Bitcoin Shorts Are Down Over 20% in 3 Days: Speculations Ahead of BitFinex Jan.7 Maintenance

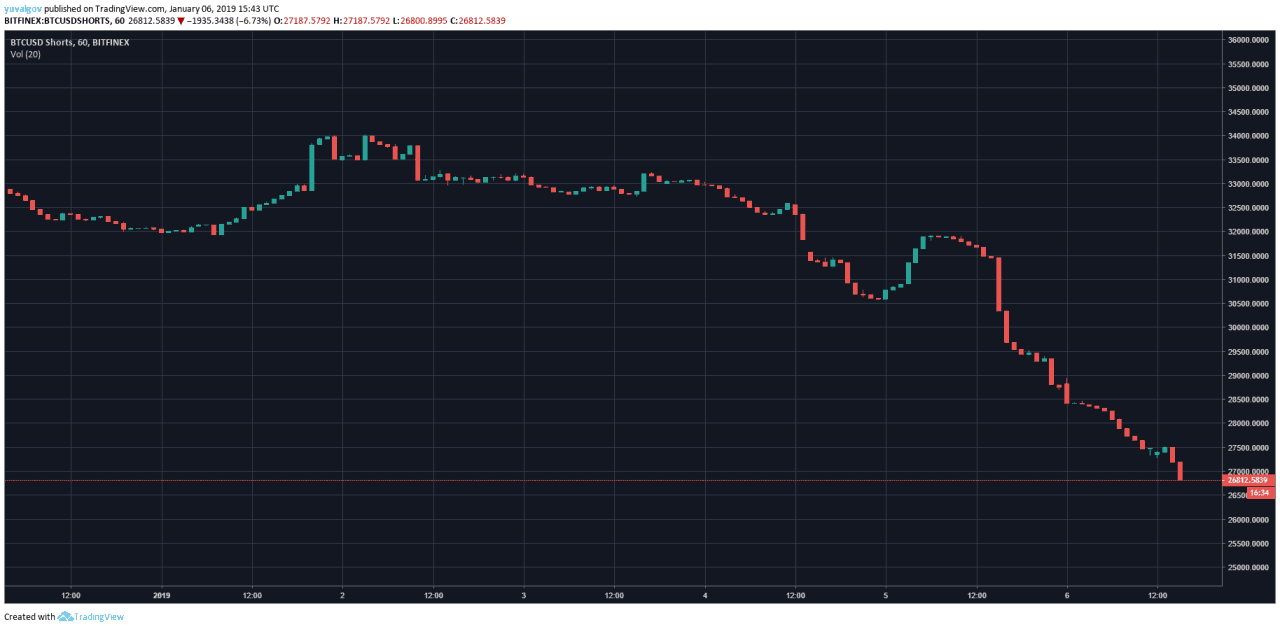

Bitcoin open short positions on BitFinex Exchange had lost more than 20% of their value over the past three days.

As of writing this, the amount of open positions is 26,812 BTC. This is the lowest level of open short positions since November 24, 2018. On January 2, just four days ago, the number of open short positions was 34,000 BTC.

BitFinex Scheduled Maintenance

One reason for the declining short positions is likely to be the scheduled maintenance of BitFinex and ETHFinex exchanges for tomorrow, January 7.

At 10:00 AM UTC, both exchanges are expected to be down for several hours due to a server migration:

“On Monday 7th January 2019 (time to be confirmed), Bitfinex and Ethfinex will be offline for a duration between three to seven hours as iFinex completes the final stage of its data migration to dedicated bare-metal servers.”, as stated on the exchange’s official blog.

As reported in the past by CryptoPotato, exchanges’ scheduled maintenance is an excellent opportunity for some Bitcoin price manipulations by whales. Hence, traders do not want to stay out of control and find their positions forced liquidation at the time Bitfinex will be back online.

Long Positions Raise: Squeeze Coming?

The above reason explaining closing positions ahead of the maintenance could be very reasonable. However, there is a question mark popping when looking on the open long positions chart. Same as for shorts, we could expect the longs to decline by more or less the same ratio as shorts’ had declined.

However, the long positions had gained over 10% over the past three days, reaching a current high of 33,730 BTC open positions.

This could be very suspicious. As we always say – when the shorts are at their all-time high – expect a short squeeze. When the shorts are near their low levels – expect a long squeeze.

We do expect a move following the symmetric triangle formation in the Bitcoin’s chart, along with the past days’ consolidation period.

However, we definitely can’t say in what direction the move will take place. What we can say is that there is a very high chance for some price action so grab some popcorn.

The post Bitcoin Shorts Are Down Over 20% in 3 Days: Speculations Ahead of BitFinex Jan.7 Maintenance appeared first on CryptoPotato.