Bitcoin Retests $55K Amid Extreme Volatility: Elrond (EGLD) Surpasses $500 (Market Watch)

In another volatile 24 hours, bitcoin spiked by nearly $3,000 in minutes before it headed south vigorously to retest $55,000. While most altcoins are also in the red on a daily scale, CRO and EGLD continue with their impressive performances.

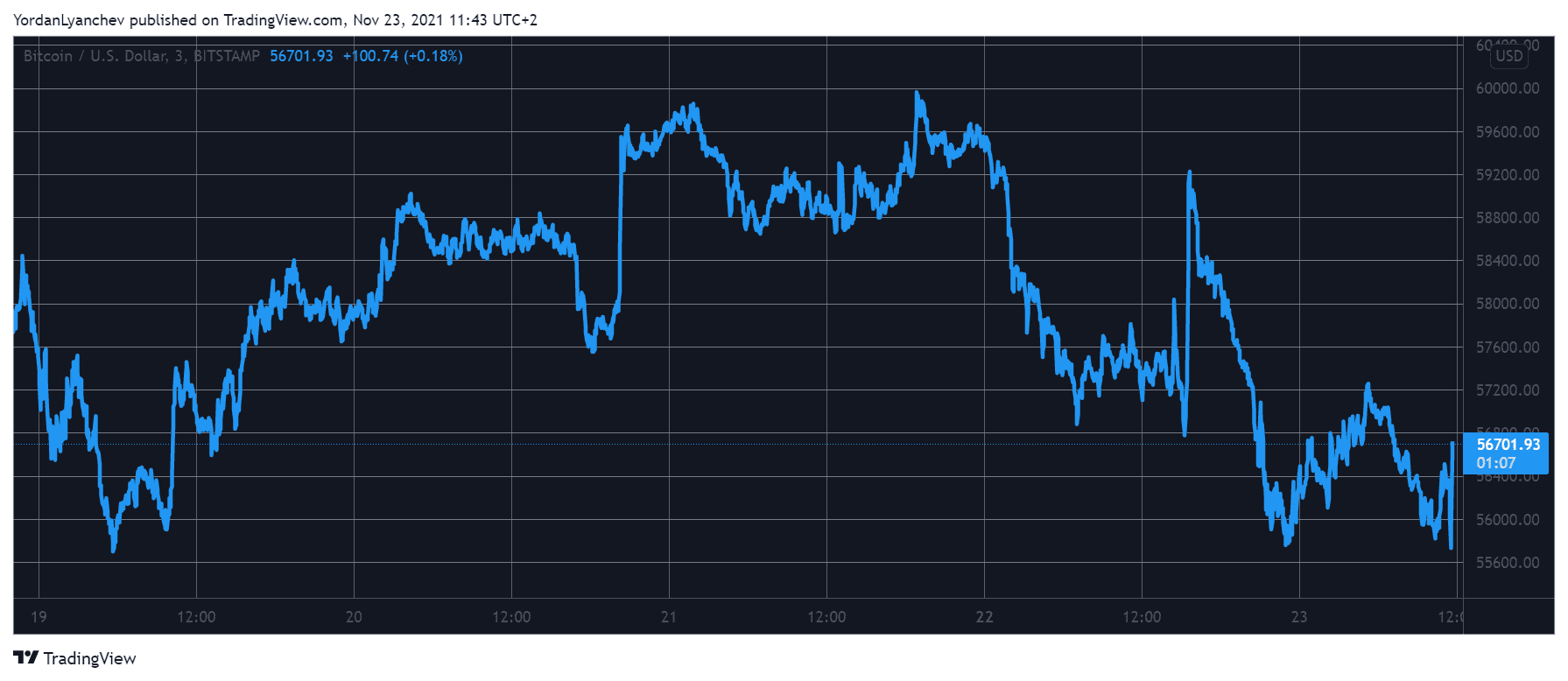

Bitcoin’s Wild 24-Hour Ride

Following last week’s price slumps, bitcoin had begun its recovery during the weekend and tapped $60,000 for the first time in days on Saturday and Sunday. However, it failed to overcome that coveted level, and the subsequent rejection drove the asset south.

In just a few hours, BTC lost around $3,000 and dumped below $57,000. The situation changed rather drastically as bitcoin went on the offensive and spiked above $59,000 yesterday.

However, it turned out to be a fake-out as BTC lost all momentum and dropped beneath $56,000 in the following few hours. Another volatile move followed in which bitcoin surged by more than a grand and neared $57,000 where it’s currently situated.

Nevertheless, BTC’s market capitalization has dumped well below $1.1 trillion, and its dominance over the alts has been further reduced to just under 42%.

EGLD’s Notable Run Continues

Most altcoins have mimicked BTC’s performance in the past 24 hours, meaning they are in the red now. Ethereum is down by 1.5% in a day and has dropped to $4,100. The second-largest cryptocurrency registered its latest peak approximately two weeks ago at nearly $4,900, but it’s down by $800 since then.

More price losses are evident from Binance Coin, Solana, Cardano, Ripple, Polkadot, and Dogecoin.

Avalanche, which has been among the best performers lately, is down by 4% on a daily scale. As a result, AVAX trades below $130. Shiba Inu has lost a similar percentage and stands at $0.000042.

In contrast, CryptoCom’s native token has surged again by 11% and is now above $0.75.

Elrond continues to mark new records, and the latest came at $540 earlier today. ELGD is up by 70% since last Friday, when the project announced a massive liquidity program for its DEX worth more than $1 billion.

More gains come from The Sandbox (37%), Amp (20%), Voyager Token (16%), Decentraland (11%), and Enjin Coin (10%).

In contrast, Fountain (-43%), Flow (-11%), ICON (-10%), Stacks (-10%), and Oasis Network (-8%) have lost the most value in a day.