Bitcoin Shows Stability As Experts Expect FED to Keep Rates Unchanged, While Bitcoin BSC Hits $1.75 Million Milestone

Bitcoin is showing remarkable stability despite the hot inflation figures from the CPI released this week.

The data showed that inflation exceeded expectations as the ‘sticky’ inflation narrative continues to loom, even with interest rates set at the 5.25% – 5.5% range.

However, with inflation rising and further rate hikes expected later this year, Bitcoin is showing resilience as it clings to $26,000.

Meanwhile, a new Bitcoin-themed alternative is starting to turn heads from investors as it raises $1.75 million in just over a week – demonstrating the building hype for the newly emerging project.

Experts Predict US Federal Reserve to Keep Rates Unchanged in September

Bitcoin continues to show hints of stability as the risky asset faces potentially higher interest rates later this year.

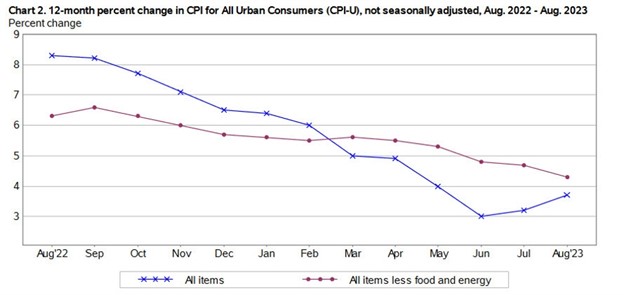

The August Consumer Price Index (CPI) report showed a year-over-year (YoY) increase of 3.7% – 0.1% higher than expected.

The YoY figure showed an increase from June’s figure of 3.2%, hinting that inflation might be ‘sticky’ in the economy despite elevated interest rates.

However, the core CPI data, excluding energy volatility, noted a yearly increase of 4.3%, lower than the previous month’s 4.7%.

As a result, core CPI data is showing consistent declines since September 2022;

In light of this, experts from JP Morgan believe that the US Fed will hit its inflation target of 2% by late 2024 but doesn’t expect any further interest rate hikes.

David Kelly continued further, stating;

“I don’t think that today’s upside surprise is sufficient to trigger a rate hike next week and I continue to expect the Fed to stay on hold.”

Bitcoin Shows Remarkable Stability Despite Hot Inflation Data

Interestingly, Bitcoin is showing hints of resilience as it clings to the $26,000 level regardless of the hot inflation data.

The cryptocurrency had established a short-term rising price channel during September but dipped beneath it at the start of the week;

It found support at $24,970 – provided by the Feb 2023 resistance – and rebounded into the price channel ahead of the inflation report.

Since the release of the inflation figures, Bitcoin has been bouncing between the boundaries.

The cryptocurrency would need to clear resistance at $26,400 and break the upper angle of the price channel to show hints of bullish price action throughout the rest of September.

In this case, resistance could be expected at $27,000, $27,745 (Jan 2021 lows), $28,000, and $28,650 (June 2021 lows).

Conversely, support lies at $26,000, $25,770, $25,415 (May 2022 lows), and $25,000.

Added support lies at $24,755 (June 2023 lows), $24,235 (December 2020 resistance), and $24,000.

Which New Altcoins Are Also Rising?

While Bitcoin continues to show stability in the face of rising inflation, a handful of altcoins also see momentum.

One example is Bitcoin BSC ($BTCBSC), whose innovative stake-to-earn model has quickly generated hype around its ongoing presale.

Bitcoin BSC is an Alternative to Bitcoin on Binance Smart Chain That Raised $1.75m in Just Over a Week.

Bitcoin BSC ($BTCBSC) is a bitcoin-themed alternative that introduces a stake-to-earn concept expected to alleviate any selling pressure on launch and create long-term utility.

The project follows the success of recent bitcoin derivatives like BTC20, which produced a 5x return for early adopters at its peak.

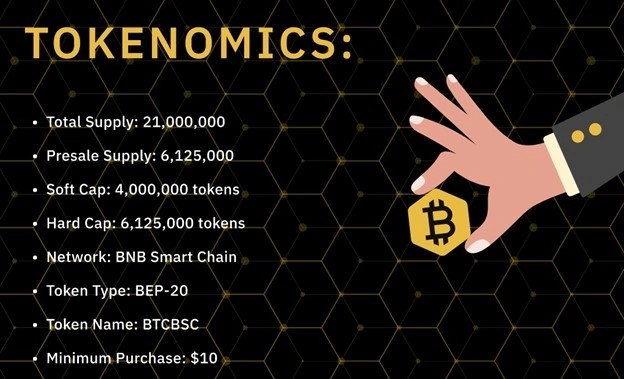

It’s a BEP-20 version of Bitcoin built on the Binance Smart Chain that introduces a verified staking contract that releases $BTCBSC tokens in line with the original Bitcoin block rewards schedule.

Those staking their $BTCBSC earn a percentage of the rewards through the accessible proof-of-stake (PoS) mining algorithm.

The tokenomics behind the project mirror the 21 million $BTC supply.

The presale is paying homage to the early days of Bitcoin when there were 6.125 million $BTC in circulation at $1.

Therefore, the presale is selling 6.125 million $BTCBSC – 29% of the supply – in two phases at the price of $0.99.

Following the presale, 14.455 million $BTCBSC – 69% of the supply – will be sent to the staking contract to provide rewards for the next 120 years, lining up with the $BTC release schedule.

The remaining 2% is pre-mined to provide liquidity to decentralized markets.

The tokenomics behind this project have experts predicting that there will be a supply crunch on the open market, meaning that newcomers to Bitcoin BSC will be forced to pay higher prices following the presale.

This is because most of the supply (69%) will already be locked in the staking contract, with presale buyers expected to add further to it as they take advantage of the stake-to-earn passive income.

For example, more than half of the presale tokens already bought are being staked, providing stakers with an impressive 300% APY;

As a result, newcomers might struggle to find $BTCBSC at the presale price of $0.99 and will have to pay higher costs to get positioned once it starts to trend on popular platforms like DexTools.

The staking concept is unique as it fosters a community-driven approach, where investors earn from the staking rewards and the rising value of the token.

Overall, the FOMO is building for $BTCBSC as its presale progresses at an alarming rate.

Prospective investors are encouraged to get positioned early as the presale isn’t expected to last more than a fortnight at the current pace.

Visit the Bitcoin BSC Presale

Disclaimer: The above article is sponsored content; a third party writes it. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Bitcoin Shows Stability As Experts Expect FED to Keep Rates Unchanged, While Bitcoin BSC Hits $1.75 Million Milestone appeared first on CryptoPotato.