Bitcoin Slides Below $27K as Investors Eye Debt Ceiling Negotiations

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

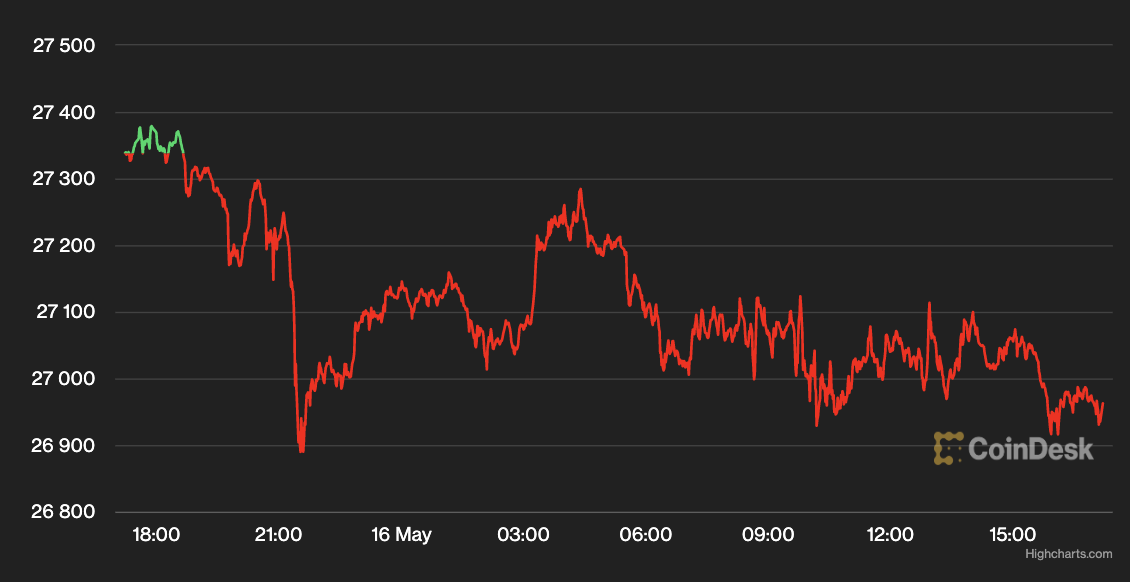

Bitcoin (BTC) continued its slightly downward consolidation on Tuesday, slipping just below $27,000 as investors kept close attention on the debt ceiling negotiations in Washington.

The largest cryptocurrency by market capitalization was recently trading at $26,950, down roughly 1.3% for the day, according to CoinDesk data. Over the past 24 hours, BTC’s price has been range-bound between $26,800-$27,400.

Bitcoin price chart showed that the cryptocurrency’s price hovered below $27,000 on Tuesday. (CoinDesk)

While Treasury Secretary Janet Yellen warned that the U.S. is projected to breach the debt limit as early as June 1 and said a default “could lead to a recession,” several analysts believe a resolution to the debt ceiling issue could potentially buoy bitcoin.

“The current macroeconomic situation is, in our view, conducive for increased crypto adoption,” Joe DiPasquale, CEO of crypto fund manager BitBull Capital, told CoinDesk in an email. “The debt ceiling getting raised also bodes well for risk assets as market participants seek to secure wealth,” he added.

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, told CoinDesk that there “could certainly be a bid for BTC” whether or not there’s a deal on the debt ceiling.

Outumuro sees the impact of these negotiations and the ongoing bank crisis as similar: “They both highlight the weaknesses of the system and create doubts about their long-term sustainability, thus creating demand for potential alternatives like crypto.”

Ether (ETH), the second-largest cryptocurrency by market capitalization, slid 0.2% on Tuesday to change hands around $1,820. Among other digital assets, LDO, the governance token for the liquid staking platform Lido, continued Monday’s strength to rise an additional 3%. Layer 2 blockchain Polygon’s native MATIC token dropped by 2.8% to hover around $0.82 cents.

The CoinDesk Market Index (CMI), which measures overall crypto market performance, was down 1.1% for the day.

Equity markets closed lower on Tuesday, with the Dow Jones Industrial Average (DJIA) sliding 1%, the S&P 500 down 0.6% and tech-heavy Nasdaq off by 0.2%.

In bond markets, the 2-year Treasury yield rose 6 basis points to 4.08%, while the 10-year Treasury yield was up 3 basis points to 3.54%.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.