Bitcoin Shorts Take on 87% of Futures Liquidations as BTC Crosses $30K

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

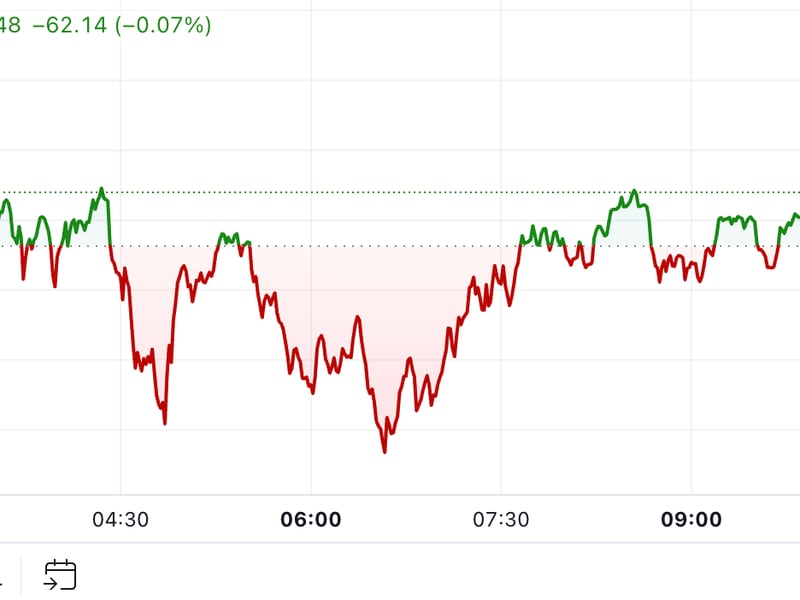

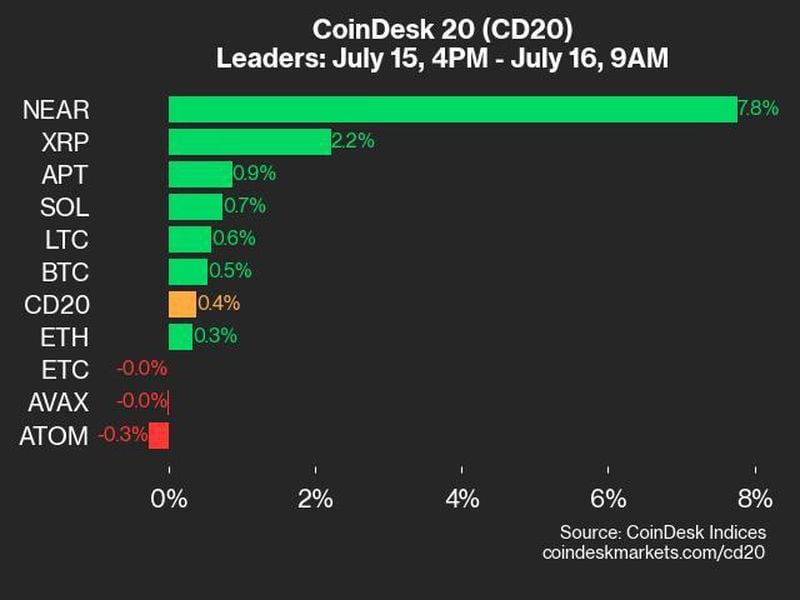

Strength in bitcoin (BTC) pushed the asset over the crucial $30,000 level for the first time since June 2022, causing heavy losses to traders betting on a decline.

Over 87% of all future trades that were liquidated in the past 24 hours were short, or bets against a rise in prices. Losses from these trades amounted to some $145 million in the process. Crypto exchange Huobi saw over $45 million in liquidations on its platform, followed by counterparts Binance and OKX at $35 million each.

The largest single liquidation order happened on Huobi, a bitcoin/tether trade valued at $11 million.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly.

Recent strength in bitcoin can likely be attributed to worsening economic conditions which may lead to the adoption of a decentralized asset among investors, some opine.

“Bitcoin has effectively decoupled from the traditional markets since the start of the year, up over 80% while stocks have slumped,” said Alex Adelman, CEO of bitcoin rewards app Lolli, in an email to CoinDesk. “Bitcoin’s strength compared to the traditional markets shows that investors are increasingly shifting their capital into bitcoin, choosing it instead of traditional investments to build their wealth.”

“The fact that today’s rally did not have a clear catalyst is a bellwether of bitcoin’s newly bullish market conditions and strong investor confidence. Bitcoin’s ongoing strength suggests that bitcoin is emerging from the so-called ‘crypto winter’ into a new phase of strength and renewed interest from retail and institutional investors,” Adelman added.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Co-Leader of the CoinDesk tokens and data team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.