Bitcoin Rises Back to $11K Despite Signs of Indecision in the Market

Bitcoin is again looking to establish a foothold above $11,000 on Friday, although the technical charts are anything but stridently bullish.

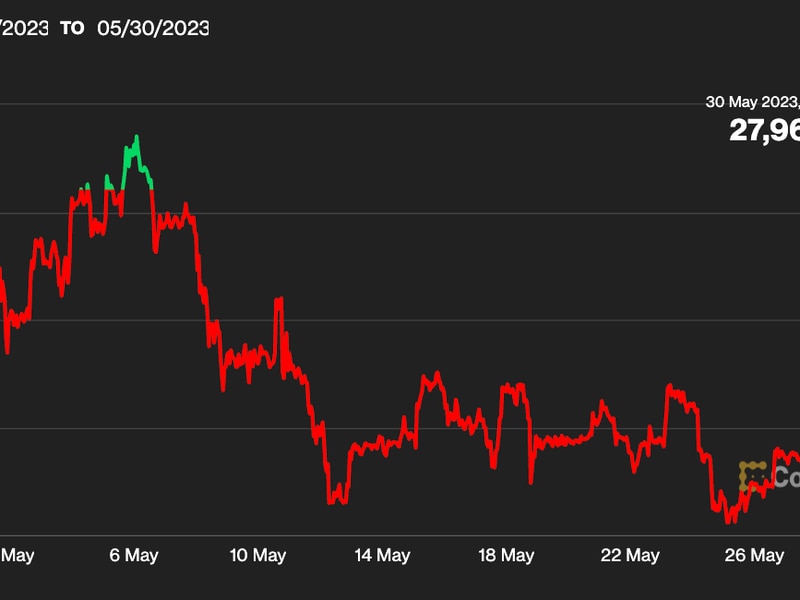

- The leading cryptocurrency by market value is trading just over $11,000 at press time, having found bids below $10,800 on Thursday, according to CoinDesk’s Bitcoin Price Index.

- Buyers, however, have been struggling to keep prices above $11,000 over the last few days.

- The cryptocurrency clocked highs of $11,104 and $11,050 on Wednesday and Thursday, respectively, but printed a UTC closing price below $11,000 on both occasions.

- Notably, bitcoin created a doji candle on Thursday, as it swung both ways before ending the day on a flat note.

- A doji shows both buyers and sellers are not willing to lead the price action.

- However, new investors are entering the market at a faster pace and one may expect bitcoin to post sustainable gains above $11,000.

- On the other hand, onchain analyst Cole Garner believes the recent spike in bitcoin outflows from miner wallets to exchanges is a cause for concern for traders expecting a continued price recovery.

- According to data source Glassnode, 1,113.85 BTC were transferred to exchange wallets from miner wallets on Sept. 13 – the biggest single-day outflow since December.

- An increased supply of bitcoin moving onto exchanges suggests increased selling pressure.

- So far, however, bitcoin has largely remained resilient and is up 6% this week.

- This may have been helped by investors moving money out of alternative cryptocurrencies and into bitcoin, according to Patrick Heusser, a senior cryptocurrency trader at Zurich-based Crypto Broker AG, told CoinDesk in a Twitter chat.

- Indeed, major alternative cryptocurrencies like ether (ETH), bitcoin cash (BCH) and litecoin (LTC) have depreciated by 2–5% against bitcoin in the past seven days; while Chainlink’s LINK token is down 17%, according to data source Messari.

- Should the latest indecisive price action end with an upward move, the focus would shift to the next hurdle at $11,200. That level served as strong support in August.

- Thursday’s low of $10,765 is the level to defend for the bulls.