Bitcoin Rises in Line With Stocks After Dip Below $9K

Bitcoin Rises in Line With Stocks After Dip Below $9K

Bitcoin’s positive correlation with stocks continues Monday, with the cryptocurrency drawing bids alongside gains in global equities.

As of 09:35 UTC, the leading cryptocurrency by market value is trading at $9,190, representing a 1.4% gain on a 24-hour basis, according to CoinDesk’s Bitcoin Price Index.

Meanwhile, major European equity indices are up at least 1.5% each, following a 4% rise in mainland Chinese stocks seen during the Asian trading hours. Futures tied to the S&P 500 are also up over 1%, according to data source Investing.com.

Equities are flashing green despite a worrying increase in coronavirus cases in the U.S. and other parts of the world. According to CNBC, investors are cheering the progress of potential coronavirus drugs. On Friday, the European Commission moved to grant conditional approval for U.S.-based Gilead’s antiviral drug remedesivir to be used in the European Union.

Equities save the day

Bitcoin fell below the psychological support of $9,000 on Sunday, validating bearish lower highs at $10,000 and $9,800 created on June 10 and June 23, respectively.

In addition, momentum indicators like on-balance volume (OBV) were signaling weakness, as noted by popular trader NebraskanGooner Sunday. As such, the cryptocurrency looked set for a deeper loss.

However, selling pressure ran out of steam near $8,900 around 06:15 a.m. Tokyo time, as U.S. stock futures rose and bitcoin prices charted a quick move back above $9,000. The cryptocurrency would have faced stronger chart-driven selling had prices established a foothold below that psychological support.

So, the uptick in stocks looks to have saved the day for the bitcoin bulls. The cryptocurrency’s positive correlation with stocks reached record highs last week.

Problem ahead?

Bitcoin’s positive correlation with stocks makes it vulnerable to bouts of risk aversion in traditional markets. The equity markets could soon come under pressure, dragging bitcoin lower, if the U.S. Federal Reserve fails to appease equity markets with additional stimulus.

According to analysts at JPMorgan, the U.S. money markets are signaling the need for further monetary and/or fiscal policy. “If the additional stimulus is not delivered, then the money market curve inversion could worsen, eventually becoming a more problematic signal for equity and risky markets going forward,” said the bank’s analysts.

The Fed seldom disappoints markets. The central bank has already expanded its balance sheet by over $3 trillion in the past 3.5 months and will likely add more, if deemed necessary.

BTC awaits directional move

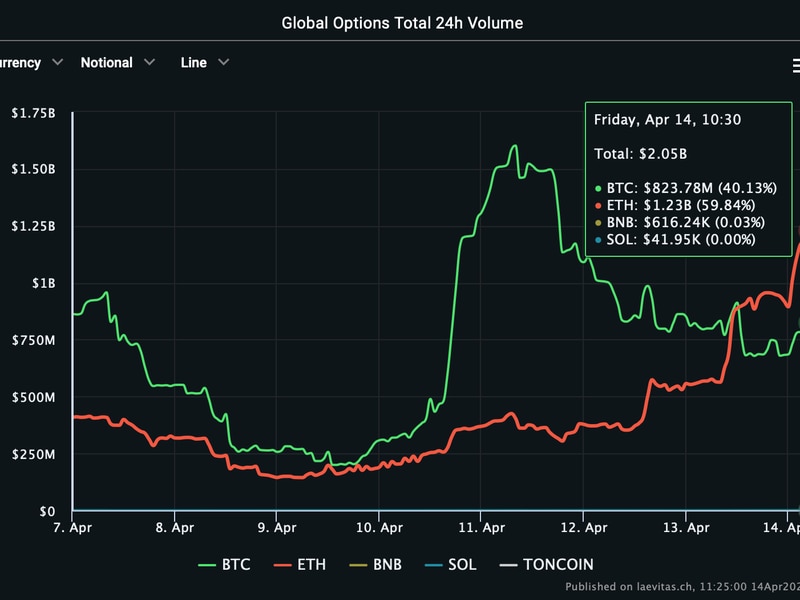

Bitcoin has witnessed minimal movement over the past nine days, with upside capped around $9,300 and downside restricted near $8,830.

Notably, the trading range narrowed to $395 last week. That’s the smallest weekly trading range since the last week of March 2019.

A prolonged period of consolidation often ends with a big move to either side. For instance, the cryptocurrency jumped 26% in the first week of April 2019, having witnessed low-volatility consolidation in the preceding five weeks.

Disclosure: The author holds no crypto assets currently.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.