‘Bitcoin Request for Comment’ Tokens Surge to $137M in Market Value

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Interest in “Bitcoin Request for Comment” or BRC-20 tokens built with Ordinals and stored on the Bitcoin base chain has skyrocketed, lifting their market value by several hundred percent.

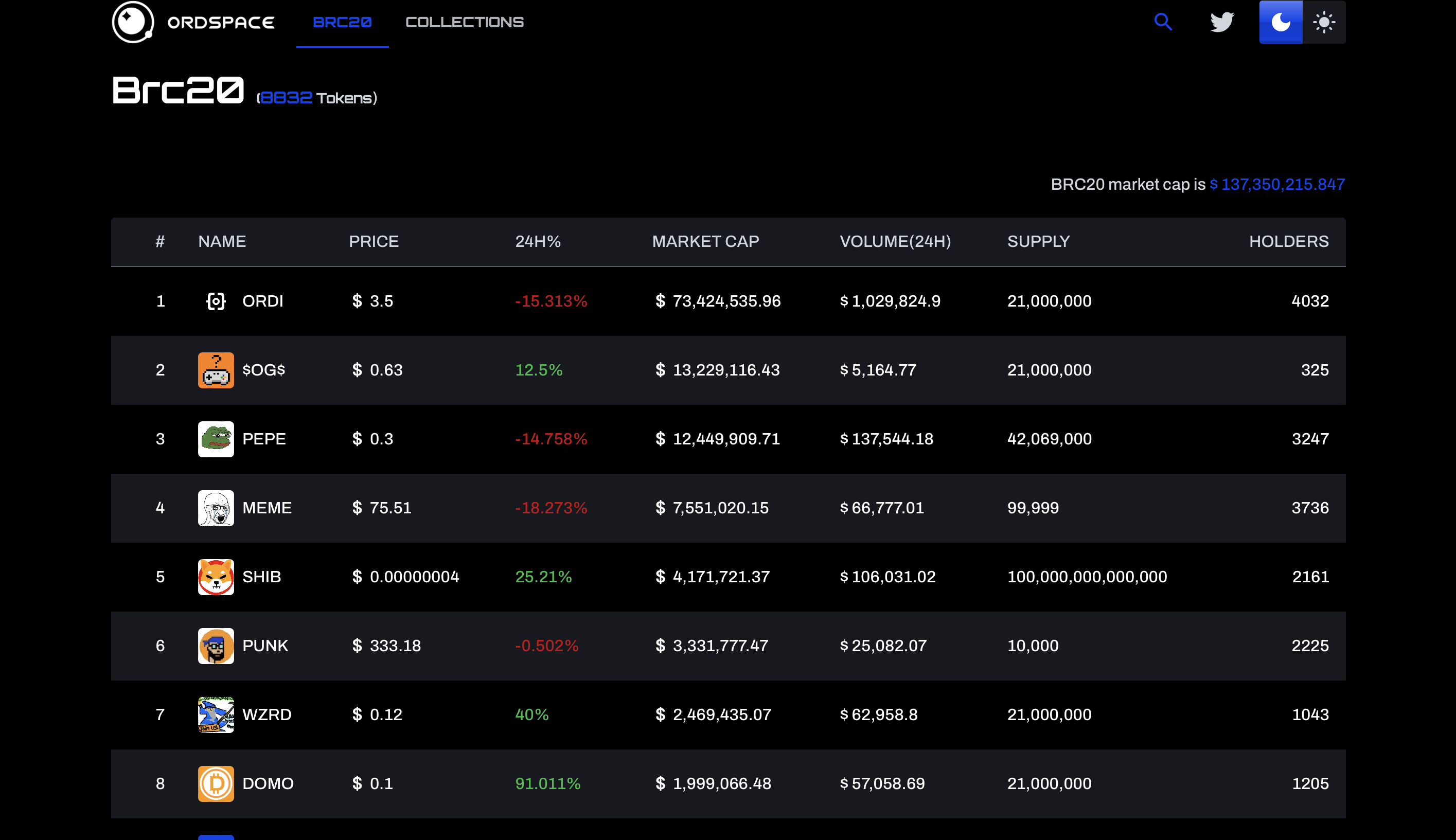

As of writing, the combined market cap of more than 8,800 BRC-20 tokens was $137 million – a staggering 682% rise from $17.5 million seen a week ago, according to data tracked by Ordinals-builder Ordspace. (For a brief moment early Tuesday, the website showed the total market cap at $2.93 billion. Ordspace said the figure wasn’t accurate and likely resulted from low liquidity in some of the tokens.)

A pseudonymous on-chain analyst named Domo created the BRC-20 token standard in early March to facilitate the issue and transfer of fungible tokens on the Bitcoin blockchain. The experimental invention came weeks after Ordinals Protocol went live, allowing users to inscribe digital art references into small transactions on the Bitcoin blockchain.

“Ordinals on Bitcoin have had unintentional consequences. Of these is the invention of the BRC-20 fungible token standard. It’s now possible to create fungible tokens on BT,” pseudonymous analyst and yield farmer Dynamo DeFi said in the latest edition of the weekly newsletter. “Since inception, BRC-20s have accounted for nearly 6% of all Bitcoin activity.”

The BRC-20 standard sounds like the popular ERC-20 standard, but the two are different, with the former lacking the ability to interact with smart contracts. The ERC-20 is the technical standard for fungible tokens created using Ethereum, the premier smart contract blockchain.

“This[BRC-20] is not a token standard like you’re accustomed to with EVM chains, which create smart contracts that manage the token standard and its various rules. Instead, it’s simply a way to store a script file in bitcoin and use it to attribute tokens to satoshis and then allow them to be transferred between users,” crypto exchange Binance said in an explainer.

The market cap has surged by more than 600% in less than two weeks. (Ordspace)

Most active BRC-20 tokens fall into meme coins – cryptocurrencies originating from an internet meme or humorous characteristic. At press time, the top three coins minted using the BRC-20 standard were ORDI, OG and PEPE.

According to Boolean Fund’s Mark Jeffrey, the launch of BRC-20 tokens has eliminated the need for crypto exchanges.

“With BRC-20’s, the Bitcoin blockchain is the exchange. There is no Binance, no Coinbase required. Just a Bitcoin wallet. You create, buy and sell with sats. Bitcoin is now gas,” Jeffrey tweeted over the weekend, noting the rise in the market cap of BRC-20 tokens.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.