Bitcoin Slides Below $62K as Consolidation Drags on, but Traders Eye Possible Parabolic Rally

-

BTC is down 3% in the past 24 hours, with ETH, AVAX, LINK and UNI leading altcoin losses.

-

Bitcoin’s weekly Bollinger Bands compressed to similar levels seen not just last October, but in other episodes prior to big rallies, crypto trader CryptoCon noted.

-

Altcoin investors face more pain ahead, but Q4 and next year might promise more upside.

Bitcoin (BTC) tumbled below $62,000 during U.S. morning trading Tuesday as the crypto market halted its bounce from early August lows.

The largest crypto fell to as low as $61,500, now down more than 5% since its swift rally to $65,000 following Federal Reserve Chair Jerome Powell’s dovish speech at Jackson Hole on Friday. It’s down 3% through the past 24 hours.

The weak action spread to the wider market, with the broad-based CoinDesk 20 Index down 2.8% during the same period. Ethereum’s ether (ETH) continued its losing streak against BTC, falling more than 5% below $2,600 and dragging the ETH/BTC ratio to its lowest level in more than three years.

Altcoin majors also suffered losses, with the native cryptocurrencies of Avalanche (AVAX), Chainlink (LINK) and Uniswap (UNI) leading with 4%-7% declines.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MZFWUGJOGZAHPPEHNMZ6H4OUZU.png)

Volatility ahead

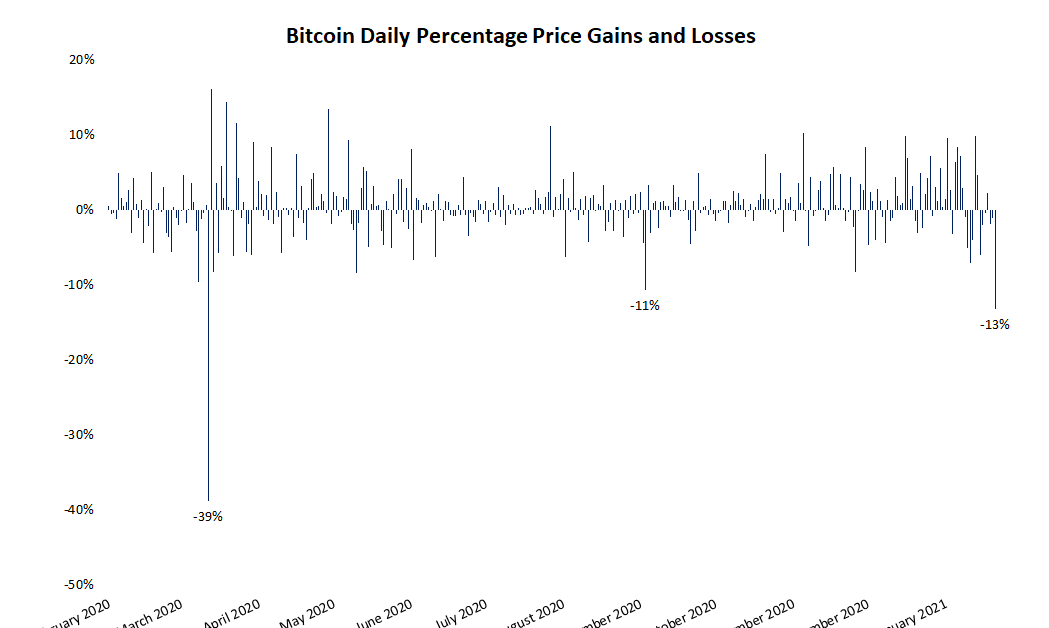

Bitcoin’s sideways actions since its March all-time highs is testing investor patience, but similar multi-month consolidation phases happened every previous bull cycle, including last year’s action between March and October.

Well-followed crypto trader CryptoCon noted that the current low-volatility phase for BTC is likely the precursor of a break-out to the upside to new all-time highs, based on an analysis of the Bollinger Band Width on the weekly timeframe.

Bollinger Bands, named after well-known traditional market technical analyst John Bollinger, represent the volatility of an asset and are placed two standard deviations above and below the 20-week simple moving average of the price.

“This is the 3rd and final low volatility phase that comes mid-cycle, every cycle on Weekly Bollinger Band Width,” CryptoCon said in an X post. “5 months of sideways price action is not new…,” he added. “Missing out on 2025 is missing out on 2021, 2017 and 2013.”

Notably, a similar compression of the Bollinger Band Width happened last October, just ahead of bitcoin breaking out of a long consolidation and eventually surging nearly 200% to $73,000 by March.

Altcoin pain

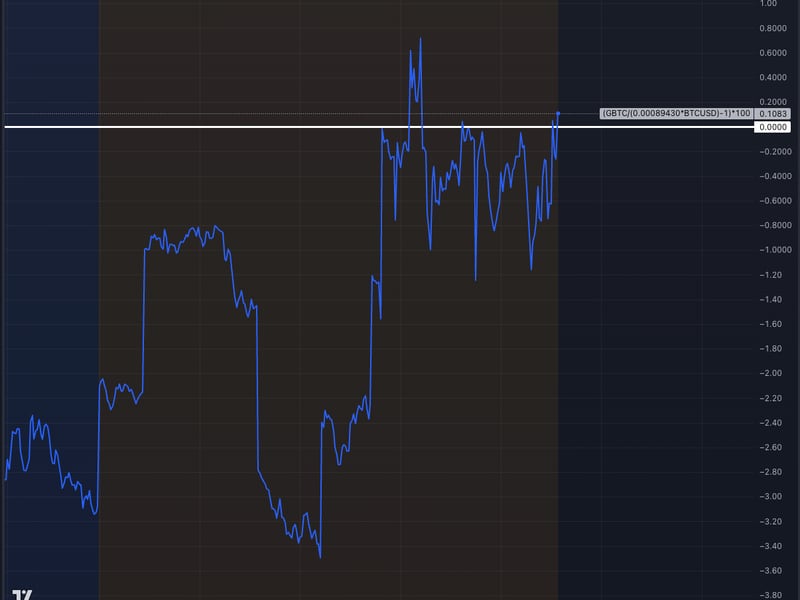

Altcoin holders might face some more pain before lower-cap cryptocurrencies would break out higher and outperform bitcoin, market research firm ByteTree pointed out in a Tuesday report.

“Altcoin investors need to keep the faith. It’s tough out there, but the underperformance of alts vs. bitcoin has been difficult,” Charlie Morris, founder of ByteTree, wrote in the report. “The good news is that positioning is light, and so when the good times return, there is the potential for yet another strong altcoin rally.”

During past market cycles, altcoins followed bitcoin’s rally six months after Bitcoin’s quadrennial halving, Morris noted.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XNHVQ7MBLFERVA32CJNOCQGWGU.png)

The last halving took place on April 19, 2024, which would point to a potential rally later this year around October.

“In each case, alts got a little worse before they got better,” Morris added. “If history repeats itself, alts should kick off in the new year, but only once Bitcoin has surged. The good news is that we are on track for a run in Q4.”

Edited by Stephen Alpher.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8b1395a8-12af-4705-9fe5-b862b248250d.png)