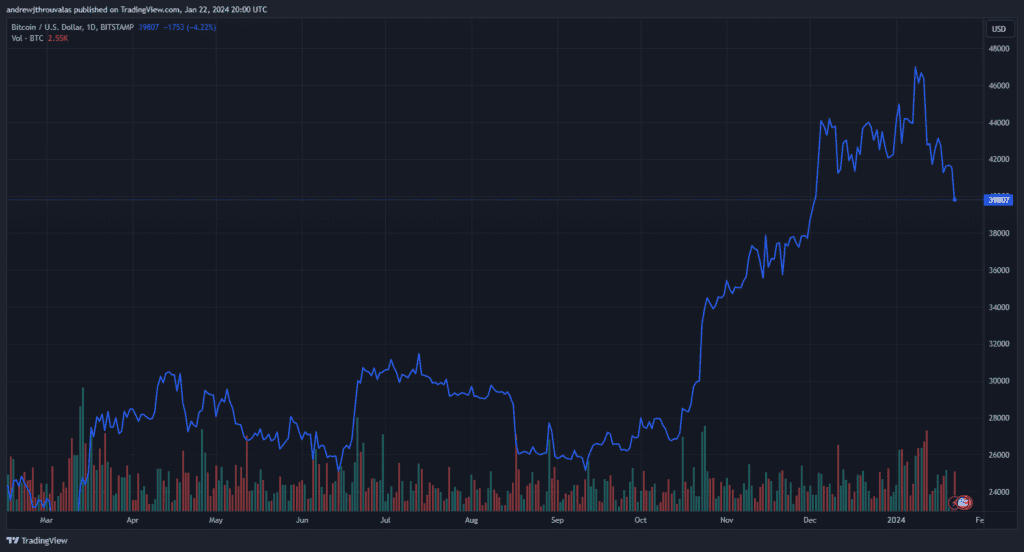

Bitcoin Slides Under $40,000 Triggering $230 Million In Liquidations

Bitcoin (BTC) fell under $40,000 on Monday for the first time since early December as a wave of ETF outflows pushed the asset into deeper waters.

Over the past 24 hours, over $236 million in trades have been liquidated, including $208 million worth of longs.

- Bitcoin trades for $39,504 at writing time – a price last seen for the asset on December 2 2023.

- According to Coinglass, Over 90,000 traders have been liquidated in the last 24 hours. The largest liquidation took place on Bybit on a $5 million BTC/USD trade.

- Bitcoin has trended downwards ever since Bitcoin spot ETFs were approved for trading on national securities exchanges on January 10.

- While new ETF products of amassed billions of dollars of inflows, their effect on the market has largely been counteracted by massive outflows from the Grayscale Bitcoin Trust (GBTC).

- Since converting into an ETF, GBTC’s share discount has been restored to parity with its underlying BTC holdings, creating major profits for some of its earlier buyers.

- Many of those buyers are now cashing out, which has led to Grayscale selling over $500 million of BTC per day as the fund redeems its shares.

The post Bitcoin Slides Under $40,000 Triggering $230 Million In Liquidations appeared first on CryptoPotato.