Bitcoin Shorts Tumble 67% on Bitfinex – Last Time That Happened, Bitcoin Plunged 10% the Following Day

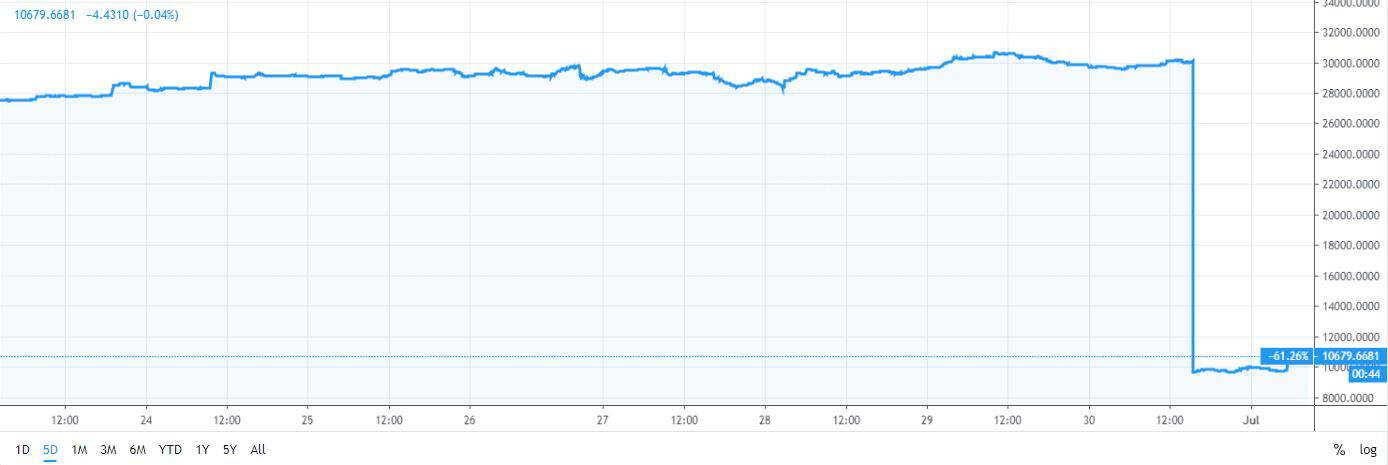

The number of Bitcoin short positions on cryptocurrency exchange Bitfinex dropped by around 67% in an instant. The current amount is the lowest it has been since January 2018. With the number of long positions being almost twice as great, one has to wonder whether the price is set up for a long squeeze.

Bitcoin Shorts on Bitfinex Tumble 64%

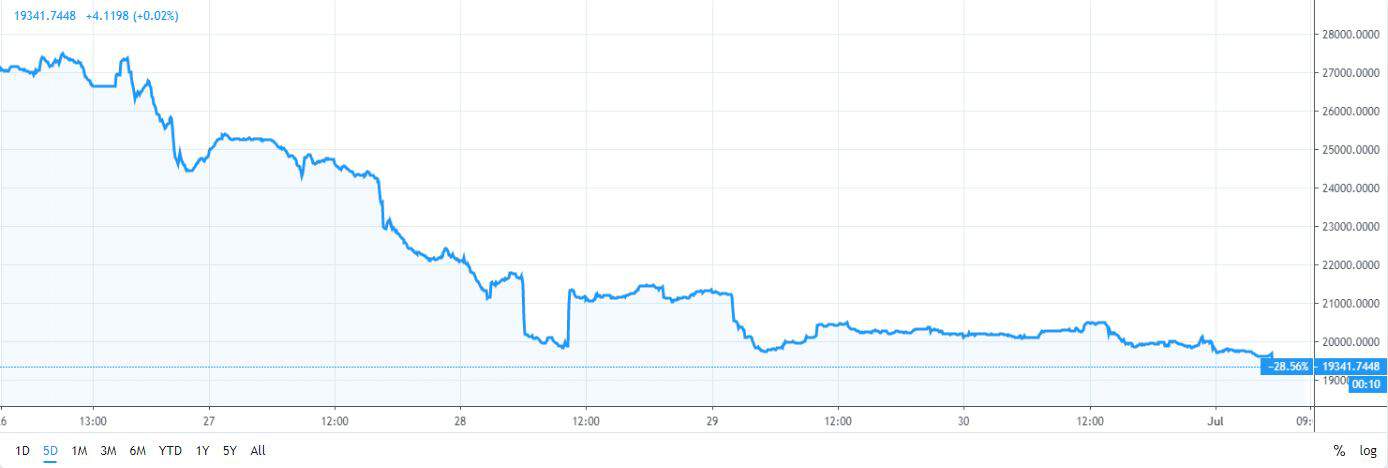

The number of short positions on Bitfinex plunged 64 percent on July 29, just a few hours before Bitcoin’s price dropped from about $12,500 to $10,900 where it’s currently trading. This represents a decrease of about 12.8%.

As can be seen from the chart, the drop was instantaneous, which could signal that it was carried out by a single entity. In any case, the number of shorts on Bitfinex at the time of writing stood at around 10,687. It’s the lowest it has been since January 15, 2018.

On the other hand, the number of long positions has also decreased by about 42 percent to approximately 19,350.

That amount, however, is almost two times greater than the number of open short positions following the massive drop.

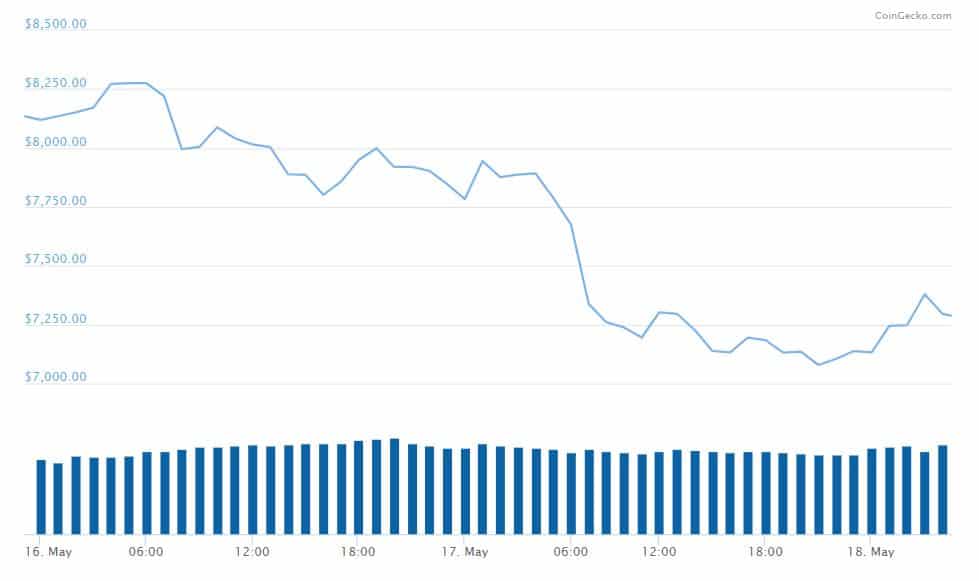

We’ve seen this happen before. As CryptoPotato reported back in May, the number of Bitfinex shorts dropped by about 40%, while long positions marked a slight increase. The next day, Bitcoin’s price dropped by about 10%.

We’ve also seen a drop in Bitcoin’s price this time, but it happened immediately after the short positions were closed. Yesterday, BTC lost around $700 or 6% of its value, begging the question of whether this was related to the sudden drop in the number of short positions.

Long Squeeze in the Making?

When the number of open short positions is substantially lower than the number of open long positions, the price is usually primed for a so-called long squeeze. It’s a situation in which the price goes down, inciting further selling.

However, it’s also worth noting that this move could have resulted from someone’s mistake or liquidation. It’s also possible that it was a mining organization which used short positions as a hedge against low BTC prices. Whatever the case, we have yet to see how this will affect the market in the days to come.

The post Bitcoin Shorts Tumble 67% on Bitfinex – Last Time That Happened, Bitcoin Plunged 10% the Following Day appeared first on CryptoPotato.