Bitcoin Seesaws Back Over $29.2K, as Investors Brush Off Binance Angst; BCH, UNI, LTC Sink

-

Bitcoin settles back above $29,200 after seesawing for much of the previous day.

-

Major altcoins were largely in negative territory with BCH and UNI down more than 5% and 6%, respectively.

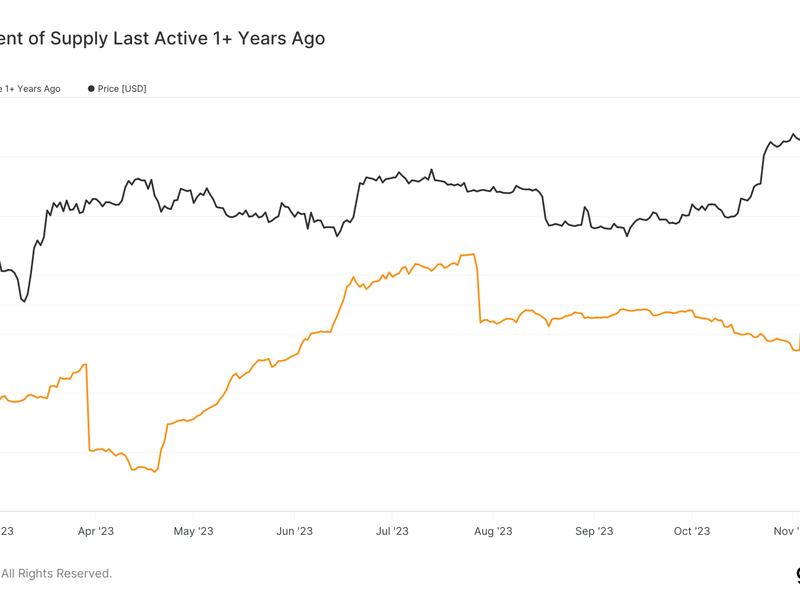

Shortly before Asia markets opened Thursday, a bitcoin 24-hour, roller coaster ride seemed over at least for now with the largest cryptocurrency by market capitalization trading at $29,207, about flat and back in the narrow $500 spread it has largely occupied since mid July.

Investors appear to have cast aside industry-specific and macro events that sent BTC’s price surging past $30,000 on Wednesday amid reports of a Fitch downgrade of U.S. Treasurys and MicroStrategy plan to purchase more bitcoin, but then had it plunging below $29,000 after news website Semafor wrote that Binance could face Federal, criminal charges.

In an email to CoinDesk, Jeff Feng, co-founder of Sei Labs, noted the swirl of recent news, including multiple applications for spot bitcoin and ether ETFs, that are figuring in the crypto market’s fluctuations and could lead to even larger price changes.

“We’re seeing a multitude of influential factors at play, which includes corporate investments, regulatory advancements, macroeconomic shifts, and potential for increased accessibility through financial products like ETFs,” Feng wrote. “MicroStrategy’s continued investment in Bitcoin certainly underscores their commitment, helping solidify corporate interest in digital assets. This, in tandem with anticipation around the upcoming Bitcoin halving event, is influencing market behavior, as traders often view such milestones as potential catalysts.”

He added: “These periods that may seem range-bound could indeed be precursors to more substantial market movements. Staying informed about…multifaceted influences is key for any market participant, from individual traders to institutional investors.”

Ether, the second largest crypto in market value, was recently changing hands at $1,842, also roughly flat over the past 24 hours. Other major cryptos were largely in the red a day after swooping upward amid a wider market upturn. UNI, the token of the Uniswap decentralized exchange, and bitcoin spinoff BCH, were recently down more than 6% and 5%, respectively.

And Litecoin (LTC) recently plunged almost 6%, despite the token’s anticipated halving event, which cut miners rewards in half, curbing the issuance of new tokens. LTC is down 22% from its yearly high recorded a month ago, CoinDesk Indices data showed.

The CoinDesk Market Index (CMI), a measure of crypto markets performance, was recently down 0.5%. The CMI has veered from negative to positive and back again

The Deribit Volatility Index (DVOL) for BTC and ETH is currently trading at “unprecedentedly low levels,” wrote Luuk Strijers, the crypto derivatives exchange’s chief commercial officer, noting that ether’s DVOL was trading below bitcoin’s DVOL, a rare occurrence “most probably caused by the activity of a single whale.”

However, he added that “the market anticipates a considerable upswing in volatility. This is largely driven by factors such as the upcoming ruling on the Blackrock spot ETF and the approaching Bitcoin Halvening. Deribit has been noticing signs of these expectations by looking at the significant steepness of the term structure (June ’24 trades at approximately 50) and the enduring call skew.”

Edited by James Rubin.